If you’re a business owner of any kind, you’ve probably heard by now about The Corporate Transparency Act (CTA), which requires many business owners to start reporting beneficial ownership information (BOI). So what is it all about?

This recent legislation aims to enhance U.S. business transparency to prevent illegal activities like tax evasion, money laundering, and terrorism financing and to ensure individuals and entities cannot hide behind anonymous shell companies. This is done by requiring businesses to report about their beneficial owners, i.e., those who own or control the company.

Due to that, the CTA legislation could also affect most small U.S. businesses! But what does this actually mean for you and your business?

What are the Corporate Transparency Act's implications for small businesses?

As of January 1, 2024 (when the act came into effect), all non-exempt businesses must comply with the CTA reporting requirements, which could add an administrative burden on your small businesses.

This includes independent contractors, family offices, mom-and-pop stores, and anyone using a legal entity like an LLC, because they now need to report business ownership details to the federal government—or face penalties and even jail time!

How might the Corporate Transparency Act affect your LLC?

Family-run LLCs often transfer business ownership through the generations using a tax-efficient accounting strategy where the original owner keeps a minor interest to get discounts that reduce the transfer value for tax.

While CTA doesn’t prohibit this tax-saving strategy, the new rules will require LLC members to report beneficial ownership information.

To ensure CTA compliance, you must understand the Corporate Transparency Act, confirm if you are a beneficial owner, understand beneficial ownership reporting rules, and what beneficial ownership information you need to include when preparing your CTA report. This post will discuss all of this in further detail.

As mentioned, the CTA aims to combat money laundering and terrorist financing by requiring companies like corporations, LLCs, or similar entities in (and outside but doing business in) the United States, to disclose their beneficial ownership information to the Financial Crimes Enforcement Network, commonly referred to as FinCEN.

FinCEN is a bureau of the U.S. Department of the Treasury combating financial crimes within the USA, focusing on preventing money laundering and terrorist financing activities. Its mission is to safeguard the U.S. financial system from illicit use by collecting, analyzing, and sharing financial information.

The primary purpose of the Corporate Transparency Act (CTA) is to stop “bad actors” (criminals and other untrustful sorts) from using the U.S. financial system for illicit activities like money laundering and tax evasion, and other illegal activities, including:

However, beneficial ownership reporting could also penalize small business owners who don’t understand or comply with the requirements. That’s why it’s important to understand all the ins and outs of this new rule, to determine when and whether you need to file a report and which information to include.

A beneficial owner is someone who owns (directly or indirectly) or controls 25% or more of a business’s ownership and individuals responsible for substantial control over a company.

A reporting company is any business you create by filing a formation document (like an LLC or corporation) with your Secretary of State (or similar government business registration office).

Owners of such businesses (called domestic reporting companies, I’ll explain that in a moment) must file their beneficial ownership information unless they qualify for an exemption.

Any business liable for beneficial ownership reporting is called a reporting company, and they come in 2 types:

The Corporate Transparency Act (CTA) of 2021 provides exemptions to 23 entity types that meet specific requirements, including businesses with a certain amount of employees, nonprofits, and public trading companies.

The 23 exemptions include:

FinCEN’s Small Entity Compliance Guide provides a checklist for all 23 exemptions to help determine whether your business meets the requirements, thus removing your obligation to comply with the Corporate Transparency Act and file beneficial ownership information.

Reporting your beneficial ownership information is a critical stage to make sure that you comply with the Corporate Transparency Act.

You file your beneficial operating information report online using FinCEN’s BOI E-filing System.

When you submit your beneficial operating report, you may also need to submit contact information, including your name, email address, or phone number.

Filing is available from January 1, 2024, and FinCen provides the following information to help you file your report correctly:

Note:

To ensure compliance with the Corporate Transparency Act, businesses needing help with their beneficial ownership reporting obligations should consult a lawyer or accountant. You can also file your BOI report with us.

The beneficial ownership information you must report depends on when you form your business.

For instance:

Here’s what LLCs, corporations, and other reporting companies must include in their beneficial ownership reporting form:

And you must report information about each beneficial owner of the reporting business:

Note:

The FinCEN’s Small Entity Compliance Guide is a comprehensive checklist to help you identify the beneficial ownership information you must include in your beneficial ownership reporting.

Those are the whys; let’s look at how you file your beneficial ownership information and comply with the Corporate Transparency Act.

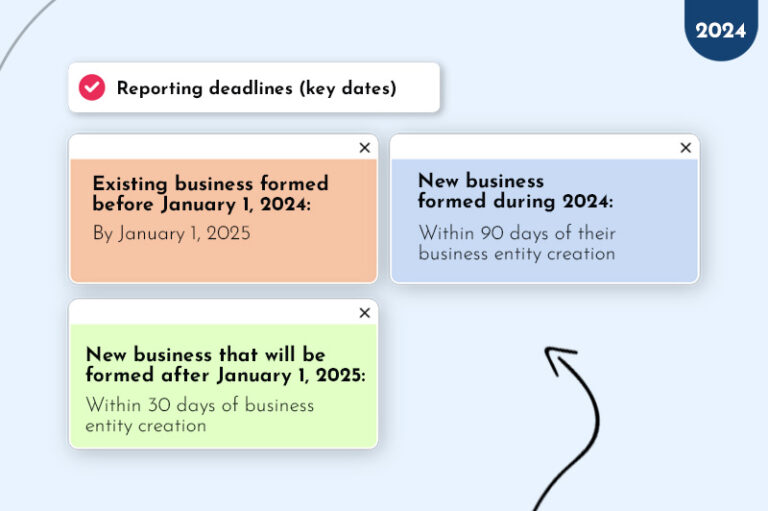

The CTA came into effect As of January 1, 2024 and affects many US-registered businesses, however, the timeframes and reporting dates depend on your business formation date.

So let’s look at those:

Reporting entities formed before January 1, 2024, must file their initial beneficial ownership information report by January 1, 2025.

Reporting entities created on or after January 1, 2024, and before January 1, 2025, have 90 calendar days to file their initial business owners’ information report after they receive notification of their business formation or after their jurisdiction’s Secretary of State (or relevant office) posts a public notice of the business entities creation.

Reporting entities created on or after January 1, 2025, have 30 calendar days (after business registration/creation is complete) to file their first beneficial ownership information report with FinCEN.

FinCEN states that it works hard to inform you of your obligations for beneficial ownership reporting, including how to update and correct your beneficial ownership information.

It also understands that some small business owners might make a mistake or omission when filing their initial report, and allow 90 days after filing to amend your original report to avoid penalties.

So, there’s no valid justifications exist for failing to comply with the Corporate Transparency Act!

Businesses and individuals that fail to fulfill their beneficial ownership reporting obligations could face severe penalties.

What are the penalties for not complying with BOI reporting requirements?

Some stiff penalties exist if you fail to comply with your beneficial ownership reporting requirements, including possible jail time and fines.

FinCEN assigns penalties for 3 reasons:

The penalties are:

Note:

FinCEN’s Small Entity Compliance Guide provides transparent information about their beneficial ownership reporting requirements and penalties in Chapter 1.3, “What happens if my company does not report BOI in the required timeframe?”

All you need to know now is what to do after you file your business owner’s information report.

You only need to file your initial business owner information report once (the initial report) unless your business circumstances change and require updating or you realize errors in your initial filing.

FinCEN stores all business owner information in a non-public secure database.

However, U.S. government and foreign officials can request (through a U.S. Federal government agency) to access secure information, and financial institutions can seek access to your reported information with your consent.

The CTA is an anti-money laundering law that identifies individuals seeking to hide their business ownership or committing tax fraud, finance terrorism, and other illegal activities.

The Corporate Transparency came into effect on January 1, 2024.

A beneficial owner owns (directly or indirectly) or controls 25% or more of a business’s ownership and individuals responsible for substantial control over a company.

FinCen uses the beneficial ownership form to identify information about individuals who directly or indirectly own 25% or control a business.

Beneficial ownership reporting is FinCEN’s new law that requires business owners (and individuals who control a majority) to provide identifiable information.

Reporting businesses file their beneficial ownership information report to FinCEN electronically using their secure filing system.

It’s free to file your business owner’s information report.

Yes, including foreign-owned LLCs that register to do business in the USA.

To sum it up, this is what you need to know about the Corporate Transparency Act, beneficial ownership reporting, and the beneficial ownership information you must submit to remain compliant with this new rule.

The key points to remember are:

But if you still have some queries, visit the Financial Crimes Enforcement Network website, where FinCen answers every business owner information question, and check out our FAQs below.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands