You’ve got lots to do when starting a business–like choosing your business name; registering as an entity if starting a limited liability company, limited partnership, or corporation; filing for a business license; and possibly getting permits.

But before you can do any of those, you must appoint a registered agent.

Many new business owners don’t know what a registered agent is, why they need one, or the problems not having one could cause.

We know you’re busy, so we’ll get straight to the point and answer the question: What’s the penalty if you fail to appoint a registered agent?

A registered agent is a designated company or person who receives all state and federal correspondence, service of process (subpoena or summons), tax forms, and legal documents on behalf of your business.

All 50 U.S. states require legal entities like corporations, limited partnerships (LPs), and LLCs to appoint a registered agent.

States also require you to designate your registered agent when submitting articles of organization (registering your business entity) with your Secretary of State.

Any business that fails to appoint an agent can’t form a legal entity in its state.

You can be your own registered agent, appoint a friend or colleague, or designate a professional registered agent service. And in some states, you can nominate your business.

Regardless of choice, your agent must be 18 or older, have a physical address in your registered state, and be available during regular business hours.

The person or business you designate as your registered agent must be available during regular business hours to accept all tax and legal documents from federal or state governments on behalf of your business.

Documents could include a service of process, annual report deadline notices, and local and state tax notifications.

There’s no exception to this rule, and failing to comply can have severe consequences.

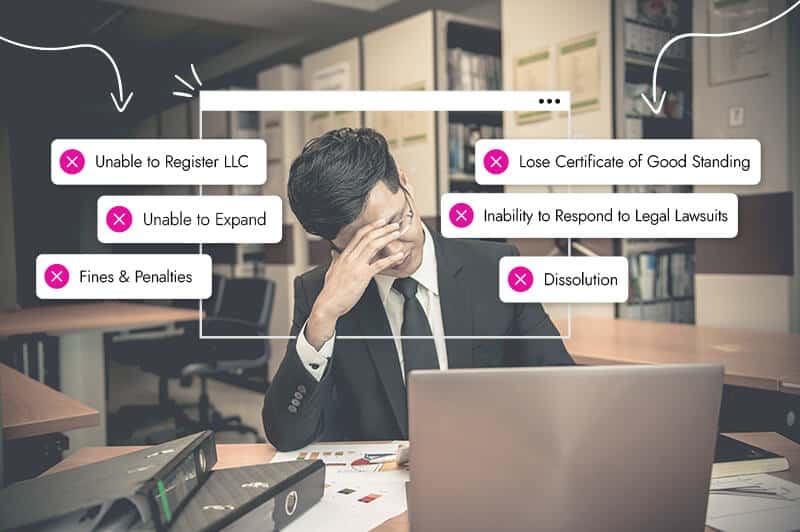

Failing to designate a registered agent might prevent you from starting your business, but failing to maintain one could put you out of business.

Let’s look at the penalties for failing to appoint or maintain a registered agent.

If you fail to appoint a registered agent, your state will deny your LLC request because naming your agent is one of the several steps required when forming a business entity.

Be aware that applying to form an entity without an agent could result in losing your registration fee.

All U.S. states have a certificate of good standing that allows a business to operate within their jurisdiction.

A certificate of good standing acts as a seal of approval that builds credibility and trust amongst local businesses throughout the state. Any business that fails to file taxes and legal forms, or misses a summons, can risk losing the certificate of good standing, and the results can be costly.

You could lose your business name and find it challenging to get funding or renew your business license and permits.

Not replying to an IRS or state tax notification, or if you’re served and don’t show up in court, can lead to a one-sided default judgment against your business.

For example, if a client sues your business and you don’t turn up in court, a judge could find you liable regardless of who’s right or wrong. This is called a default judgement.

You’ll have to hire a lawyer to appeal the verdict, with no assurance of winning, even with a case.

Operating without a registered agent restricts your ability to expand to other states because each state you do business in requires you to designate an agent.

You can’t be in 2 places at once!

Most states impose fines and penalties on businesses that don’t maintain and publish their registered agent’s contact information.

It’s because states require LLCs, LPs, and corporations to ensure they can receive legal notifications without exception.

The penalties and fines for non-compliance depend on your state, but one could cost you your business.

Failing to maintain your registered agent can lead to either the suspension or dissolution of your business. Both scenarios can be costly and cause a significant amount of stress and hardship you could do without.

Not maintaining your registered agent per state regulations isn’t worth the hassle.

Certain things in business are worth having and a registered agent is one of them.

A registered professional agent ensures you stay in good standing with your state and keep up-to-date with your legal business requirements. Thus reducing the possibilities of penalties and other legal implications.

Designating an agent also gives you the geographical freedom to work wherever you like, choose your operating hours, and expand your LLC beyond your home state.

The benefits of designating a registered agent are plentiful, including peace of mind and less paperwork.

Here are a few more significant reasons you should consider a registered agent service:

Designating a registered agent is relatively cheap compared to the advantages you gain. You can outsource to a registered agent service for as little as $199 to $400 per year.

Any limited liability company that does business in other states (known as a foreign LLC) must register an agent in each state.

Hiring a 3rd party registered agent with multiple state offices enables you to expand your business with confidence while reducing costs, as many registered agents offer reduced multi-state fees.

You can act as your own registered agent. But if you do, you tie yourself down to a specific location that must operate Monday to Friday, from 8 pm to 5 pm.

For many of us who now work remotely and on flexible schedules, time and location stipulations aren’t viable options.

Registered agent service is a separate business that manages your tax and legal documents on your behalf.

You can find agents on your Secretary of State’s website or use our registered agent service here at Tailor Brands, ensuring you never miss a letter that could cost you your business!

The best things in life are simple but deliver high-quality results. Hiring a registered agent service is one of them.

So, give yourself a break and consider designating an agent for your LLC, LP, or corporation.

Your business will love you for it, as will your peace of mind.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands