I can already see you rolling your eyes just thinking about tax season #sorrynotsorry. No one likes doing their taxes, but it’s here to stay, so it’s time you got used to it.

While doing your taxes can be a pain, we’re in the 21st century, people—there are tons of apps out there specifically designed to help make tax season a breeze.

If you’re not sure what apps I’m talking about, that’s alright. That’s why I wrote this post. Right now, you’re going to learn about the apps that can help you make tax season effortless (okay, you’ll still need to put in some effort—the apps can’t do everything for ya. Oh, I think I have an app idea!).

When tax season rolls around, you want to make sure you’re doing things right. If not, you could be missing out on potential tax deductions and who wants to miss out on that?

Luckily, filing taxes has been made easier thanks to apps.

Here are some recommended apps that can help you with bookkeeping, tracking business expenses, and filing taxes.

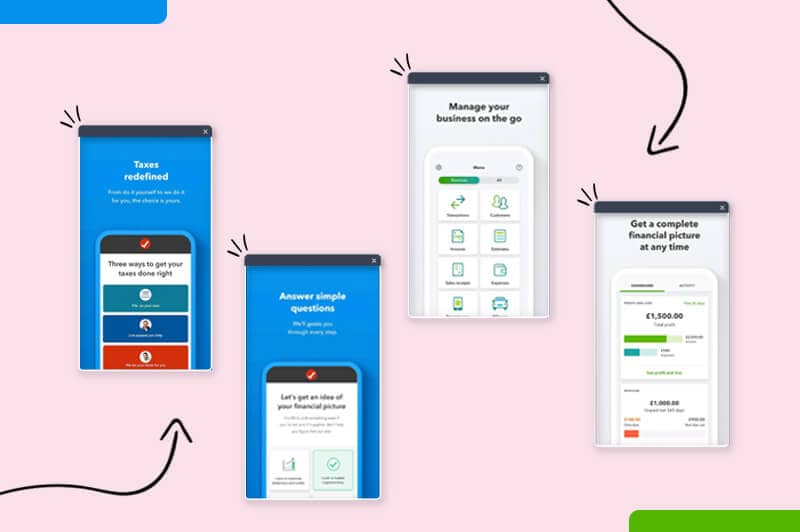

H&R Block is our best overall because it’s a trusted name in the tax world for tax preparation and really offers a well-rounded range of services for small business owners. Plus, its interface is easy to use, so if it’s your first time doing your taxes, it’ll be easy to do.

Their program walks you through the process (you can choose either the online or desktop version); however, if you need an extra hand, their customer service feature is just what you need.

It’s easy to lose receipts or, when filing taxes, have to go through endless amounts of paperwork. If you’re looking for a way to stay more organized, then CamScanner is a solid option. Using the app, you can scan documents and receipts directly to your phone.

The basic version of CamScanner is free, but if you need more features, they also offer subscription plans. While I could

Deducting business expenses can reduce the taxes you owe and increase your profits (and who doesn’t want that?). Whether you have a side hustle or a small business, expenses can add up quickly. That’s why it’s important you track your expenses and see what you’re spending money on.

We like Hurdlr because of its simplicity—you shouldn’t have to be a rocket scientist to understand how to use a tax app. It tracks and manages your expenses, refunds, and more.

TurboTax is one of the leaders in the tax world, and there’s a reason why. TurboTax offers a lot of features like on-demand support from tax experts and downloadable products—which is why it made it on the list.

Setting an account is super easy, and it also warns you if there are any mistakes in your tax application (and you’re only human, so mistakes happen). The app will also give you more information regarding tax law, deductions, etc.

As a small business owner, you may not have the extra income to get additional products for your business. TaxSlayer is ideal for people on a budget because it’s very affordable, making it a great option for your small business. That said, the price does vary depending on your business type and what state you’re in (so double-check!).

Tax season, especially if you’re a first-time small business, can feel overwhelming at times. Of course, you want to make sure you’re filing your taxes correctly. With the use of these apps, they’ll make sure to lend you a helping hand.

Always remember that if you have any questions about taxes, consult a bookkeeper or accountant (apps are just to help you out, they don’t replace the professionals).

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands