The critical legal document you need to file to start your LLC in SC is the “Articles of Organization”. This is the step that will turn your business from an idea into a reality–an actual official South Carolina LLC.

In the articles of organization, you’ll provide the essential information necessary for LLC formation in South Carolina. This information includes the name and address of your LLC and the name and address of your registered agent.

You’ll pay a one-time filing fee and can apply online or by mail.

After the South Carolina Secretary of State approves your articles of organization, there are a few more recommended steps to give your LLC a firm foundation for success.

Let’s dive into it:

South Carolina law requires that you file an LLC articles of organization form before you can legally operate your LLC in the state. When the Secretary of State approves your articles, you’ll become the proud owner of a new South Carolina LLC.

Along with the form, you’ll have to pay a filing fee of $110 if you have a “regular” South Carolina domestic LLC. That’s an LLC that you form inside South Carolina.

A “foreign LLC” conducts business in South Carolina but was formed in a different state. To register a foreign LLC, you’ll need to file a different form: the Application for a Certificate of Authority by a Foreign Limited Liability Company to Transact Business in South Carolina. The filing fee is $110, and you must renew the Certificate of Authority annually.

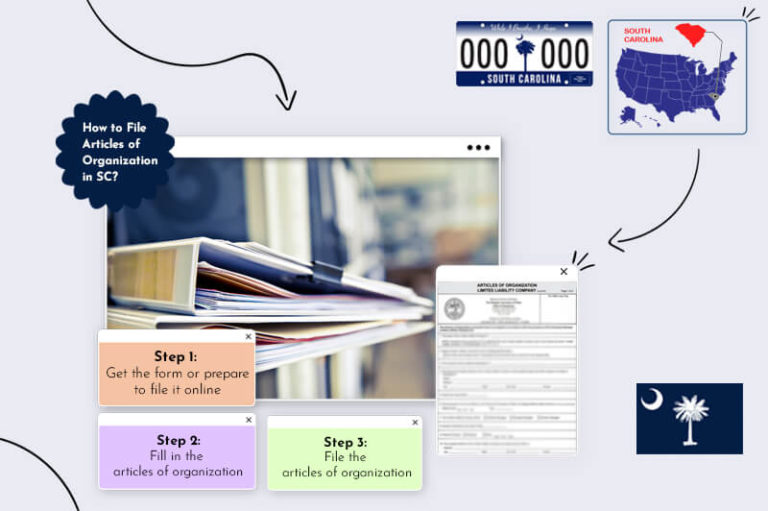

Filing South Carolina Articles of Organization for your LLC is a 3-step process:

If you want to file the articles of organization by mail, download the form from the South Carolina Secretary of State’s download page.

If you’d instead file online, start by registering an account with the Secretary of State.

Before completing your articles of organization, you’ll need to choose a name for your LLC. This name cannot duplicate any business names already registered in South Carolina. It must also follow the South Carolina naming guidelines.

To check if your desired name is already taken, look it up on the business name search page on the Secretary of State’s website.

You must add an ending to the name that indicates that the business is an LLC. South Carolina rules say that the ending must contain one of these terms: “limited liability company,” “limited company,” “LLC,” “L.L.C.,” “LC,” L.C.,” or “Ltd. Co.”

When you have your LLC name, enter it in the form.

It would be best if you had a registered agent to form and operate your LLC in South Carolina. The agent has to meet specific requirements to qualify. They are responsible for ensuring that their office has staff available during all business hours to receive official communications or service of process.

If you meet the requirements and can fulfill the responsibilities, you can serve as your registered agent. Many small business owners find it easier to hire someone to act as the registered agent on their behalf. You can find someone to hire on your own or use a registered agent service like the one we offer.

When you have your registered agent, enter their name on the articles of organization form.

The registered agent’s office must be a street address in South Carolina where the agent will be available for service of process during regular business hours. Fill in the address, where indicated, on the form.

You can file the articles of organization online or by mail.

To file online:

To file by mail, get all the required signatures, and send two copies to the following:

South Carolina Secretary of State’s Office

Attn: Corporate Filings

1205 Pendleton Street, Suite 525

Columbia, SC 29201

Enclose the filing fee of $110 and a self-addressed stamped envelope.

Although your LLC is now officially registered in South Carolina, there are a few more steps to take to get your business off to a great start.

An EIN (“Employer Identification Number”) is like a Social Security number for your business. You’ll use it when you file the LLC’s taxes.

If you have more than one member in your LLC, you must get an EIN. Even if you are the only member of your LLC, it’s still a good idea to obtain an EIN to protect your privacy and help create a division between your personal and business finances.

An operating agreement provides written documentation on how your LLC will be run. While an operating agreement is optional in South Carolina, it’s beneficial for preventing disputes and helping ensure your business runs smoothly.

Having a separate bank account for your LLC helps establish that your business and personal finances are separate. This may help strengthen your protection against liability for any claims made against your LLC.

South Carolina does not provide a statewide general business license, but many of the state’s cities and towns, as well as some of the counties, do require that you get a local license. You may also need to get state, local, and federal permits or specialized licenses to operate your business, depending on your business.

Every new LLC must file articles of organization to register and operate in South Carolina. The information you provide must be complete and correct to get your articles approved.

The process of filing articles of organization in South Carolina might seem overwhelming at first, but it’s less intimidating if you take it slowly, step by step. Or, you can use an LLC formation service like ours to handle it for you, leaving you free to use your time and energy for things only you can take care of.

Do you want to know more? Check out the questions we frequently hear about starting an LLC in South Carolina from small and micro business owners.

Download an Amended Articles of Organization form from the South Carolina Secretary of State’s website, or fill out the form online. Send two copies if you are filing by mail, and enclose a filing fee of $110.

If your LLC has an operating agreement, follow the procedures for changing ownership. File all required paperwork with the South Carolina Secretary of State, including a Members Statement of Dissociation for the member who is leaving.

To dissolve an LLC, file Articles of Termination with the South Carolina Secretary of State and enclose the required $10 fee.

To see if your desired LLC name is available, search the South Carolina Secretary of State’s list of registered names on the business name search page.

Yes. An LLC from another state can do business in South Carolina by filing an Application for a Certificate of Authority to Conduct Business and paying an annual fee of $110.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands