Every business operates as a definitive type of legal entity. The type of legal entity chosen for a business will impact numerous aspects of the business, including taxation, personal liability, and growth potential. The three primary types of legal entities for a business include sole proprietorship, partnership, and corporation. From those three, several hybrid options have evolved over the years. One of those is a Limited Liability Company, or LLC.

Registering an LLC in Texas combines many of the benefits found in a corporation with those found in a partnership. A distinct feature of a limited liability company is that it is owned by “members.” The members of an LLC are, in some way, like shareholders of a corporation; however, in other ways, they are more like partners in a partnership.

In most states, an LLC is required to create and file articles of organization that establish the rights, powers, duties, liabilities, and other obligations between the various members of the LLC as well as between the LLC and the members. In Texas it’s known as a “Certificate of Formation,” to be filed with the Texas Secretary of State (SOS). Filing can be accomplished online.

Another important advantage to forming your LLC in Texas is the lack of legal restrictions placed on who can be a member of an LLC. Specifically, the Texas Business Organizations Code does not impose residency or age requirements on who can be a member of an LLC. A member can be an individual, partnership, corporation, trust, or any other legal or commercial entity and is not required to be a Texas resident.

One of the many benefits of forming a Texas LLC is the limited liability protection afforded to members of the LLC. An LLC is considered a separate legal entity from its members, much like the relationship between a corporation and its corporate shareholders. As such, members of an LLC may be shielded from personal liability for debts and liabilities of the business; however, there are exceptions to the general rule. A properly drafted Operating Agreement can help protect members from personal liability by including provisions aimed at protecting members from personal liability.

When it comes to taxation of an LLC, the business can be treated as a corporation, partnership, or a “disregarded entity” by the State of Texas and the Internal Revenue Service (IRS). Pass-through taxation is a valuable advantage to being treated as a partnership or a disregarded entity because it means that the business itself is not taxed. Instead, the income “passes through” to the members of the LLC and is claimed on their individual tax returns. A corporation, by comparison, incurs “double taxation” because the corporation itself pays taxes and shareholders pay taxes on income derived from the corporation.

While most LLCs choose to be treated as a partnership or disregarded entity for tax purposes, one benefit of creating an LLC is the ability to choose how the business will be treated for tax purposes.

Unless an LLC requests to be treated as a corporation, the IRS default rule is for it to be treated as a partnership (two or more members) or a disregarded entity (single member) for tax purposes. To be treated as a corporation, an LLC must file IRS Form 8832 electing to be treated as such.

Another advantage to creating a Texas LLC is that the State of Texas does not impose a state income tax. While the income from the business must be reported on members’ personal income tax returns for federal tax purposes, that income is not taxed by the State of Texas.

The flexibility of deciding how the business will be managed is a vital benefit offered by an LLC in Texas. Texas allows an LLC to be member-managed or separately managed. In a member-managed LLC, every member has equal management authority. A manager-managed LLC is managed by a separate group of managers who can be, but are not required to be, members of the LLC.

Assuming your business is a success, you do not want another business capitalizing on the reputation you have built by using the same name. To prevent that, you need to protect the name of your business from its inception. Texas offers you the ability to file a name reservation with the SOS before you officially register your LLC. The registration is good for 120 days but can be renewed as needed. This prevents someone else from registering a business with the same (or substantially similar) name. Eventually, you may need to register a trademark or a service mark with the SOS to provide permanent name protection against unauthorized use within Texas.

It is important to keep in mind that filing a Certificate of Formation, an Assumed Name Certificate, or other LLC formation documents with the Secretary of State does not legally protect your business name. You must take the additional steps of reserving the name and/or registering a trademark or service mark. Equally important is understanding that the name of your LLC is only protected within the State of Texas. If you want nationwide name protection, you should review the federal rules available in the Trademark Section of the United States Patent and Trademark Office.

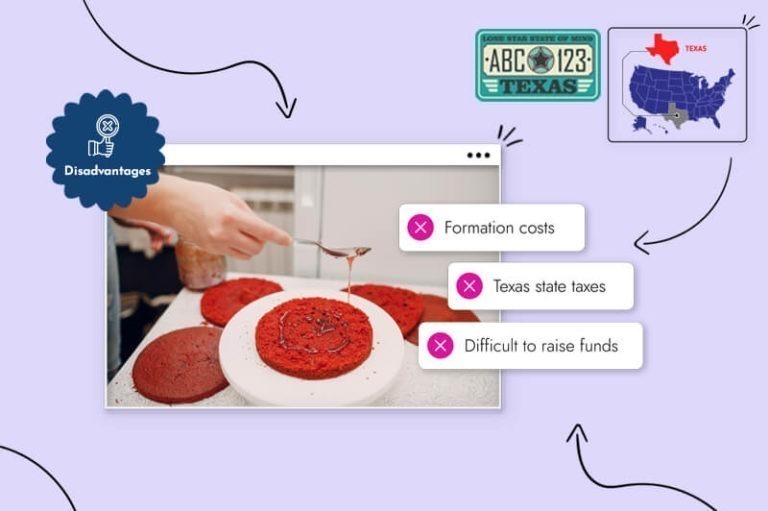

One disadvantage to forming a Texas LLC is the initial expense involved in registering the LLC. The cost of filing a Certificate of Formation (as of 2022) is $300. While that is significantly less expensive than forming a Limited Partnership ($750), it is on the high end compared to the cost of registering an LLC in other states.

While the absence of a state income tax is certainly an advantage to forming an LLC in Texas, the relatively high sales and franchise taxes imposed by the State of Texas are clearly a disadvantage. An LLC that sells goods to customers in the State of Texas must collect and pay sales tax. Texas has a 6.25 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 8.20 percent. For the year 2022, Texas ranked 36th among the states for its sales tax by the Tax Foundation.

Texas also imposes a state franchise tax on most LLCs. The amount of franchise tax may be determined in several different ways. Your LLC will not owe franchise taxes if the taxable amount is below the “threshold” for that year ($1.23 million for 2022).

The ability to raise investment capital to grow your business is a final disadvantage to forming a Texas LLC. Unlike a corporation that can sell stock shares to investors, an LLC cannot sell “member” shares. As such, a business must find other ways to raise money for growth.

The State of Texas routinely ranks at the top of the list for entrepreneurs. For example, U.S. News & World Report took the number one spot in a list of the “10 Best States to Start a Business.” Texas was also ranked 5th by CNBC in their “America’s Top States for Business 2022” survey.

Check out our step-by-step guide to learn more about starting a business in Texas.

One reason Texas ranks so high for businesses is the affordable cost of living in the state. The overall economy in Texas came in 8th in the CNBC study which looked at things such as the state’s gross domestic product job growth over the past year, the residential real estate market, and the number of major corporations headquartered in each state.

Texas is one of only seven states that does not collect income taxes from residents or businesses in the state. Not having to pay state income taxes is unquestionably a valuable benefit to entrepreneurs trying to get a new business off the ground.

Whether you plan to hire employees immediately or down the road, a skilled workforce is always important to a new business. CNBC ranked the workforce in Texas 2nd in the nation after comparing factors such as the concentration of science, technology, engineering, and math (STEM) workers, the net migration of educated workers to the state, and right-to-work laws. Texas also placed 4th in technology and innovation based on factors such as the number of patents and research grants issued per capita and the degree to which the state fosters emerging technologies.

Texas has the fourth-highest concentration of businesses with fewer than five employees and offers the second-highest annual payroll for businesses with fewer than five employees, according to a report recently published CNBC.

Getting a business off the ground is only the beginning of the challenges faced by entrepreneurs. Long-term survival and growth are among the other major challenges all new businesses face. Fortunately, for anyone planning to start a business in Texas, the Lone Star State has a good business survival rate and low risk from climate disasters.

If you are planning to start a Limited liability Company, it should be clear the benefits of forming your LLC in the State of Texas are numerous and may help provide your new business with significant long-term advantages and success.

No, unless the LLC elects to be treated as a corporation for federal tax purposes. The State of Texas does not tax corporations; however, it does impose a gross receipts tax.

The cost to maintain a Texas LLC is minimal in comparison to other states. Because Texas does not require an LLC to file an annual report, maintenance costs are limited to things such as fees for changing the registered agent or filing tax reports.

Non-expedited filings of a Certificate of Formation typically take about a week to process; however, because of increased demand in recent months, you may face a processing time of a month or longer. The SOS does offer the option to pay extra for expedited or overnight processing. Additional time may also be required to obtain permits and licensing.

You will need to choose and reserve a name with the SOS. File a Certificate of Formation and designate a Registered Agent. Create an Operating Agreement (optional but highly recommended) and apply for tax permits and other licenses.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands