Bookkeeping is part of all small business operations, but only some can afford a full-time accountant. For many business owners, that means maintaining their accounts, taking up hours of their precious time.

Accounting software is an affordable solution.

It helps you track your cash flow (how money moves in and out of your business) and provides an easy-to-understand overview of your financial health.

But with a packed accounting software landscape to choose from and too few spare hours in the day, researching the best accounting software can be a pain.

We know that research is a huge part of making the first steps in building your business.

To save you time and make life easier, we’ve selected the 11 best accounting software for small businesses, including cost, capabilities, and industry suitability.

The best accounting software for any small business must suit its operational needs, be easy to use, and support growth.

For example, a restaurant owner wouldn’t need the same accounting features as a freelancer. And one business might need invoicing capabilities, while another, accounting software that integrates with their payroll or point-of-sale system.

But all accounting software should help small business owners track their cash flow, provide a clear picture of profitability, and ensure they’re ready for tax season.

With those essential points in mind, let’s dive in:

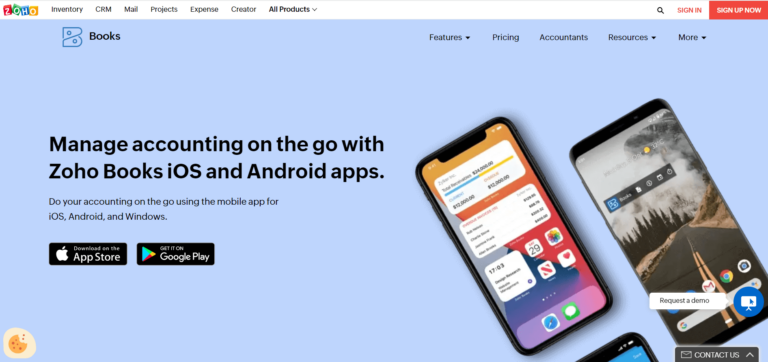

Best for ease of use and mobile accounting

Pricing: Starts at $15.00 per month

Zoho Books is an online integrated bookkeeping accounting software that connects with Zoho apps and third-party systems, such as your e-commerce platform, bank account, accounts payable and receivable, and payment processor.

The software is fast, reliable, and convenient for business owners that need to see their finances in real-time or manage inventory.

Zoho books also offer many other features that meet most small business needs at an affordable price.

Perfect for service-based businesses and any entrepreneurs already using other Zoho products.

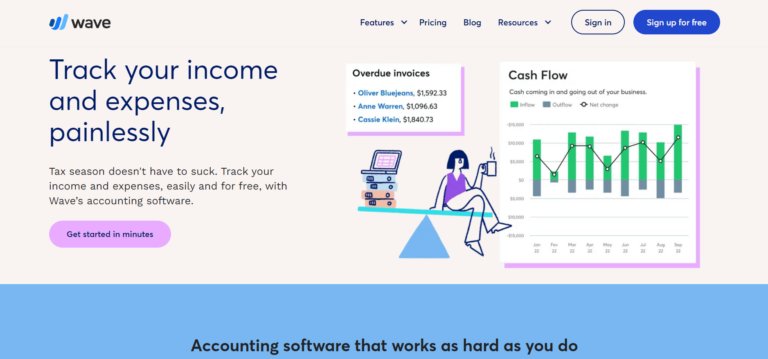

Best free accounting software

Pricing: Free

Wave offers a free, user-friendly dashboard with features that rival most paid accounting software systems.

The software’s abilities include unlimited invoices, expense tracking and management, banking reconciliation, multi-currency capabilities, and double-entry accounting.

Double-entry accounting benefits entrepreneurs who run multiple businesses as it enables you to track finances using the same accounting software.

Wave also enables your accountant to access year-end reports and prepare tax returns.

Suits freelancers, consultants, and small businesses with few employees.

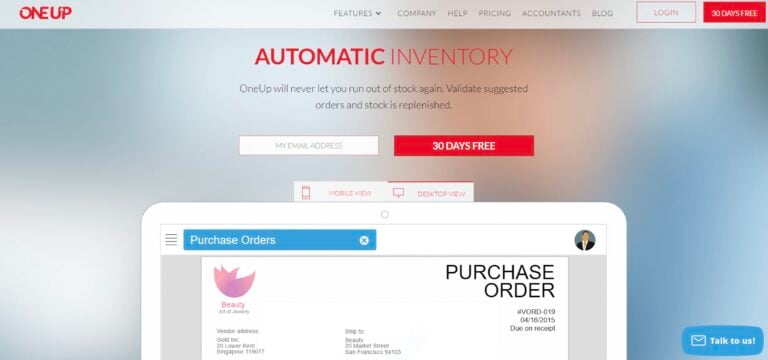

Best for inventory management

Pricing: Starts at $9 per month

OneUp is a digital bookkeeping system that uses algorithms to learn and grow with your business by analyzing your inputs and transactions.

The software then streamlines your accounting process by suggesting reconciliations and automating tasks. Each time you approve a suggestion, it validates OneUp’s algorithms, increasing its accuracy to meet your accounting needs.

OneUp also matches bank transactions with invoices, enabling you to control your cash flow, which every small business needs.

Suits sales teams that use customer relationship management (CRM) features to connect with customers.

Best for start-ups and businesses that need simple accounting solutions

Pricing: Starts at $20 per month

Kashoo’s accounting software is another AI system that uses algorithms to learn about your business, make recommendations, and automate your bookkeeping administrative needs.

Kashoo achieves this by analyzing your daily business operations, like sales tax tracking, invoicing, and receipt categorization, using the results to streamline your bookkeeping efficiency, saving you time and money.

Great for new business owners who need a simple bookkeeping solution and affordable plans that grow with their business.

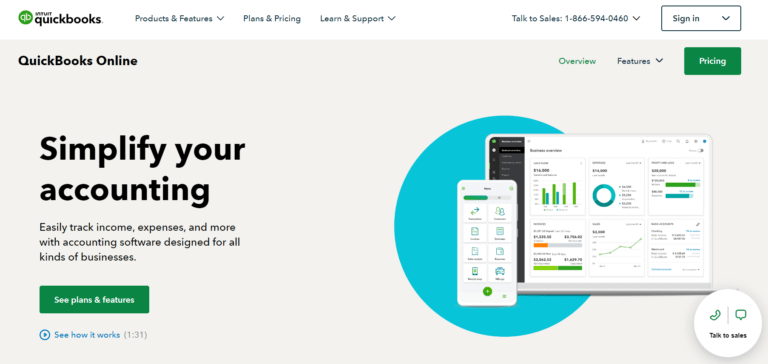

Best overall accounting software

Pricing: Starts at $15.00 per month

QuickBooks Online accounting software provides everything a small business needs to control its bookkeeping and run efficiently.

The QuickBooks easy-to-use dashboard and intuitive reporting make life simple for business owners new to online accounting software.

All QuickBooks price plans include important bookkeeping features, such as income and expense tracking, mileage tracking, 1099 contractor management, and sales and tax reports. Other plans offer extra functionality, like dedicated customer support, access for 25 users, and inventory tracking.

And there’s a ton of free online forums and training courses to support you.

Perfect for small businesses or freelancers that need to track expenses, log mileage, and organize receipts.

Best for mobile and advanced features

Pricing: Starts at $12 per month

Xero accounting software suits small businesses that need ease of use and mobile ability.

The software has an intuitive interface that handles most accounting tasks, such as billing and invoicing, expense tracking, sales tax calculation, custom invoices, inventory tracking, and payroll.

You can also sync Xero with multiple devices and receive real-time reports, ensuring you have up-to-date bookkeeping information when and where you need it.

Suits small business owners who need user-friendly mobile accounting software.

Best for ease of use and customer support

Pricing: Starts at $4.50 per month

FreshBooks accounting software’s goal is to make small business accounting and invoicing efficient for small business owners.

The software’s primary function is creating, sending, receiving, printing, and paying invoices, which is ideal for service-based businesses that need to project job times and receive payments.

FreshBooks also handles your basic bookkeeping needs; the platform integrates with third-party apps, provides regular backups, and is accessible on mobile devices.

FreshBooks claims its software can help users save up to 46 hrs per year on filing their taxes. And include a clever feature that lets you see when clients open your online invoice.

Suits small service-based business owners who send or receive multiple invoices, need easy-to-use accounting software, and efficient customer service.

Best for customization and growth

Pricing: Starts at $340 per year

Sage 50cloud Accounting is a cloud-based accounting software system that offers advanced features and customization options, including invoicing, expense management, and inventory tracking.

The accounting software integrates with Microsoft Office and enables multiple company account management to help small business owners run and grow their businesses.

A good option for start-ups and micro-businesses that need accounting software with affordable upgrade options.

Best for freelancers and micro businesses

Pricing: $200 per year

Neat in name, neat in nature!

Neat accounting software usability makes it a popular choice for self-employed entrepreneurs, with users saying it only takes 5 minutes to set up.

The software lets you filter your transactions, manage expenses, correlate receipts, customize invoices, and make payments. And provides automatic accounting reports, handy for your end-of-year tax returns.

Suits self-employed entrepreneurs like freelancers and micro business owners.

Best for restaurants

Pricing: $300 per month

MarginEdge accounting software is specifically for restaurants and other food-industry businesses like food trucks and cafes.

It includes many features that integrate with point-of-sale (POS) systems, enabling you to track your margins and automatically import sales data in real-time. And create detailed food usage reports to help minimize waste and increase your profit margins.

A tasty option for restaurant owners and other food business entrepreneurs who need to track costs and reduce food waste.

Best for deadline-driven businesses

Pricing: Starts at $149 per month

Tipalti is a cloud-based accounting software platform that suits deadline-driven businesses that work with multiple partners, such as vendors, suppliers, affiliates, and freelancers.

The software automates your accounts payable process, enabling multiple payment management capabilities in over 190 countries in any currency, and ensures you stay tax compliant.

Suits entrepreneurs doing business in multiple countries who work with deadlines and need a time-bound payment solution.

No two businesses are alike and most need specific accounting solutions that suit their daily operations.

And while many accounting software services overlap, some provide solutions more suited to one small business than another.

So, before investing in any accounting system, know what you need, ensure it can provide, and take advantage of any free trials.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands