Start your LLC with our Registered Agent service. We’ll take you through every step, worry-free.

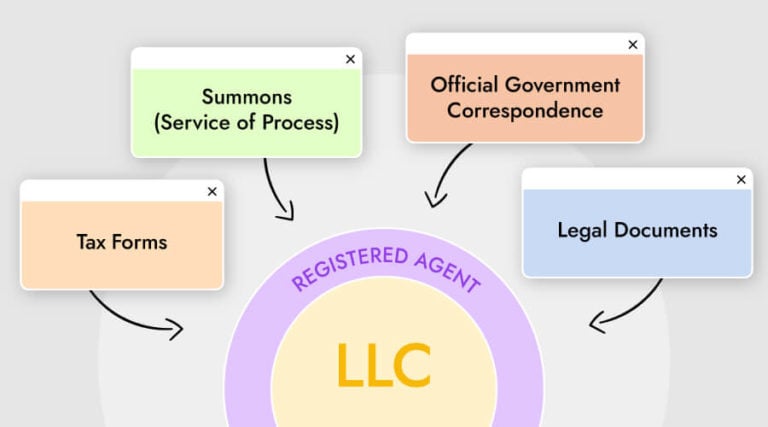

A registered agent is a person or business entity appointed to accept legal documents and official mail on behalf of a limited liability company, limited liability partnership, and corporation.

A registered agent is also known as a statutory agent, agent of process, or resident agent.

All 50 states require an LLC, LLP, or corporation to designate a registered agent.

When starting an LLC, you’ll file articles of organization with the secretary of state, at which point you need to appoint a registered agent.

By appointing a registered agent, you’ll ensure you never miss legal correspondence, such as service of process, or a pending lawsuit against your business.

And there are other benefits too, all of which I’ll cover in this post.

Registered agents act as the point of contact for LLCs with their state.

A registered agent maintains a dependable communication channel with your state’s office and is contactable during business hours to ensure corporate compliance by informing you of all legal notices, official mail, and annual report filing reminders.

Having a registered agent enables you to take appropriate action and resolve potential issues in a timely manner.

Whether you run a small LLC or a large corporation, your designated registered agent will receive the following on your behalf:

Every state has its own regulations and rules regarding the qualifications pertaining to serving as a registered agent. For example, check New York state law.

One such is whether your agent must be a registered business or if an individual can fill the role.

There are 3 limits of the law that apply throughout the U.S:

Yes, you can appoint yourself as a registered agent, and in some states, you can even select your business.

While designating yourself might sound like the simplest solution, it’s not advisable for several reasons. None more so than privacy since registered agents are required to list their name and address for public record.

You can use your business address as your registered office address but not vice versa.

However, registered agents are only required to receive official government documents and not regular mail.

It’s to ensure official mail is received and not lost in the post.

Generally speaking, if you act as your own registered agent, you should only use your business address if you own it and have complete control of incoming mail to ensure you don’t miss any legal correspondence. Because if you, do it could potentially eliminate your limited liability protection in the case of litigation.

Making anything fool proof is a difficult task, and when it comes to your business’s response to legal notification of appliance, you need a water-tight solution. Because if you miss something important, saying, “I didn’t receive it in the mail” holds no water where your state, financial institution, or a law court are concerned.

Simply put, the best way to ensure your business never misses a compliance obligation and avoids costly results is to use a registered agent.

But a registered agent provides more than an inbound postal service. They can help you in a variety of ways, such as:

All of which are worth learning more about, so we’ll look at those next.

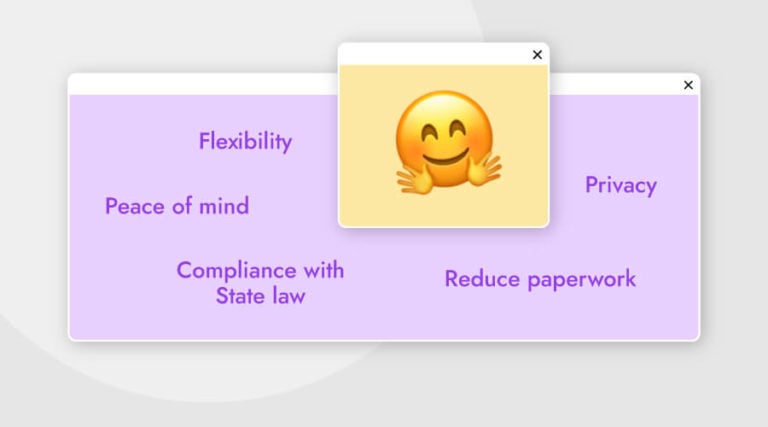

Designating a professional 3rd party to serve as a registered agent for your business has real benefits.

Such as never missing a deadline or necessary paperwork. Providing you with the geographical freedom to operate in several states without a physical address. And if you have a physical place of business and should need to move, you’ll avoid the process of “filling the change of address” paperwork.

And your registered agent knows who to contact within your business to make updates and verify information when required.

What do all that amount to?

Peace of mind.

Registered agents provide peace of mind to business owners at a relatively affordable cost. Freeing up your time and energy to attend to your business while ensuring you never miss a legal beat.

But more importantly, they buy you time to do the following:

Make growing your business your priority – All legal and tax documents for your company will be received, logged, and stored safely, giving you more time to run your daily business activities.

Separate work from personal life – Your personal and business mail will remain independent, ensuring your home doesn’t become an office.

Complying with state law is both labor and time-intensive due to the unavoidable requirements of completing long and often confusing government forms, many of which require additional information from numerous sources.

By employing a registered agent, you’ll stay up-to-date and avoid unnecessary state late filing penalty fees, ensuring your business retains a favorable standing with your state.

Your registered agent will also send you regular reminders, and if instructed, they can even file your annual report.

But more importantly, if you suffer an unexpected loss of official documents due to natural disasters, fires, or theft at your place of business, your registered agent will have a backup enabling you to maintain compliance.

A registered agent’s address is a matter of public record, meaning anyone can access it. And if you’re a home-based business owner, you could have safety and privacy concerns about using your home address.

Registered agents also receive a significant amount of “junk mail,” reducing the amount of unsolicited mail arriving at your business’s front door.

In case of a lawsuit, having a registered agents prevents you being served in person. No one wants to receive a summons, let alone in front of employees, customers, or worse, family.

Flexibility concerning remote working, pliable working hours, geographical freedom, and multi-state trading have become necessary for many modern-day business owners. And registered agents facilitate that flexibility.

A registered agent’s address must be open during regular business hours to receive official mail and other essential documents. By designating a registered agent, you’re free to choose your working hours 365 days a year.

If you form a business or set it up to have a physical location in multiple states (known as a foreign qualification), you’ll require a registered agent in each state.

When you appoint a nationally registered agent company, it ensures all your entity requirements are met and payable with one vendor, streamlining your accounting process.

Business owners who trade without a permanent work address have grown in popularity due to e-commerce and the gig economy.

And travel flexibility is also vital to a long list of traditional services, such as professional tradesmen, real estate agents, and salespeople who often work out of the office.

Meaning a registered agent’s service is equally valuable to both new and old business models.

Registered agents safeguard your business’s compliance by maintaining official paperwork, but they’re also seasoned professionals whose experience and service ensure every correspondence is completed correctly.

And managing your annual report filings can fall into that category—especially if you’re doing business in multiple states.

Annual report management services include:

One of the only disadvantages to designating a registered agent is the cost (isn’t it always?).

If you’re a small business owner on a tight budget, open during regular business hours, and have the knowledge required to maintain and update business compliance obligations, you could save yourself the cost of designating a 3rd party registered agent.

However, using a registered agent service could help you avoid late filing fees or legal trouble caused due to missing or misplacing a critical notice or document. And as registered agent fees are often cost-effective and deductible, employing one could save you time and money in the long run.

Registered agent fees vary from company to company and according to your needs, but generally, costs range from $99 to $300 a year.

When sourcing a registered agent, look for one offering a lower introductory fee for the first year and possible cost-reducing bundles, such as business formation, annual filing, and other services.

If you need to change your registered agent for any reason, be aware that some states charge a fee to file and update your paperwork, while others provide this service free of charge.

As I’ve mentioned a few times already, you can act as your own registered agent if you’ve:

Most states do not allow a business entity to name itself as a registered agent; however, there are some exceptions, such as Delaware and Colorado.

Sole proprietorships and general partnerships don’t need to designate a registered agent as these business types are not obliged to register with their state.

In addition to having a legitimate address and office in your state of business, you should choose a registered agent that provides the following services:

Document management – An online business account where you can access your official legal documents whenever you need them.

Compliance management – A reminder service for filing important deadlines and annual reports.

Thorough coverage – If you’re trading in more than one state, your agent must be legal to provide registered agent services in all 50 states.

Availability – Ensure your agent provides a reliable customer service team that’s available to answer questions regarding your business.

And it’s advisable to check an agent’s reviews out online and on Google My Business before choosing one.

You can also ask your secretary of state for a recommendation, that’s if you don’t mind waiting. Or, if you love simplicity, register with us here at Tailor Brands!

Running a business can often feel like a juggling act, and it requires constant attention to keep those balls in the air.

Designating a registered agent reduces that pressure by providing a helping hand.

And the peace of mind of knowing you’re compliant every step of the way while freeing you up to focus on running your business.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness.

Products

Resources

@2024 Copyright Tailor Brands