There comes a time in many a sole proprietor’s life when they need to formalize their business.

Often it’s because their side-hustle has grown into a booming full-time business.

And now they need the tax benefits, liability protection, funding options, or any of the other advantages an LLC provides.

If that’s you and you’re wondering if you can and should change to a limited liability company (LLC), the answer is (probably) yes.

A sole proprietorship is the most basic business structure, and if you start a business and don’t register it with your state, you automatically become one.

You and your sole proprietorship are one entity; this means you pay tax on profits as your own, and you’re liable for your company’s debts.

There are few ongoing requirements to running one, and that’s why 23 million U.S. entrepreneurs use it as their business structure.

But there are downsides to running your business as a sole proprietorship, ones that could hold your business back from reaching its full potential.

A sole proprietorship isn’t a legal entity, so it doesn’t provide the limited liability protection of an LLC or corporation. This means the owner is liable for all business debts in bankruptcy or litigation cases, which puts their personal assets at risk.

As a sole proprietorship isn’t a legal entity, banks and other lenders are often reluctant to provide funding. And as there are no shares in the business, it can’t raise capital by selling stocks.

Generally, the only way a sole proprietorship can raise funding is by the owner taking out a personal loan.

The IRS treats a sole proprietorship as a disregarded entity for tax. A disregarded entity is a pass-through tax system where all profits, losses, and taxes go to the owner, who reports them on their income tax return.

Sole proprietorship owners also pay self-employment taxes (Medicare tax/Social Security) at 15.3%.

The only time a sole proprietorship does not pay self-employment tax is when the business makes a loss. The downside here is that the owner loses their Medicare tax/Social Security for that period.

A sole proprietorship owner isn’t an employee, so the business does not withhold taxes from their paycheck.

Instead, the owner must make estimated quarterly payments throughout the year and amend any differences in their annual tax return.

Most U.S. states require a sole proprietorship to have a business license and impose hefty fines for those who trade without one. And a sole proprietorship may also need federal, state, city, or town permits.

Most people change to an LLC when their business outgrows the basic structure of a sole proprietorship. And the advantage of registering an LLC outweighs the cost and ongoing legal requirements.

There are many advantages to starting an LLC compared to running a business as a sole proprietor, such as limited liability, better tax options, increased credibility, and access to funding.

The primary benefit of an LLC is the limited liability protection it can provide.

An LLC is a separate legal entity, so the owners (called members) may not be liable for its losses or debts, protecting their personal assets. The protection can be in place as long as the legal requirements of managing an LLC are met.

An LLC is a disregarded entity; there’s no tax separation between the owner and the business.

The IRS views a single-member LLC as a sole proprietorship and a multi-member LLC as a partnership, and both are almost identical for tax.

The benefit here is that neither LLC type pays corporation tax. Instead, tax passes through to the owners who pay it on their tax return, avoiding double taxation while benefiting from limited liability protection.

Shifting your business to an LLC shows prospective clients that your company is registered with your state, which provides a higher level of credibility than a sole proprietorship.

The LLC structure enables its owners to qualify for business loans that otherwise may have been unavailable as a sole proprietorship, providing more opportunities to expand and grow their business.

But as with any loan, the LLC must meet the lender’s requirements, and approval often depends on factors such as collateral, how long you’ve been in business, your revenue, and credit score.

2.5 million U.S. businesses choose to run their company as an LLC because the advantages outweigh the disadvantages.

But it helps to know what those disadvantages are to make an informed decision.

Before you start your LLC, you must first register it with your secretary of state by filing an articles-of-organization.

Some states use different names for this document, such as a “Certificate of Organization” or a “Certificate of Formation.”

But regardless of the name, an articles-of-organization includes:

1. Your LLCs name.

2. The names of any members or managers.

3. Your LLC’s principal place of business.

You can find out what paperwork your state requires by visiting your state’s secretary of state website.

Your first cost when forming an LLC is filing an article of organization with your state.

State filing fees vary and range from $40 to $500. You can find out your filing fee by visiting its website.

Most U.S. states also charge limited liability companies an annual franchise tax. And similar to filing fees, state franchise taxes vary by location.

As franchise tax is an addition to federal or state tax, changing to an LLC does not guarantee a lower tax bill.

An LLC requires legal maintenance to ensure it stays in good standing with state and federal laws.

Such as creating an operating agreement, filing your annual report, having a designated registered agent, and keeping the business assets separate from your personal ones.

If owners of an LLC mix personal and business assets, and someone sues them, a judge can remove their limited liability protection because of what’s called “piercing the corporate veil“.

To have a better chance avoiding piercing the corporate veil, LLC members must transfer all business assets to the LLC, write an operating agreement, use the LLC business name on all contracts, and open a separate business bank account.

Piercing the corporate veil is a complicated legal doctrine. To make sure your LLC is keeping all the rules and regulations, it’s always best to consult a lawyer once your LLC is set up.

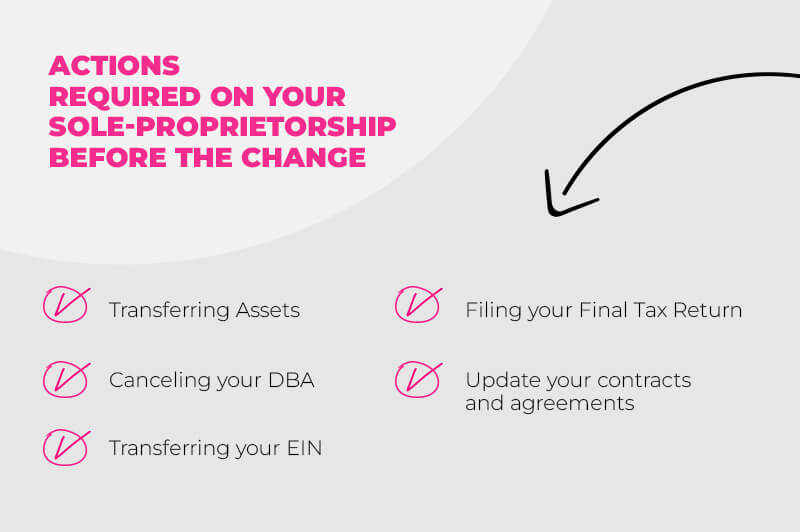

There are 5 steps to take when closing your sole proprietorship and changing to an LLC:

To better the chances you won’t pierce the corporate veil (as part of properly managing your LLC), you must transfer any assets your sole proprietorship owns to your new LLC.

You can do it by either making a capital contribution, assigning the assets over, or using your LLC to buy them from your sole proprietorship.

Always speak with a tax accountant before transferring assets, as one method might have tax advantages over another.

Many sole proprietors use a separate business name known as a DBA for trading.

Depending on your state, you may have to cancel your DBA before forming your LLC, and if it’s not available as an LLC name, you’ll have to choose and register a new one.

A sole proprietorship with an EIN cannot transfer it over and use it for their LLC. Instead, you must get a new Employee Identification Number once your state approves your LLC.

A sole proprietor must file final tax returns, forms, and schedules when they close their business.

You do it by filing Schedule C (Form 1040 or Form 1040-SR), Profit or Loss From Business, with Form 1040, U.S. Individual Income Tax Return.

To ensure any contracts and agreements you have in place remain valid, you must update them from your sole proprietorship trading name to your new LLC name when you change your business structure.

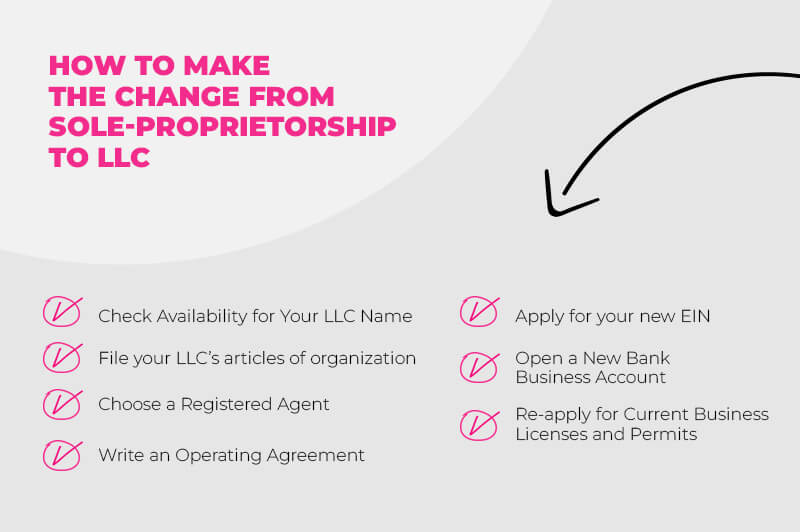

Each state governs its business entities, so you must follow state rules when changing your sole proprietorship to an LLC.

However, filing an article of organization and most other legal requirements are similar in all 50 states.

If you want to use your sole proprietorship’s name for your LLC, you must first confirm its availability in your state.

You can check your name’s availability on your secretary of state’s website, your state’s business formation website, or using a business name search tool.

When you change from a sole proprietorship to an LLC, you must file an article of organization and register your business with your state.

An article of organization, also known as a (Certificate of Organization or Certificate of Formation), is a legal document that includes information about your new LLCs business name, its address, the names of its members, and your registered agent.

A registered agent acts as your LLC’s point of contact with your state to accept official papers and documents on behalf of your business.

You can act as your agent, hire a registered agent company, or employ an attorney to fulfill the role.

Whichever you choose, you must do so before you file your LLC’s articles of organization.

An operating agreement is a document that outlines who owns your LLC, their duties, voting rights, how the business distributes any profits and losses, and what happens if a member wants to leave the company.

Not all states require an LLC to write an operating agreement. But having one is good business, as it avoids internal disputes, and if you’re a single-member LLC, you might need one to prove you are a separate entity in litigation cases.

When forming a new LLC, you must apply for a new Employer Identification Number with the IRS, regardless of whether you already had one as a sole proprietor.

You can apply for an EIN here and use it for handling payroll taxes, filing taxes, and opening your new business bank account.

You’ll also need to open a new bank account for your LLC to maintain separation between your personal and business finances.

Not only will this may help you keep your limited liability status, it also helps you streamline your business accounts, which reduces your tax reporting costs.

Now that you’re starting an LLC, you might have to re-apply for business licenses and permits.

As regulations for permits and business licenses vary by locality, industry, and state, contact your local state’s office or use the Small Business Association Licenses and Permits Tool to determine whether your new LLC has to re-apply.

Sole-Proprietorship is a great starting place for new entrepreneurs. It allows you to start trading and establishing your new business with minor red tape.

Once you’ve started your growth and your profits (yes!) are getting bigger and bigger, shifting your Sole-Proprietorship to an LLC might be an excellent solution to make sure your expansion can continue with ease.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands