Sole proprietor owners and their businesses are not separate taxable legal entities, so the IRS doesn’t require them to have an EIN.

Instead, you can use your SSN to identify your business come tax time and report your income and expenses using Form 1040 Schedule C.

However, some cases require a sole proprietor to get an EIN, such as:

- You hire one or more employees

- File for bankruptcy

- You incorporate (start a multi-member/single-member LLC or corporation)

- Take on partners/operate as a partnership

- Buy or inherit an existing business you use as a sole proprietorship

- Have a Keogh or Solo 401(k) retirement plan

- File pension returns or specific excise tax

- Make payments to non-U.S. residents and withhold taxes

- Administer estates or trusts

- Work with farmers’ cooperatives, nonprofits, or use administrators

When none of the above apply to your business, you don’t need a sole proprietorship EIN.

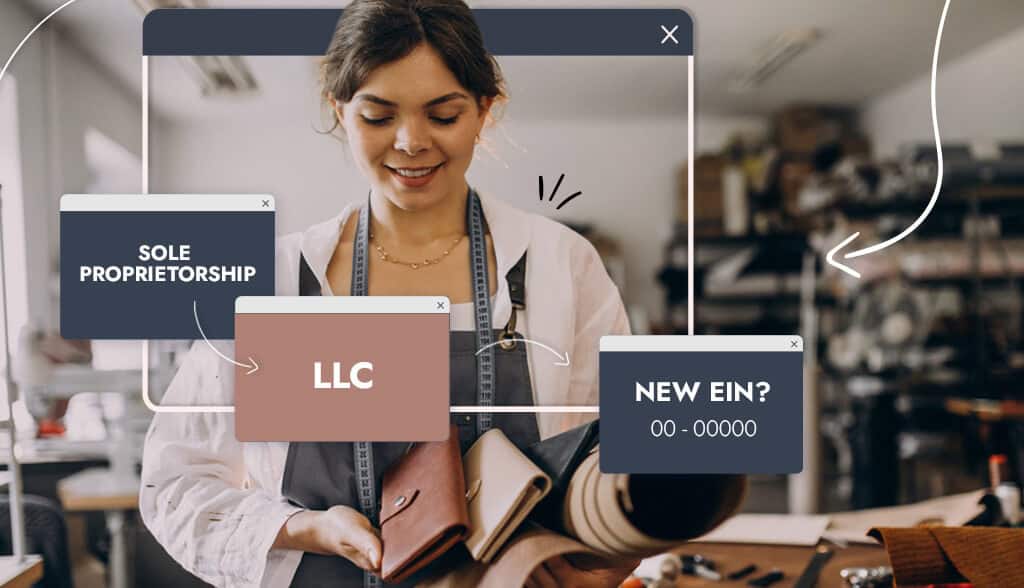

Okay, simple enough, but what about that LLC you want to start? Will you need a new EIN?

I’ll clarify next:

The IRS “Do You Need a New EIN” page says that the sole proprietorship owner needs an EIN if they form a corporation, multi-member LLC or partnership.

However, when we look at the IRS “Single Member Limited Liability Companies” page, it says that you must use either your SSN or EIN when filing tax returns.

So, what’s the answer? It comes in 2 parts:

- It depends on the type of LLC you form

- And how you run it

Stick with me, and I’ll explain.

The IRS doesn’t require single-member LLC owners to get a separate EIN because they’re not employees of the LLC. So, when you move from a sole proprietorship to a single-member LLC, you can use your SSN to report returns and pay taxes using Schedule C (Form 1040).

However, you will need an EIN if you form a multi-member LLC.

Let’s say you start a single-member LLC using your SSN but then need employees to expand. Here, you’d need an EIN.

And even if you don’t hire employees and are a single-member LLC that can use your SSN, most LLCs need an EIN when: