Deciding to call it quits on a company you worked hard to build is a big decision. But if you do determine that dissolving your LLC is the best path forward, it’s essential to follow the right process and do it correctly.

Dissolving an LLC in Washington requires a few specific steps that must be carefully completed. In this guide on how to dissolve an LLC in Washington, we’ll go over the basics of LLC dissolution and the step-by-step process you can follow to ensure your company is formally dissolved in the eyes of the law.

Dissolving an LLC means that you are formally ending the company’s existence in the eyes of the state. This means that you and the company will no longer be required to meet obligations such as reporting requirements and filing corporate taxes.

In Washington, there are three different types of LLC dissolution. Here is a breakdown of these three types and the circumstances that apply to each one:

Administrative dissolution is a type of LLC dissolution that is ordered and initiated by the state. This happens when LLCs in Washington fail to comply with state requirements. However, administrative dissolution can often be overturned if the company rectifies the issue(s) that led to the dissolution.

This type of dissolution occurs when a company is ordered by the court to be dissolved, typically due to reasons such as illegal activities, fraud, or situations where it is no longer possible for the business to continue its operations.

The most common type of LLC dissolution is voluntary dissolution, and this occurs when the members of an LLC voluntarily decide to dissolve the company. This type of dissolution requires LLC members to complete a specific process, and it’s the type that we will focus on for the remainder of this guide.

If you and the other members of your Washington LLC decide to voluntarily dissolve the company, it’s essential to follow the right steps. Here is the step-by-step process you can follow to dissolve your company and avoid any complications:

Before an LLC can be dissolved, its members must vote to approve the dissolution. For single-member LLCs, this decision lies with just one person. But for multi-member LLCs, a formal vote will be required.

Owners of a single-member LLC can decide all on their own whether they want to dissolve the company. For multi-member LLCs, the procedure for voting on dissolution is typically outlined in the company’s operating agreement. This includes details such as how the vote is to be held and the majority that is required to proceed with dissolving the company.

Most LLC operating agreements will include specific details on how the dissolution process is to be conducted. This includes specifics on voting for dissolution, but it also includes considerations like how the company is to distribute its remaining assets, cancel contracts, and notify creditors. Before you move forward with dissolving the company, be sure to carefully review its operating agreement and follow all of the requirements it outlines.

Once you and the rest of the LLC’s members have made the decision to dissolve the company, the next step is to wind up any remaining business affairs. This includes things like:

If your company owes any outstanding debts, these will have to be paid in full before the LLC can be legally dissolved. Notify all creditors and claimants of your intention to dissolve the company, and pay any debts that are still owed to them.

Once all outstanding debts are paid, you will need to distribute any company assets that remain. As we previously discussed, your company’s operating agreement should detail how assets are to be distributed among members.

The final matter that must be seen to before you can legally dissolve your Washington LLC is to file final state and federal tax returns. If the LLC owes any taxes, these must also be paid before it can be dissolved.

While Washington does not have a state income tax, your LLC may still owe other types of state taxes, such as business and occupation (B&O) tax, sales tax, or use tax. Confirm that all state taxes have been paid by checking with the Washington State Department of Revenue.

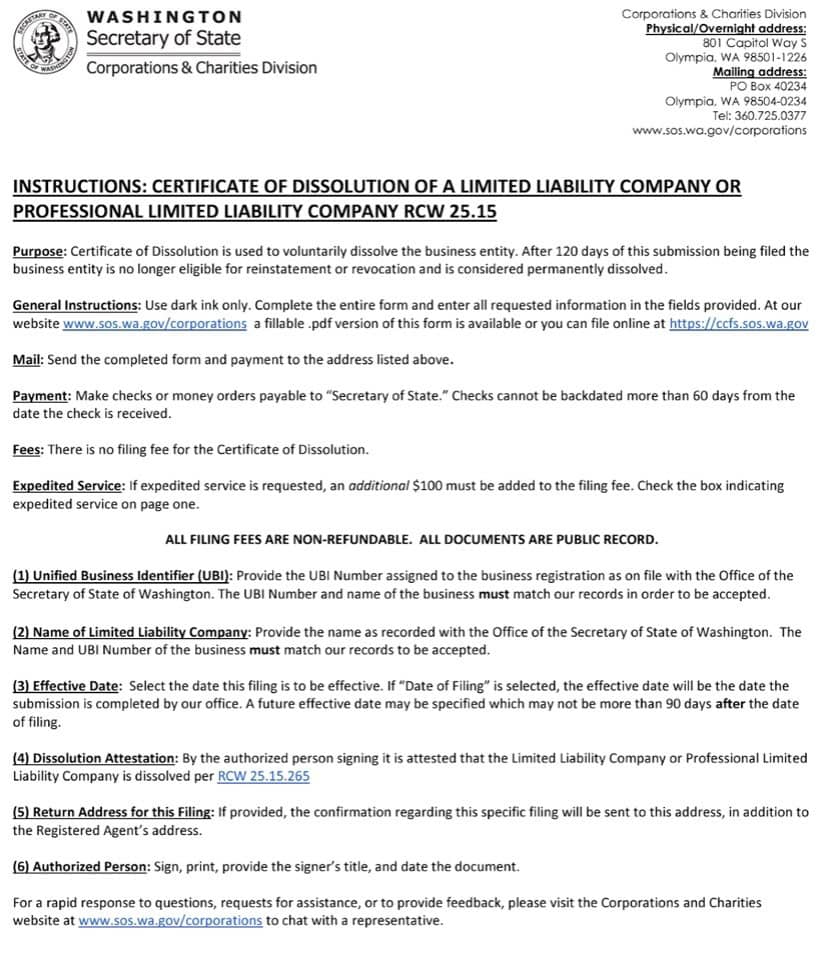

Once you have completed all the necessary steps to dissolve your LLC, you can formally dissolve it by filing a Certificate of Dissolution with the Washington Secretary of State. This form is available on the Secretary of State’s website, and it looks like this:

Carefully review the Certificate of Dissolution form and fill in all required information to ensure there are no mistakes that could delay the process. You can file the Certificate of Dissolution either online or by mail.

To file online:

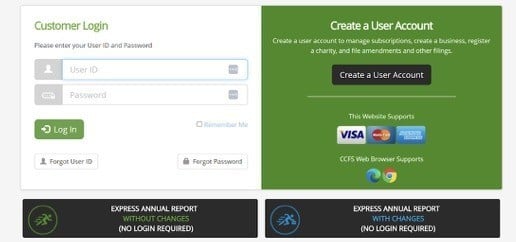

Visit the Washington Secretary of State’s website and access the Corporations and Charities Filing System (CCFS).

Log in or create an account, then select “Dissolve or Withdraw” from the menu.

Search for your LLC by its name or UBI number.

Once you find your LLC, select the option to file the “Certificate of Dissolution” and complete the form.

You will need to pay a filing fee of $20 when submitting the form online.

Washington Secretary of State

Corporations and Charities Division

801 Capitol Way S

PO Box 40234

Olympia, WA 98504-0234

You will receive a confirmation once your filing has been processed. Keep in mind that mailed filings may take longer to process compared to online submissions.

If you and the rest of your LLC’s members have decided that it’s best to no longer continue operating the company, legally dissolving it is an essential final step. By following the steps covered in this guide, you can dissolve your Washington LLC so that it ceases to exist as far as the state is concerned, freeing you up to put the company behind you and move on to your next venture.

Keep in mind that every business outcome is a learning opportunity. Dissolving your LLC may mark the end of one era, but it can also mark the beginning of something new and more successful!

There is a wide range of reasons why business owners choose to dissolve a company. Whatever the reason may be, though, it is essential to formally dissolve your LLC by following the appropriate process. This will eliminate any ongoing legal obligations that the company has.

The only cost associated with dissolving an LLC in Washington (not including paying off existing debts and tax obligations) is the filing fee of $20 that you will be required to pay when you file a Certificate of Dissolution with the Washington Secretary of State.

Yes, once you’ve completed all prior steps (such as holding a dissolution vote and filing a final tax return), the rest of the process can be completed entirely online by visiting the Washington Secretary of State’s website and accessing the Corporations and Charities Filing System (CCFS).

How long it takes to dissolve an LLC in Washington depends on whether you are filing by mail or online. Online filings typically take 2-3 business days to be processed, while mailed filings typically take 7-10 business days. Washington also offers an expedited filing option for an additional fee, With expedited service, online filings are usually processed within 24 hours, while mailed filings are processed within 1-2 business days after they are received.

If you fail to formally dissolve your Washington LLC, you will still be required to meet obligations such as filing annual reports, filing taxes, and other compliance obligations. This is true even if you do not continue operating the company.

If your Washington LLC is also registered to conduct business in other states, you will have to dissolve the company in each one of those states separately. Be sure to keep in mind that different states will have their own unique requirements and fees when dissolving an LLC.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands