You put your best effort into making your business successful, so dissolving your Idaho LLC can be bittersweet. Whether you decide to sell your business or simply need to close due to financial challenges, taking the proper steps to dissolve your LLC is important.

In the post that follows, you can learn about the ins and outs of dissolving an LLC in Idaho, as well as the specific steps you’ll need to follow on your end.

Before we dive into a step-by-step guide to LLC dissolution in Idaho, it can be helpful to understand what dissolution is, what it entails, and what the different types of dissolution are.

Legally speaking, when you dissolve an LLC, this means that you are effectively canceling the independent legal status of your business with the Idaho Secretary of State. When your LLC is dissolved, your business is closed.

Each state sets its own requirements and processes for LLC dissolution—so to ensure things go as smoothly as possible on your end, it’s critical that you follow all steps required to dissolve an LLC in your state. This includes not only filing a dissolution application, but notifying your creditors, paying off existing debts, and distributing any remaining assets.

There are three types of LLC dissolution in Idaho. Administrative and judicial dissolution are involuntary and should generally be avoided by business owners. If you’re looking to dissolve your own LLC, then voluntary dissolution is what you’ll want.

When an LLC goes through administrative dissolution, the state itself takes measures to remove its LLC protections. Most often, this occurs when the business has failed to meet certain administrative requirements, such as paying state franchise taxes or submitting an annual report.

Judicial dissolution, on the other hand, is carried out by the courts. There are many reasons as to why the court may order an LLC’s dissolution, including:

When an LLC is voluntarily dissolved, the decision has been carried out by its members or owners themselves. If there are multiple owners, then a majority vote in favor of dissolution is required before the process can begin.

There is an exception to this, however. When an LLC is started, its members must draft a document known as a business operating agreement. This document can lay out situations or “triggers” that would constitute dissolving the LLC without the need for a vote, such as if an owner passes away.

If an LLC’s operating agreement doesn’t include stipulations regarding voluntary dissolution, however, a majority vote among members will be required to move forward via Idaho state law.

Now that you have a better idea of the types of LLC dissolution and what they entail, here’s what you need to do to get the ball rolling on your own LLC dissolution process in Idaho.

When an LLC is being voluntarily dissolved, its owners/members need to be in agreement or a trigger from the LLC’s operating agreement must be activated.

Before you get started, it’s a good idea to review the operating agreement that was drafted for your LLC when you first started your business. Look specifically to see if there is anything written in the document pertaining to dissolution. It is not uncommon, for example, for these documents to include plans for discharging and settling debts upon closing, dividing assets, and canceling existing business contracts.

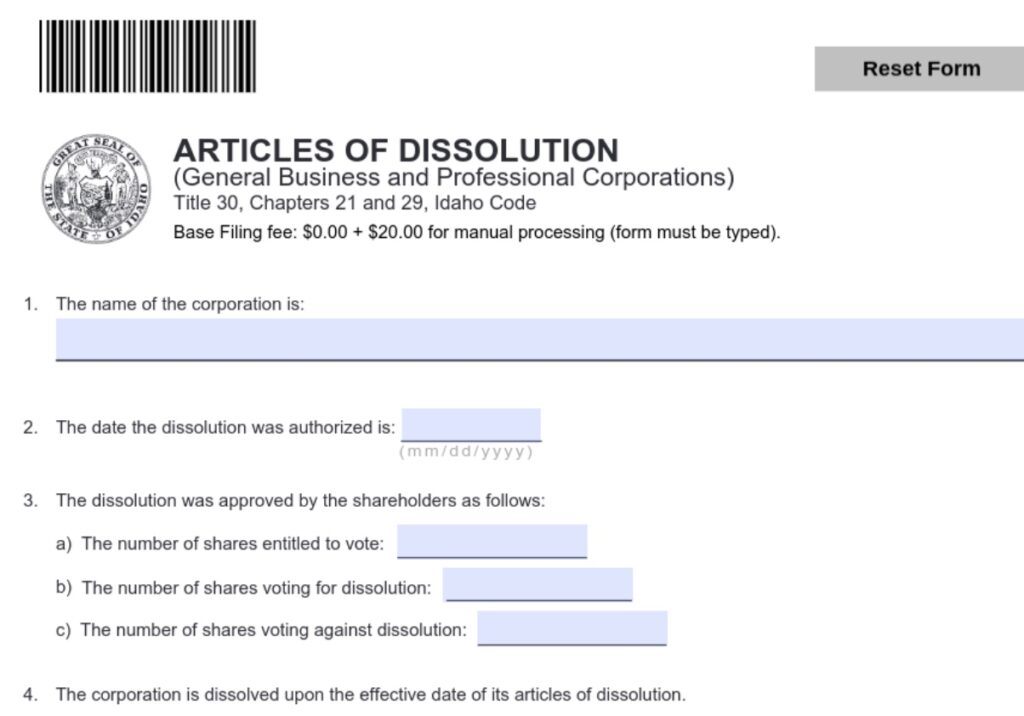

If your LLC’s dissolution will come down to a formal vote, you’ll need to set a date for your owners to vote on the dissolution and record it in writing. The Idaho Secretary of State website offers an “Articles of Dissolution” form where you can record the number of shares entitled to vote, the number of shares that voted for dissolution, and the number of shares voting against it.

After your LLC’s owners have reached an agreement regarding dissolution, it’s time to wrap up your business affairs and prepare for the final closure of the business itself.

If you have a registered agent, the first thing you’ll want to do is notify them of your intent to dissolve the business. From there, you’ll also want to formally cancel any recurring business licenses and permits through the state of Idaho.

Other people or entities you may want to inform of your decision to dissolve include:

One common misconception when it comes to dissolving an LLC is that the liability protection you enjoyed while your LLC was in business will extend and “erase” any debts remaining when your business closes.

In reality, dissolution doesn’t cancel out any remaining debts. You will still need to meet any outstanding financial obligations, whether you owe money to creditors, suppliers, or anybody else.

As you prepare to dissolve your LLC, this means you have an obligation to notify creditors of your impending closure, pay off all existing debts, and/or set up payment plans to pay off outstanding loans/debts. If there are any remaining business assets, these should be distributed appropriately among owners.

Just as your financial obligations don’t end when you dissolve your LLC, the same applies to your business tax responsibilities. Before your LLC can be dissolved, you’ll need to reach out to the state and pay off any outstanding taxes that are due in advance. This may include income state, unemployment insurance tax, and franchise taxes.

LLCs applying for dissolution in Idaho are not required to obtain formal tax clearance, but owners must file all final tax returns via IRS Form 1065 or Form 1120.

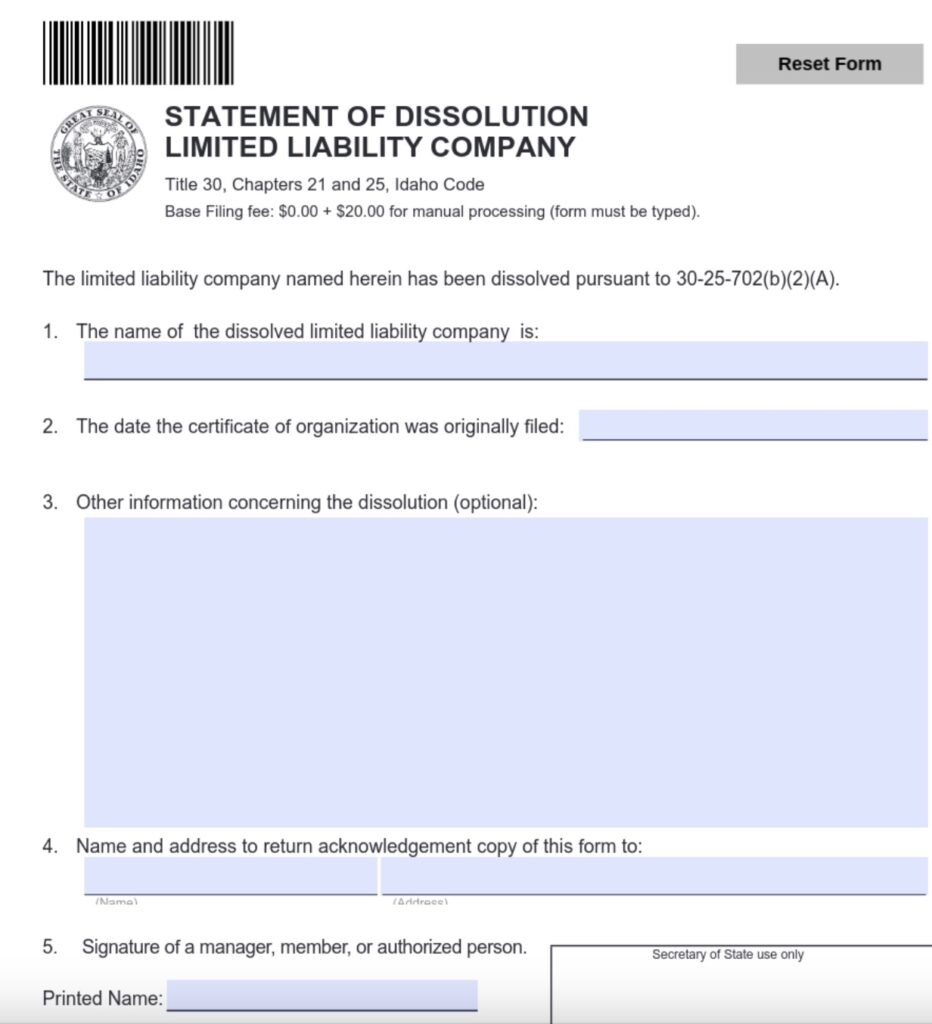

In Idaho, businesses are required to file a statement of dissolution with the Secretary of State’s office. This document names the LLC being dissolved, its original organization’s filing date, and other relevant information concerning the dissolution. This document must also be signed by an authorized manager or owner of the LLC.

Statement of dissolution forms should be mailed or delivered directly to the Idaho Secretary of State. Mail-in documents can go to:

P.O. Box 83720

Boise, ID 83720-0080

Documents being hand delivered should be taken to the Idaho Office of the Secretary of state at the following address:

450 North 4th Street

Boise, ID 83720-0080

Be sure to enclose the proper payment with your documentation. The base fee is $20, though expedited service is available for an additional $40. For same-day processing, an additional $100 must be enclosed.

Once the state approves the dissolution, a copy of the form (along with a certificate of dissolution) will be mailed back.

The process of filing for voluntary dissolution of an LLC in Idaho can be somewhat complicated. However, as long as you carefully follow the steps outlined here, you should be in good shape. And of course, once your business is formally dissolved, you can move onto your next venture with peace of mind and confidence.

Still looking for guidance with anything LLC-related? Check out the Tailor Brands blog for helpful resources, guides, and more. You can also reach out to learn more about our LLC and other business services that can save you time, stress, and hassle.

There are many potential reasons to dissolve an LLC, including:

Ongoing disputes between owners/members that cannot be resolved.

Selling your business or having it acquired by another business.

Issues with cash flow or finances.

Increased market competition or other economic factors.

When you file your statement of dissolution with the Idaho Secretary of State, the base filing fee is $20. However, if you want expedited or same-day filing, you must pay an additional $40 or $100, respectively.

While you can obtain the forms that you need to apply for dissolution online, you will need to physically mail or deliver all documentation to the Idaho Secretary of State’s office. There is currently no option for online filing.

This can vary, but most LLC dissolutions are approved within seven business days (assuming the process was followed correctly). However, expedited and same-day service are also available for those who pay the appropriate fees.

If you fail to dissolve your Idaho LLC and simply stop submitting your annual reports or following other requirements, your business will eventually be placed under administrative or judicial dissolution. This can result in additional penalties and fees, so it’s generally best to be proactive and handle voluntary dissolution yourself.

While an LLC can technically be formed in any state (including in more than one state simultaneously), it typically makes the most financial sense for business owners to only register and operate out of one state at a time. If you need to move your LLC to another state, you can do this without having to dissolve and re-register in another state.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands