LLC Formation → Virginia LLC → Filing LLC Articles of Organization in Virginia

Deciding to create an LLC in Virginia can be an exciting time, but there are a few legal steps necessary to ensure your business is on a solid foundation with the state. The key first step is to set up your articles of organization in Virginia. This is the most important legal document in the state, providing you with key protections and allowing you to operate within the economy.

The LLC articles of organization sound pretty complex, but it does not have to be. To register your LLC in the state, you will need to complete this document. The form, called Articles of Organization (Form LLC-1011), is available to you through the State Corporation Commission. This formal legal document helps to create the rights and powers of the members within your LLC. It also outlines the liability and duties of all members or people who make up your LLC. It helps to outline the specific obligations of each member as well as the relationship between the LLC is and each member.

By filing your articles of organization with the state, you provide information that the state needs to be able to understand your business and, most importantly, who is responsible for that business.

There is a fee for filing your articles of organization in Virginia. For a domestic LLC, which is an LLC based in Virginia, the fee is $100. This is a non-refundable fee that you pay at the time of submitting the form to the State Corporation Commission. If your business is a foreign company operating in the state of Virginia, you also must pay a $100 fee. However, you must register the foreign LLC in the state by completing the Certificate of Registration to Transact Business in Virginia (Form LLC1052).

The process for starting an LLC in Virginia begins with filing the articles of organization. Here’s what you can expect throughout this process.

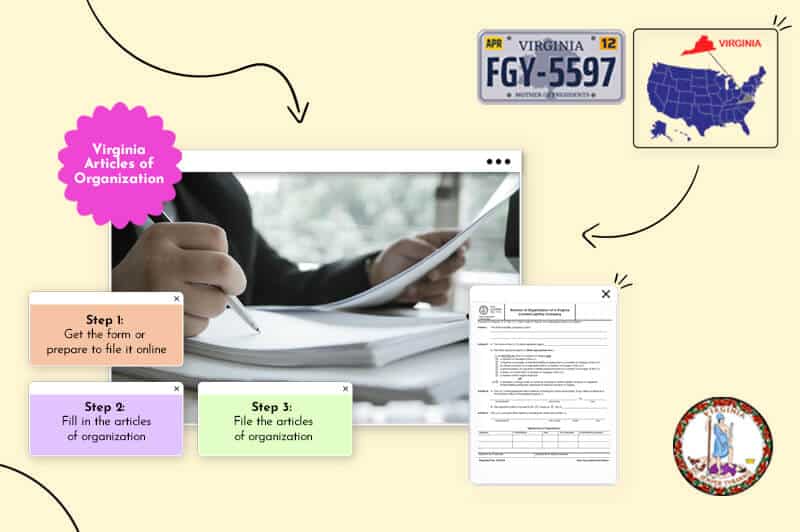

The process is managed through the Virginia State Corporation Commission. To go any further, your first step is to visit the organization’s website and create an account. This does not cost anything and just requires basic information. At the bottom of the page is the ability to “Create a CIS Account.” Click there to provide information to set up your online account.

Once you set up your account, you can access all the forms and processes available through the State Corporation Commission. There are two options available to you.

To do this online, click on the “Get Started” icon and navigate to “Form a Virginia Limited Liability Company.” This is located under “eFile Express.” From there, you can fill in the necessary information requested.

The second option is to download the necessary document and form, fill it in, print it, and mail it in. You can access the form on the CIS account as well.

Filling out the Articles of Organization requires having completed a few steps ahead of time. Here’s what you need to do first.

If you have not done so yet, you will need to select an LLC name for your Virginia business. You have to ensure the name is not otherwise in use. To do that, go to the state’s Name Availability tool. Just put in the name you are considering, and you’ll quickly have information about whether it is available. Checking your desired name through the name search site helps to ensure that if there is another name that is the same or very close, you can choose another. You will need to create a name that does not show any results in the name search tool.

Once you do this, you can reserve the name and hold it for up to 120 days. You’ll pay a $10 fee to do this. Then, the next step is to actually reserve your name. To do this, fill out Form SCC631 (you can find it through the portal). You can mail it in or complete it online and submit it virtually through the same portal.

Keep in mind that there are a few limitations on the names allowed. The state of Virginia requires that you have one of the following terms within your name:

If your business is a professional LLC, you need to choose from endings like P.L.L.C., PLC, PLLC, or P.L.C.

Once you have your name, fill it in on the articles of organization form.

All LLCs in Virginia need to have a registered agent. This is a specific person or a business that will accept all legal documentation for the LLC, including any lawsuits or other legal correspondence related to the company.

It is possible for an individual to serve as the registered agent so long as they’re over the age of 18, lives within Virginia and has a physical address in the state.

The second option is to select a company as a registered agent service. It’s an excellent way to ensure there’s always someone available.

Once you determine your registered agent, name that person on the articles of organization.

The next step is to fill in the details about the registered agent’s office, such as their address.

Once your form is complete, you can submit it through the online portal. The state encourages this use as it is faster and more streamlined.

If you decide to print and mail off the form, you can do that by sending it to:

State Corporation Commission

Clerk’s Office

P.O. Box 1197

Richmond, VA 23218-1197

There is also a second option:

Courier Delivery Address

1300 E. Main Street. 1st Floor

Richmond, VA 23219

You cannot drop it off in person. Choose to mail or submit online.

Here are some additional steps you need to take for this process.

If you have not done so yet, set up your Employer Identification Number. This is done through the IRS website. It works just like a Social Security Number but is for companies rather than individuals. You’ll need to use your EIN for reporting taxes.

An operating agreement is an internal document that creates some guidelines for running an LLC. It outlines the rights of each member and outlines who the managers in the business are. It also states how the LLC is managed, who manages it, and other details to create separation between a person’s personal assets and professional assets.

A business bank account helps you to create separation from personal assets. It also allows you to easily manage the money coming into the company and the money that’s being spent. It’s quite important to ensure that this is done for accounting and tax purposes.

Virginia requires many businesses to have proper business licensing to operate in the state. You will need to determine which business licenses and permits you need based on the type of work you complete. This is often key after LLC formation in Virginia so you can start to work.

There’s a lot to do when it comes to LLC articles of organization, but you do not have to do it alone. With some help, you can streamline the process and make it easier to manage.

You can amend your Articles of Organization in the state using Form SCC710N, Articles of Amendment. You can download that form in the portal.

When you log into your CIS account, you are then able to complete the Articles of Amendment form, as noted previously. You will need to update the information on the form, and the new member must sign the form.

After LLC formation in Virginia, it is necessary to formally dissolve the organization if it is no longer in operation. You can do that by paying a $25 filing fee. The process can be handled in the same portal.

Use the Name Availability tool. This tool allows you to see if any names are like yours in the state.

Yes, you can establish your Articles of Organization in Virginia by completing the Certificate of Registration to Transact Business in Virginia (Form LLC1052).

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands