Whether your just starting your business as a side hustle or a full-time job, you want to be able to profit from it. If this was just something you were doing as a hobby, money wouldn’t come into the equation.

But your business is something you want to live off of, and there’s nothing wrong with that. But to profit off your business, you need to make sure your finances are in check. Ugh, I know, no one likes to do this part of running a business, but it needs to be done!

Balance sheets are a crucial accounting tool for small businesses by giving financial insight into how the business is running. If this is your first time hearing about a balance sheet, don’t worry – that’s why I’m here.

In this post, you’re going to learn what a balance sheet is, how to create your own balance sheet and how to read it.

So what is this balance sheet I’m insisting you have for your business?

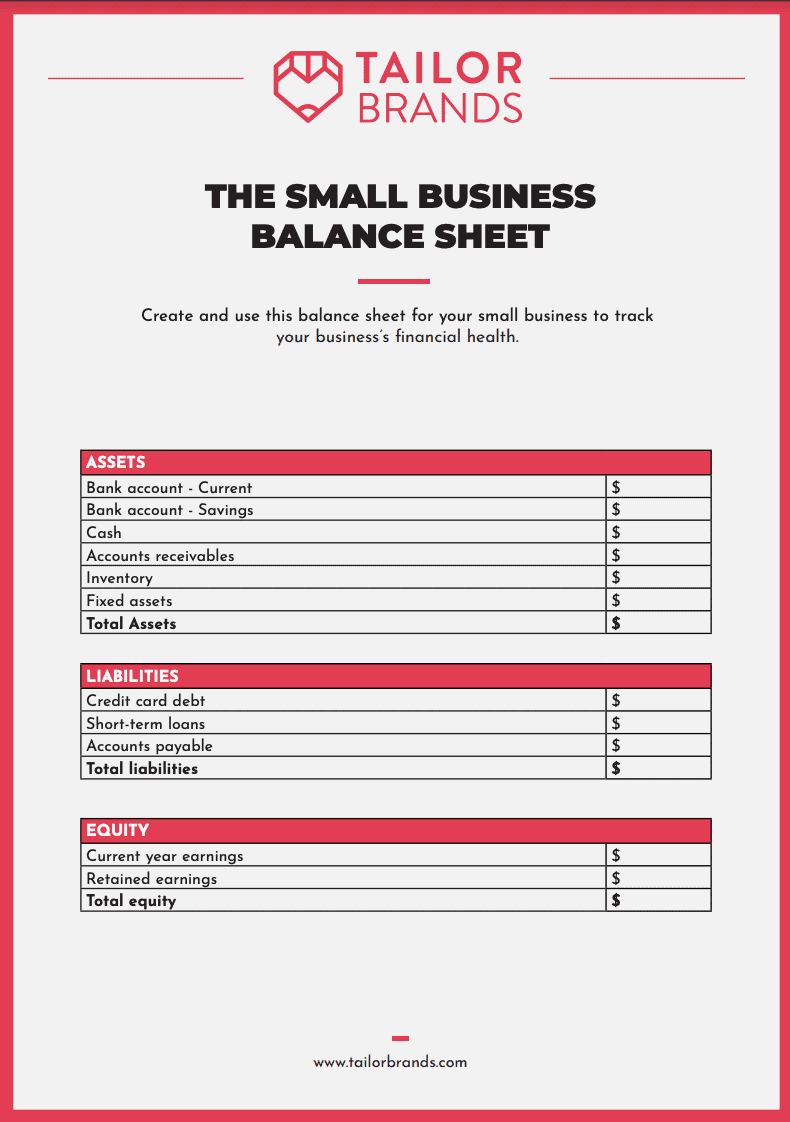

A balance sheet is a financial statement that records your business’s assets, liabilities, and equity. They can be created at any time – monthly, quarterly, or annually – and give insight into your business’s financial position.

A balance sheet includes assets, liabilities, and equity (don’t worry, I’m going to talk about these elements in more detail). Having this information can help you, the business owner, make the right decisions for your business.

I wouldn’t be talking about balance sheets if it wasn’t important. Balance sheets are essential to your business for several reasons. Let’s talk about it now.

Understanding your business’s financial standing can help you identify any issues. For example, many small businesses fail because they experience cash flow issues, but a balance sheet can help you stay one step ahead so you can come up with a preventative plan.

Knowing your financial situation can help you avoid common challenges many business owners face.

Like I said before, you want your business to make money. Ideally, a small business should show increasing equity, also known as net worth. If that isn’t happening, a balance sheet can tell you why.

For example, if a majority of your assets are inventory and you’re not selling product, it can become a serious liability.

Your balance sheet lists all your business assets and liabilities on one sheet, making it visually easy to read what’s going on behind the scenes.

Ideally, your business should have more assets than liabilities, which will result in an increase in net worth. Your balance sheet will be able to show you the long-term assets and debts, indicating your risk and return.

For example, if your liabilities exceed your cash balance, you’ll most likely need more capital which you can get from loans or investors.

Okay, having a balance sheet won’t make tax season that easy, but it will help you maintain your financial records.

With your financial information, your accountant or bookkeeper will be able to prepare accurate tax returns and prevent you from paying more taxes than needed. Plus, if the tax man comes knocking on your door, you’ll have all your financial records ready.

A balance sheet gives a quick summary of your business’s financial standing. When trying to get a loan, you’ll need a balance sheet to show financial institutions.

Financial statements like a balance sheet show your creditworthiness and your ability to repay the loans on time. It also shows institutions where the money will go.

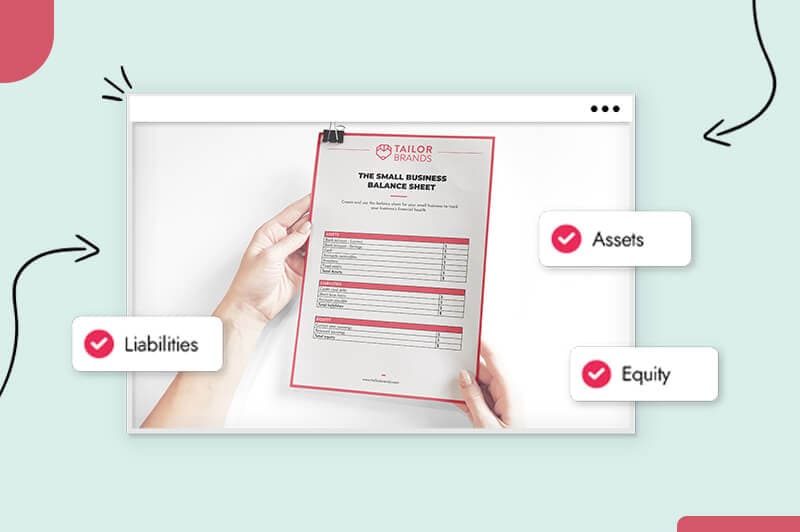

Your balance sheet will be divided into three categories: Assets, liabilities, and equity.

Okay, sounds good, but what do these categories mean? Good question! Let’s break these three categories down in more detail:

Assets are the things you own in your business. Assets include:

Property, equipment, cash, intellectual property, and vehicles are all assets.

For example, If you have a dog treat business and you own an industrial blender and a series of different molds, those are assets.

Liabilities are also known as “debts.” They are the things you owe to other people. Liabilities are divided into 2 categories: Current and long-term liabilities.

For example, loans and accounts payable (current liabilities) are both liabilities.

Let’s say you have a bank loan of $15,000 that you’re paying over the course of 3 years. This bank loan would be a long-term liability. However, the supplier you pay on a monthly basis would be a current liability.

Equity

Equity is the difference between assets and liabilities. It includes the initial cash invested into the business plus the additional income you’ve made (or losses) over time.

To create a balance sheet, there are a couple of steps you’ll need to follow.

Download this PDF template and have it available whenever you need.

As a general goal, you want to. create a “strong balance sheet.” To achieve this, you need to balance two components: your assets and equity. Okay, but how?

From here, you’ll need to understand how to read your balance sheet. That’s what we’re going to talk about now.

To achieve a strong balance sheet, you need to know to read it. Those numbers won’t mean a thing unless you know what to do with them. Balance sheets can offer tons of insight and can help you make the right long-term decisions for your business.

Here are some key ratios you can calculate with your balance sheet:

Over to You

Now that you know what a balance sheet is and how to create one, it’s time to make your own. Using our downloadable PDF, create your own balance sheet to understand your business.

With that information, you can see what areas you need to improve on to achieve a strong balance sheet.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness.