Need to dissolve your LLC? There are many reasons why this could be the case, from economic challenges to legal or personal reasons. Regardless of your specific reasoning for needing to dissolve an LLC, however, there are specific processes and procedures that must be followed. Typically, these are state-specific.

So, how can you dissolve your LLC in Hawaii? We’re covering all the details below so you can proceed with confidence.

First, it’s important to understand what LLC dissolution entails. Specifically, dissolving an LLC means removing your LLC’s independent legal status by canceling it directly through the state of Hawaii. Usually, this involves submitting an application for dissolution directly through the Hawaii Department of Commerce and Consumer Affairs.

To ensure that your application is accepted and that the LLC you formed can be properly dissolved, however, it is critical that you follow all dissolution requirements set forth by Hawaii—which may include anything from paying off any remaining debts and outstanding taxes, as well as notifying your creditors and respective government agencies.

In the state of Hawaii, there are three different types of dissolution to be aware of. By understanding the differences between each dissolution type, you can determine which option best applies to your business.

Administrative dissolution occurs when a business fails to adhere to its obligations as an LLC. This may occur when a business fails to pay state franchise taxes or fails to submit an annual report by the required due date. When an LLC is administratively dissolved, this usually means that the business has been involuntarily dissolved by the state of Hawaii directly.

Another common type of dissolution in Hawaii is known as judicial dissolution, which occurs when dissolution is ordered by a court. This type of involuntary dissolution may occur when there are charges of fraud by LLC members or other internal disagreements that cannot be resolved outside of court.

When a business owner wants to voluntarily dissolve an LLC due to a lack of finances, illness, or any other reason, this is known as a voluntary dissolution. Depending on the number of members in the LLC, this type of dissolution may require a majority vote, as well as completion of an application that must be approved by the Hawaii Department of Commerce and Consumer Affairs Business Registration Division (BREG).

In Hawaii, there are five steps that business owners must take to formally and voluntarily dissolve an LLC.

First, all members/owners of the LLC must vote to dissolve the business. A majority decision may be required for businesses with two or more members. However, if the LLC has an operating agreement with dissolution triggers that were already agreed upon, a vote may not be required if one or more of those triggers has occurred.

If you’re looking to dissolve your Hawaii LLC, be sure to check your operating agreement first and foremost. This document will outline any specific procedures or steps that need to be taken in order to dissolve the business, as well as details regarding any kind of voting requirements that may be in place.

Many states require a majority vote to dissolve an LLC, though a two-thirds vote may be all that is needed in some cases. Again, these are details that should have been outlined in your LLC operating agreement.

In addition to meeting voting and other requirements to dissolve your Hawaii LLC, you’ll also need to wrap up any remaining business affairs. This should include informing your suppliers of your impending business closure, as well as canceling your Hawaii business licenses and permits. LLC owners will also need to have a plan for closing any business bank accounts and informing employees of the planned closure.

Another important aspect of dissolving your Hawaii LLC is settling any debts that your business may owe. All too often, LLC owners mistakenly assume that being a limited liability company means that they do not have any obligation to pay back debts once the business is dissolved. In reality, creditors can (and often will) pursue money owed to them even after dissolution.

With this in mind, it’s a good idea to get ahead of future problems by notifying your creditors of your intent to dissolve the LLC. From there, you can work out plans to liquidate remaining assets, generate debt repayment plans, and pay off outstanding bills.

In Hawaii, LLCs are liable for taxes even after they are dissolved. This means that you will still need to file a tax return with the IRS (as well as a state tax return) and pay any applicable income tax, payroll taxes, state taxes, and any other taxes for which you are responsible. If your LLC pays quarterly taxes, be sure to keep up with these payments as well. Otherwise, you could be subject to fines, penalties, and interest on taxes left unpaid.

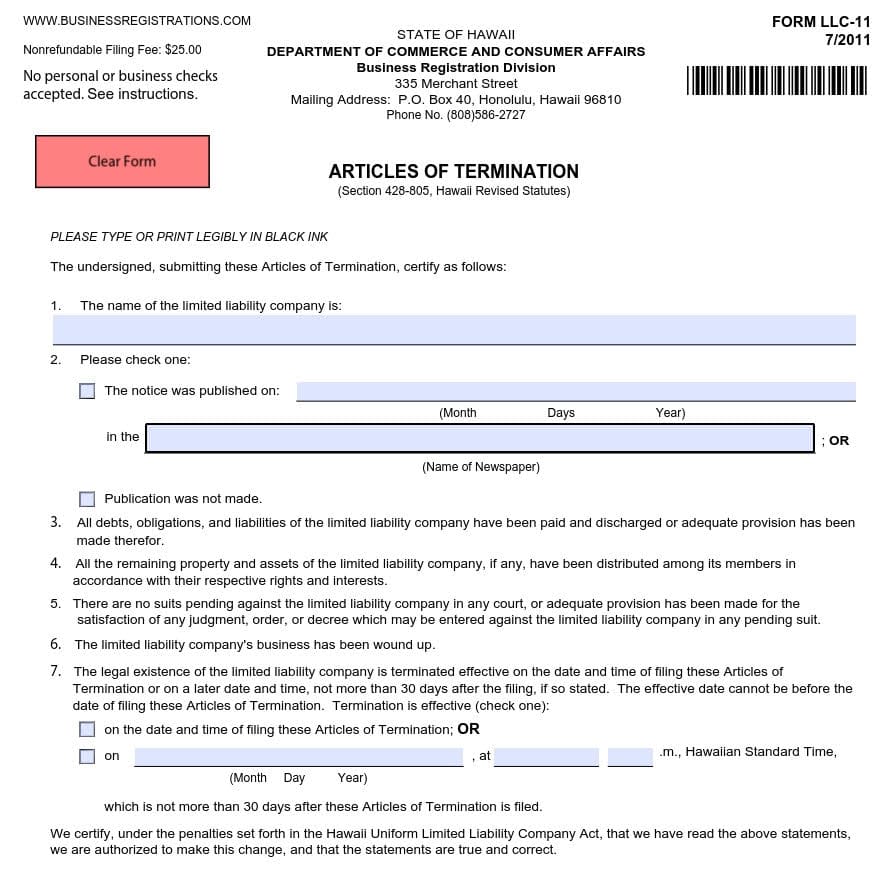

In order to formally dissolve your LLC in Hawaii, you will also need to file formal paperwork with the Hawaii Department of Commerce and Consumer Affairs Business Registration Division (BREG). This includes submitting Form LLC-11 (Articles of Termination) and paying any applicable fees. In Hawaii, the filing fee to dissolve an LLC is $25 as of September 2024—and you can file via fax at (808) 586-2733, by mail, or in-person.

The mailing address for the Hawaii Department of Commerce and Consumer Affairs Business Registration Division (BREG) is:

P.O. Box 40

Honolulu, Hawaii 96810

In-person dissolution paperwork can be dropped off at 335 Merchant Street, Honolulu, Hawaii 96810.

When paying your filing fee, be aware that the only accepted payment options are cash, certified cashier’s check, money order, or credit card (Visa or Mastercard). Personal and business checks are not accepted.

After the state has accepted your application for LLC termination, you will receive a certificate of dissolution or certificate of termination via mail. If you have a registered agent in Hawaii, keep in mind that this certificate may be mailed to your agent directly.

As you can see, there’s a lot to keep in mind when it comes to legally dissolving an LLC in Hawaii. Not only do you need to follow the requirements of the state, but you’ll also need to defer to your original operating agreement and take steps to settle any remaining debts.

And remember that although an LLC dissolution does signify the end of your company, it can also prepare you for new beginnings.

Looking for more guidance? Tailor Brands is here to help. Check out our blog for helpful articles on everything related to LLCs. We can even help you when it’s time to apply for a new LLC in Hawaii or any other state, so get in touch to learn more.

There are many common reasons to dissolve an LLC, ranging from internal disagreements and disputes to financial struggles. In some cases, it may also be necessary to dissolve an LLC if your company is moving to another state or merging with another business.

The cost to file Form LLC-11 in Hawaii is $25 regardless of whether you file by mail, in-person, or via fax.

As of September 2024, the Hawaii Department of Commerce and Consumer Affairs Business Registration Division does not offer an option to file LLC dissolution paperwork online. Instead, paperwork must be faxed, mailed, or delivered in-person to their Honolulu office.

It typically takes about five (5) business dates for the Hawaii Department of Commerce and Consumer Affairs to process an application for LLC termination once received. However, expedited processing is available for an additional $25 and may be completed in as little as one business day after receipt of appropriate paperwork.

If you fail to formally dissolve your LLC in Hawaii, you will still be responsible for paying any taxes (including state franchise taxes), annual fees, and other costs related to doing business as an LLC. Eventually, your company may be involuntarily dissolved by the state or by the courts if you fail to file your annual report or meet other obligations.

Typically, businesses only need to be registered in the state out of which they operate. This means that if your LLC operates out of Hawaii, it may still be able to do business in other states without being formally registered anywhere else. In most cases, registering an LLC in just one state will make the most logistical and financial sense, but it never hurts to consult with a professional if you’re unsure.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands