Connecticut enjoys a robust economic foundation built by more than 360,000 small businesses that comprise 99 percent of companies. Ripe with opportunity, entrepreneurs and thought leaders can turn their ideas and side hustles into profit-driving juggernauts. Unfortunately, the challenges of securing a business entity name when forming an LLC in Connecticut cause even exceptional people to shy away. If you are considering creating a Connecticut LLC, the following information can help you seamlessly negotiate the entity search process.

Performing a business entity search is a critical early step in creating a Connecticut LLC. The process helps prospective business owners distinguish their organization from others. It’s not unusual for a wide range of business names to be in use. The state and business owners have a vested interest in distinguishing one enterprise from another.

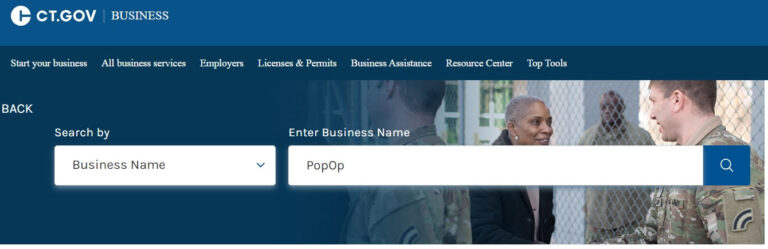

The State of Connecticut tasks professionals with verifying the availability of names on the Connecticut Secretary of State’s Business Records Search page. First-time entrepreneurs may quickly discover some of their favorite options already exist. That’s why it’s important to compose a list of business names and follow Connecticut’s naming guidelines.

Connecticut does not necessarily provide a comprehensive list of established naming guidelines or prohibitions. The New England state requires a business entity name to be available and free of trademark infringement. These are examples of what Connecticut might disqualify.

It’s essential to prepare a list of potential business entity names before starting your search. Much to the surprise of many first-time entrepreneurs, many of the memorable and popular monikers are being used. Between actual entity names and DBAs, you may need to run several searches to secure a name that customers remember, and that can be effectively branded and marketed. You can also type in your preferred options on the Business Records Search engine, or during the active Connecticut LLC filing process.

The Business Records option runs possible names through an existing database. It allows users to run an advanced search based on name, address, principal, and agent, among other options. Simply type in the name you desire and hit Enter. If another business has the name, it will be listed. Once you find a unique name that furthers your interests, move on to the Connecticut filing process option and follow these steps.

You will also be tasked with answering a series of related questions and providing information about the organization. One of the key items will be including a registered agent, simply an “agent” on the Connecticut platform.

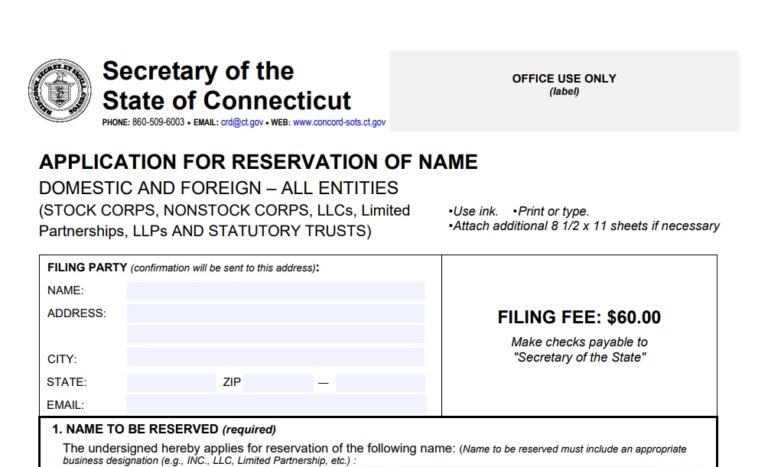

Connecticut charges a $60 fee when filing an Application for Reservation of Name form. You can reserve a business name for up to 120 days, and the reservation can be renewed at an additional cost.

The state generally allows local municipalities to handle Doing Business As (DBA) names, sometimes referred to as Trade Names in Connecticut. Although the fictitious name process differs between communities, these are steps you’ll need to follow.

Once you have acquired a business name in Connecticut, you can prepare to launch the operation. These are things startup organizations typically do with name in hand.

The Connecticut economy thrives on small business opportunities, and entrepreneurs employ nearly half the workforce. If you are considering launching an LLC in Connecticut, reserving a name is a vital first step.

Running a Connecticut business entity search helps startups select a name that is not being used by another company. Presenting your brand as a unique and preferable option is in your best interest. Having the same name as another entity could lead to people confusing your brands and reputation.

You can run a Business Records Search to determine if and how many others are using a specific name. You can then follow the Connecticut LLC filing process.

Connecticut charges $60 to reserve a name for up to 120 days. You can also renew the reservation if you are struggling to negotiate the cost of the Connecticut LLC formation process.

The short answer is: Yes. Registering a Trade Name demonstrates that you plan to launch an enterprise. When you follow the Connecticut filing process, the platform will ask for wide-reaching information that defines your niche. That data may deter other similar entities from echoing your name.

The State of Connecticut keeps naming guidelines relatively simple. Businesses cannot use foul language terms, call themselves something misleading, such as a “bank.” Only use the name of a municipality if you have an actual operation there. Do not include abbreviated business types such as LLC or Inc.

Continue running business entity name searches until you find one that is available. Given there are more than 350,000 small businesses in Connecticut, it’s prudent to create a list of options before starting your search.

The short answer is: No. Some states, namely abutting New York, require startups to advertise their existence. You can use that money to create a logo, website, or another goal-achieving measure.

A DBA, also known as a fictitious name or Trade Name, is filed with the state as part of your Connecticut LLC. That means a DBA is, effectively, a business asset, not a separate company. No. You won’t need another EIN.

Because each municipality has its own system and processing timeline, it can be difficult to know. Some towns require 3-5 business days, others upwards of 10 or more.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands