The LLC State fee in Oklahoma is $100 for filing the articles of organization. If you’re planning to forming a limited liability company it’s best to learn about the possible costs in advance. Read more to understand what is relevant for your business and plan your budget accordingly.

Easily form your low cost LLC in Oklahoma with Tailor Brands

There’s a presumption that establishing a limited liability company (LLC) can be a difficult and expensive proposition. However, it’s not that difficult if you understand the necessary steps or hire an LLC formation service to take the stress and details out of your hand.

The annual fees to establish an LLC vary from state to state. The costs can differ depending on the municipality you choose to call your business home. Here, we’ll walk you through the costs of forming an LLC in Oklahoma.

Before diving into the LLC Oklahoma costs, it’s essential to understand the steps necessary to create an LLC business entity in the state.

One of the first things you’ll want to do is decide on the formal name and, if desired, a trading name for your business. Name search is free – but please mention the option of reserving a business name and filing a DBA (and for both – the costs)

You’ll establish a formal name when you file your paperwork to establish the LLC in Oklahoma. However, many businesses want to use a different name as their daily brand.

In that case, you’ll want to consider a trading name, often referred to as an assumed name or fictitious name. The trade name allows you to use a name that’s not your legal name on signage, in advertising, and in other public-facing instances. In many states, the process is called selecting a “doing business as” (DBA) name.

To do so, you’ll want to complete an Oklahoma assumed name search to ensure your desired name is not already taken. Then, you can register that name for a $25 fee.

Articles of organization list basic information about your business, such as your physical address, the name and address of a registered agent, and a signature. The cost is $100 to file, plus an additional $25 if filing in person for same-day service.

A registered agent is a person or entity that received essential documents, including those issued by the state and any related to a lawsuit you’re a party to. The registered agent must meet specific qualifications – be 18 years old, be located in Oklahoma, and be available to receive documents within regular working hours.

It’s an option to act as your registered agent. However, you must be available daily in the office to receive documents. You also will receive sensitive documents in front of employees and customers.

For those reasons, many businesses opt instead to use a service to act as a registered agent. Using a registered agent service frees you up to focus on other business priorities, confident that the service will ensure that documents are received and delivered to you discretely.

The cost of acting as your registered agent is nothing. Using a service like Tailor Brands costs $199 to $400 annually.

The Oklahoma Secretary of State does not require an LLC to create and file an operating agreement, but it’s a good idea. An operating agreement is an intelligent practice, especially if you have partners in the LLC.

The operating agreement is a binding legal document that outlines foundational principles for the LLC. Typically, an operating agreement includes sections on:

By having an operating agreement in place, disputes can be minimized and guided by the document.

If you create the operating agreement yourself, there is no cost. You can also opt to use a service to create your operating agreement or hire a lawyer, with fees ranging up to $1,000.

How much does an LLC in Oklahoma cost? In addition to the fees listed above, some other fees are required to do business in the state.

For tax years 2023 and prior every for-profit corporation, including LLCs, were required to pay an annual franchise tax in Oklahoma. The tax was $1.25 per $1,000 of capital invested or used otherwise in the state. The maximum annual levy for that was $20,000. Businesses had to file annually, and there were penalties for filing late. Foreign LLCs had to pay an additional $100 per year. Entities with a tax liability of less than $250 did not need to pay a tax.

On June 2023, a new franchise tax law (H.B. 1039) was enacted by The Oklahoma state, which eliminates all corporate franchise tax fees and reporting requirements for tax year 2024 and beyond.

Depending on your business type, you may be required to pay various license and permitting fees. Here are a few of the most common Oklahoma business licenses and permits:

LLCs in Oklahoma have to file an annual report for $25. The annual report includes basic information about the business, including its name, primary address, whether it’s active, and an email address for the primary contact.

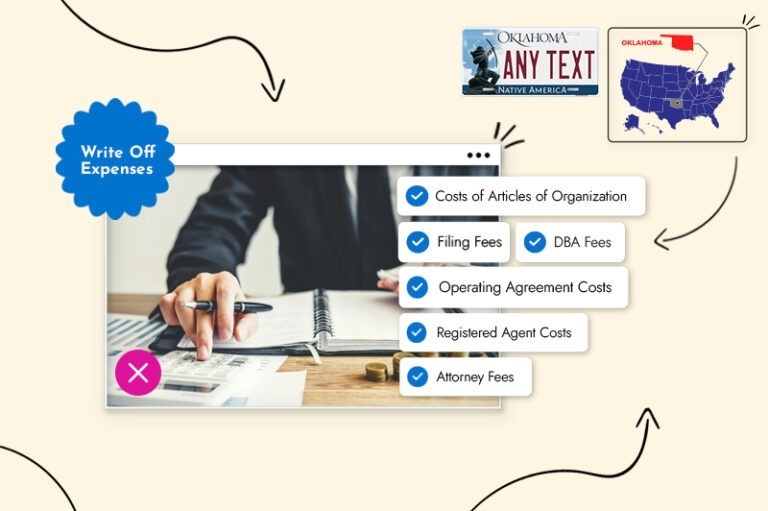

The good news is that the costs you pay for your LLC formation are tax deductible. You can deduct the state fees and the costs of using a service to complete the documentation on your behalf. The following expenses are deductible on your federal tax return:

Here is a summary of your LLC costs:

LLC filing fee (Articles of Organization) | $100 |

A registered agent (optional) | $199-$400 |

Filing a DBA (optional) | $25 |

Operating Agreement (optional) | $0-$1,000 |

Franchise tax (If there is one in IL) | $1.25 per $1,000 in capital investments |

Annual report | $25 |

There are many costs your LLC may incur in Oklahoma; understanding the different fees, deadlines and costs can be a lot to manage on your own.

Tailor Brands offers services to assist in the preparation and filing.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

©2025 Copyright Tailor Brands