Start a Small Business → Start a Business in Texas → How to Get a Sales Tax Permit in Texas?

Most US states require any individual or business that sells specific products, provides certain services, or owns, sells, or leases tangible property within the state (including remotely) to have a sales tax permit.

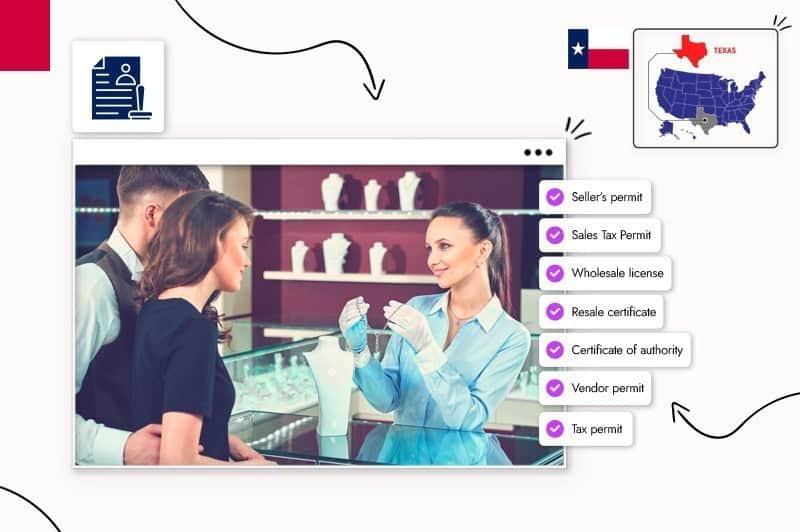

Sales tax permits have many names depending on the state; they call it a sales and use tax permit in Texas.

The question is:

If you’re about to start a business (or already have one), do you need a Texas sales and use permit, and if so, how do you get one?

This guide answers those questions.

But first, let’s see why Texas is such a darn fantastic state to start a business in:

Texas often ranks number one (always in the top 5) in the Forbes “Best States for Business” list because of its prosperous business climate and favorable regulatory environment that provides entrepreneurs and small businesses the ingredients for success.

So, if you’ve chosen to start a business in Texas, you’ve made a smart decision.

But to do it, you must take specific steps (like forming an LLC and choosing an appropriate business name) to ensure you set up and run your business correctly.

Another one of those steps is getting your Texas sales tax permit.

It’s pretty simple.

Sales tax is a percentage (ranging from 2.9% to 7.25% in Texas) added to the price of a taxable product or service.

The seller collects it from the buyer upon sale and pays it to their state’s Department of Revenue.

45 US states charge sales tax; those that don’t are Oregon, Montana, Alaska, Delaware, and New Hampshire.

A seller’s permit , also known as a sales tax permit, reseller permit, resale certificate, sales tax license, or sales and use tax permit, enables you to charge, collect, and remit state and local (if any) sales tax on the products you sell or services you provide.

Collecting and paying sales tax is the seller’s (not the consumer’s) responsibility, and failure can cause fines, interest, and, in severe cases, criminal charges.

Once you receive your Texas sales and use tax permit, you must charge your customers the appropriate sales tax rate (on taxable items and services) and remit it to the Texas Department of Revenue.

Sales tax payment dates can vary annually, quarterly, or monthly, but all fall on the 20th of the month following your reporting period.

Any business selling or leasing taxable products, services, or property in Texas needs a Texas sales and use tax permit.

That includes individuals and entities like LLCs, sole proprietorships, partnerships, corporations, and any business formed in another state but engages in business within Texas and has a nexus (a physical presence that includes product fulfillment facilities).

Taxable products and services include most physical products like furniture, clothing, computer equipment, digital goods, and downloadable software. Services like house cleaning and auto repair are also taxable.

Nontaxable products include groceries, medications, utilities, and fuel.

You can find a complete list of taxable and exempt products and services on the Texas Comptroller’s website.

You probably have what you need to apply for a Texas sales and use tax permit, and what you don’t have, you can get.

Texas sales tax permit requirements:

Federal statistical agencies use the North American Industry Classification System (NAICS) to classify businesses and collect and analyze data relevant to the US business economy.

Your business’s NAICS code is on the US Census Bureau’s website.

You can register for a Texas seller’s permit in 2 ways: online or by mail.

Visit the comptroller.texas.gov website and click the “Sales Tax Permit Application” link to open the register as a “New Permit Applicant.” First-time users must create a profile and set up their user ID and password.

Download the PDF application AP-201 (Texas Application for Sales and Use Tax Permit), complete the paperwork, and send it to:

Once you have your Texas sales tax permit, you must do the following:

After collecting sales and use tax, you pay it to the Texas Comptroller of Public Accounts.

Texas state sales and use tax is 6.25%; some Texas cities and districts levy an additional local sales tax. Check out the Sales Tax Rate Locator to see what your locality charges.

Each US state has its own sales tax permit regulations; in Texas, those include:

The quick answer is yes if you sell to customers in Texas.

And that includes remote sellers (like Amazon, Etsy, and eBay) or from your non-Texas state business website.

Only occasional sellers (and online businesses selling to customers in another state) avoid the sales and use tax permit obligation.

But even then, keeping at least 4 years of online sales records is advisable in case of an IRS audit.

Any individual or business that sells over 2 taxable items in a calendar year within Texas must have a Texas seller’s permit.

The Texas Comptroller’s website provides specific information regarding online sales, and their Marketplace Seller tax guide is also helpful.

When you start a business in Texas that isn’t a sole proprietorship, you must file an annual Texas Franchise Tax form.

Many businesses that need a Texas seller’s permit fall into that category; if that’s you, here’s what you need to know:

Franchise tax is a charge all Texas legal entities (LLCs, corporations, etc.) pay to do business in the state. Fortunately, start-ups earning under $1.18 million annually file a zero franchise tax return.

But here’s the annoying bit!

Texas law requires any business registering for franchise tax to list their phone number as a matter of public record, which means annoying telemarketers can get it.

To avoid this, contact the Texas Comptroller’s office and ask to remove your phone number from your public information.

Zero. Texas doesn’t charge for a sales and use tax permit.

The Texas Comptroller says it takes 2-4 weeks (from receiving your application) to get your Texas seller’s permit.

No, your Texas sales and use tax permit remains active for as long as your business does.

No, you’ll need a Texas seller’s permit for each business you run that sells or provides taxable products and services.

Your permit becomes invalid, and the buyer must apply for a new Texas seller’s permit.

No. A sales tax permit lets you collect and remit sales tax to the Texas Comptroller and your local municipality’s Department of Revenue.

A Resale Certificate allows you to avoid paying sales tax when you purchase goods from a wholesaler intending to resell them to your customers, who then pay you the sales and use tax.

You get a Resale Certificate by completing Form 01-339 (Texas Sales and Use Tax Resale Certificate).

And that’s everything you need to know about a Texas sales and use tax permit.

Just remember what Margaret Mitchell (author of Gone with the Wind) said: “Childbirth, Death, and taxes. There’s never a convenient time for any of them.”

But the quicker you get your Texas sales and use tax permit, the less painful it’ll be come tax time!