Dissolving a limited liability corporation (LLC) in Massachusetts is the final critical step to closing your business. Whether you’ve achieved your entrepreneurial goals that made you form your Massachusetts LLC or decided to move in a different direction, legally dissolving your LLC ensures that your business is wrapped up and your legal obligations towards it are over. Below, we discuss the types of LLC dissolution, how to get the process started, and what else you need to know before winding down your business.

Dissolving an LLC means you formally end its legal existence. This means stopping all business operations, settling any debts, distributing remaining assets, and filing the necessary paperwork with the commonwealth of Massachusetts. Once your LLC is dissolved, it’s no longer legally responsible for taxes, fees, or liabilities.

There are three main types of LLC dissolution: administrative, judicial, and voluntary. Administrative and judicial dissolution are involuntary, while voluntary dissolution happens only when the LLC members take action.

This happens when the commonwealth administratively dissolves your LLC because you haven’t complied with legal requirements, like failing to file annual reports or pay fees.

Judicial dissolution happens when a court orders your LLC to be dissolved. This can be due to disputes among members, illegal activities, or other serious legal issues.

Voluntary dissolution, which is covered in more detail below, is initiated by the LLC members when they decide to close the business. This process is typically straightforward but requires compliance with Massachusetts laws and the LLC’s operating agreement.

To begin the dissolution process, the members of the LLC must vote to dissolve the business.

In a single-member LLC, the sole member can unilaterally decide to dissolve the LLC. In a multi-member LLC, the dissolution usually requires a majority or unanimous vote, depending on the operating agreement.

Your operating agreement likely includes specific provisions regarding dissolution, such as voting requirements, asset distribution, and debt management. It’s important to review these rules to ensure the dissolution process is handled correctly.

If your company’s operating agreement or articles of organization don’t provide a process for dissolving your LLC, you’ll need to apply the state’s default rules. This means you can dissolve your LLC if all members consent in writing. Massachusetts doesn’t require LLCs to obtain a tax clearance before dissolving, although you will need to pay all outstanding taxes. You also don’t need to notify creditors that you plan to dissolve your company, although you’ll need to pay any outstanding debts before you distribute assets.

After voting to dissolve the LLC, it’s time to wind up the business’s affairs. This includes notifying your registered agent, suppliers, and customers about the closure, canceling business licenses and permits, handling employee-related matters, and closing business bank accounts.

Although Massachusetts law doesn’t require you to notify creditors, it’s essential to settle any outstanding debts before you distribute any remaining assets among the LLC members.

Filing your final tax returns and settling any outstanding taxes with the Massachusetts Department of Revenue is a critical step in the dissolution process.

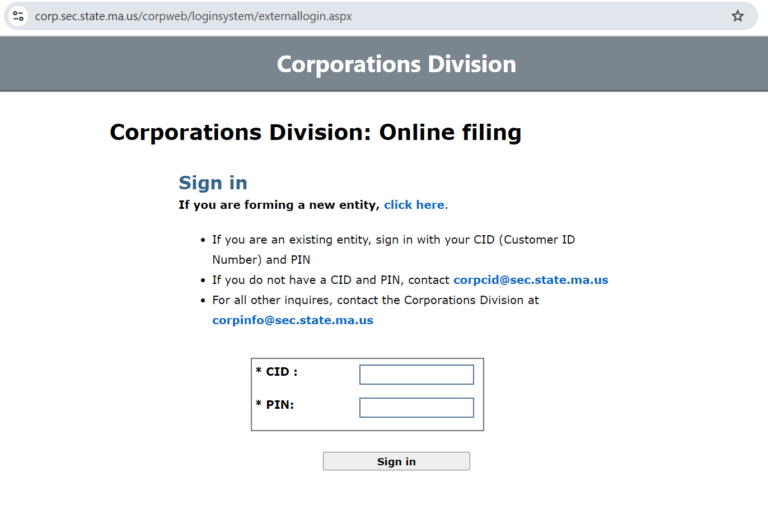

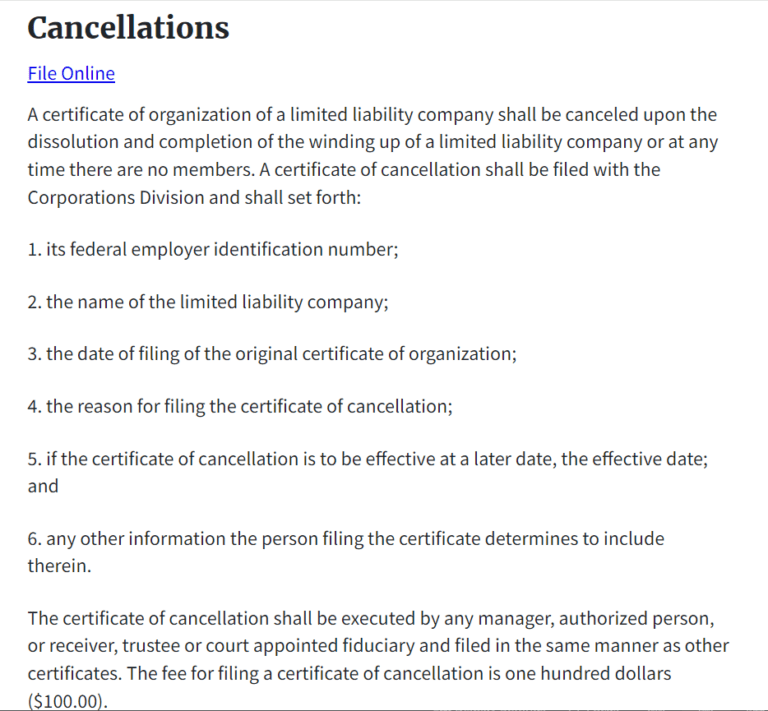

The final step in dissolving your LLC is to file a Certificate of Cancellation with the Massachusetts Secretary of the Commonwealth. This document officially terminates your LLC’s legal existence. After you create an account and fill out the cancellation form, you’ll pay a $100 filing fee and submit the paperwork to the Commonwealth online or by mail.

Below is the information you’ll need to have on hand to fill out the Certificate of Cancellation.

Once the dissolution process is complete, ensure that all records are maintained for future reference and that any other post-dissolution matters are properly handled.

Dissolving your Massachusetts LLC closes the door on your business. But it’s not legally final until you file the Certificate of Cancellation with the Secretary of the Commonwealth, which terminates your business’s legal existence. While this is pending, you can take other necessary steps like paying your debts, canceling any licenses or permits, and distributing assets among the members according to the operating agreement. Doing your research before you begin the process should help it run more smoothly and complication-free.

Closing your LLC is necessary to make your business officially ‘dissolved’, minimize potential ongoing liability, and make sure it’s not open-ended.

The cost of dissolving an LLC in Massachusetts is the $100 filing fee for the Certificate of Cancellation. This does not include the cost of settling debts or canceling licenses.

Yes, you can dissolve your Massachusetts LLC online by filing the Certificate of Cancellation on the Secretary of the Commonwealth’s website.

This depends on how quickly your paperwork is completed, but it should be a matter of weeks once the Certificate of Cancellation is filed.

Yes, you may be able to dissolve your LLC even if it is no longer actively operating. But before you do, you should follow your LLC’s operating agreement’s dissolution steps to avoid any future taxes or fees associated with an improperly closed LLC.

When you do decide to dissolve your LLC, you are still responsible for filing a final tax return for that year, as well as paying any final taxes due. You must also pay any and all taxes due to the federal government and the Massachusetts Department of Revenue before you can file your Certificate of Cancellation.

Yes, you should complete a final tax return and file it with the IRS while noting that the business is shutting down. This lets the IRS know that you’ll no longer need to file returns covering the life of your LLC.

The rules about how a dissolution can take place without the consent of all members depend entirely on your operating agreement or articles of incorporation. Many LLCs require that members act with majority or even unanimous consent to dissolve the LLC. If your operating agreement doesn’t specify, you’ll need unanimous consent under Massachusetts law. Be sure to review your operating agreement to see what rules apply.

Yes, after you’ve decided to dissolve your business, you must cancel all business licenses, permits, or other registrations related to your LLC. This helps to close out your business ties and avoid any future renewal obligations or penalties you might have overlooked.

If the LLC has employees, you must give them notice of the dissolution, pay any remaining payroll liability, and file final employment tax returns. You may also need to wind up your unemployment insurance and any other employment-related obligations while the dissolution is pending.

Yes, but LLC assets must be distributed pursuant to certain procedures. Before a distribution, an LLC must first use all of its assets to satisfy debts payable to creditors. This includes members whose distributions are contingent on the settlement, extinction or termination of their membership interests.

When all the LLC’s debt has been paid, the assets that remain may be distributed proportionally to LLC members. LLC members may also obtain distributions from their LLCs once the shares of ownership are broken up. The exact method of distribution will depend on the LLC’s operating agreement.

After you voluntarily dissolve an LLC in Massachusetts, the dissolution is not reversible. The only exception is if you apply during a two-year period to reinstate or redomesticate – which means that you may have to form a new LLC rather than ‘reforming’ the dissolved entity.

You’ll have to find ways to settle your company’s liabilities, then deal with any legal issues and claims and get all of your ducks in a row (filling out forms, and other necessary steps). This process should take a few weeks to a few months, depending on your circumstances. For example, if your operating agreement requires a unanimous vote to dissolve and you have a couple of holdouts, it could take longer to get the ball rolling.

It doesn’t matter if you have suits pending, you can still dissolve your LLC – but that dissolution doesn’t relieve your business’s legal obligations. You might have to resolve any cases in progress before or while you are winding up the business.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands