If you plan to end your business and dissolve your LLC (Limited Liability Company) you’ve probably thought about the process and the importance of that decision for a while. However, you can’t just decide to shut your business down without following the right process. The State of Kentucky has specific requirements to close down your LLC and it’s vital that you implement that process the right way.

Here, we’ll take a look at the reasons you might have for dissolving your Kentucky LLC, what types of LLC dissolution options you have, and the steps and requirements for you to do that in Kentucky. Then, you can feel confident that you’re doing things the right way and won’t have regulatory repercussions in the future.

Dissolution, specifically, is the process through which you officially dissolve your LLC with the state where it’s registered. An LLC dissolution removes the independent legal status of your LLC with the Kentucky Secretary of State. This cancelation of your LLC can be either voluntary or involuntary.

In order to be sure that your state chooses to accept your application for business dissolution you’ll need to follow the right steps. That includes notifying your creditors, as well as local and federal government agencies that relate to your business. You’ll also need to pay any outstanding debts you have and include a certification regarding the status of your account. That certificate will indicate that you don’t own money and your LLC is currently in good standing.

By following the proper dissolution procedures you’ll be able to dissolve your LLC effectively and protect yourself from liabilities in the future.

There are three main categories of LLC dissolution, which are judicial, administrative, and voluntary. The procedure you need to follow to dissolve your LLC will depend on which one of the three types applies to you. Here’s what to know about the different types and how they work.

When there’s an administrative dissolution the State of Kentucky will remove your LLC’s powers, authority, and rights because you didn’t comply with your obligations. Some of the reasons this could happen to an LLC are:

A judicial dissolution isn’t the same thing as an administrative dissolution, but it’s still considered involuntary because the owner(s) of the LLC didn’t choose it. This type of dissolution is often referred to as the corporate death penalty, and it’s a process whereby the court orders that your LLC be dissolved. Some of the main reasons for a judicial dissolution include:

If you and any other members of your LLC vote to dissolve the business that counts as a voluntary dissolution. You may need a majority vote to do this, depending on how many members are part of the LLC. There are two ways that this kind of dissolution can take place:

If you want to know how to dissolve an LLC in Kentucky these are the steps you need to follow.

If you decide to dissolve your LLC, that’s the process of voluntary dissolution. When there are several LLC members, though, they need to vote in favor of it for it to go through. Without a majority decision you generally won’t be able to close down your LLC.

However, one exception to this is a pre-agreed trigger for dissolution in your LLC operating agreement. For example, your operating agreement could say that the death of an LLC member is a trigger for dissolving the business. LLCs that don’t have operating agreements, or those that don’t have information on voluntary dissolution, have to follow the default provisions of the the Kentucky state statutes.

The only real difference between multi-member and single-member LLC dissolution is that multi-member dissolution requires the partners to cast a majority vote. If they don’t, the LLC can’t be voluntarily dissolved.

It’s a good idea for your operating agreement to have internal rules for running your LLC but also information about dissolving it. Referring to the operating agreement is the right way to trigger your LLC dissolution, allowing you to make sure that everything complies with the terms you created at the beginning of your business journey.

The rules in an operating agreement might include:

At least two-thirds of the members of your LLC must vote for dissolution in order for it to move forward. That’s true with most states, and Kentucky is no exception.

“Winding up” your LLC and its affairs is a vital part of shutting things down and making sure you’re legally complying with everything required by the state. For example, you should expect to:

Even though having an LLC means liability protection for the members based on any debts the business accrues, dissolving the LLC doesn’t remove the obligation for the business to pay those debts.

When you’re dissolving your Kentucky LLC you need to let claimants and creditors know. You also need to pay off any loans or credit cards your business had before the dissolution can be considered final. Your obligations in this area include:

Before you can be allowed to dissolve your LLC in Kentucky you need to show proof that all of its state and federal taxes have been paid. Once you’ve shown that you’ve taken care of outstanding business issues you can get ready to file the paperwork that will officially close your LLC.

To file articles of dissolution with the Kentucky Secretary of State you’ll want to visit the Voluntary Dissolution page located under Business Filing Information.

On that page you can find a link to the forms you need to fill out. Links to the IRS, the Kentucky Department of Revenue, and the Kentucky Department of Unemployment Insurance are also provided, so you can reach out directly to those entities and ensure that you’re in compliance with them and don’t owe taxes or other fees.

Once you click on the link for the forms, choose the + sign next to Limited Liability Company Forms. That will take you to this screen:

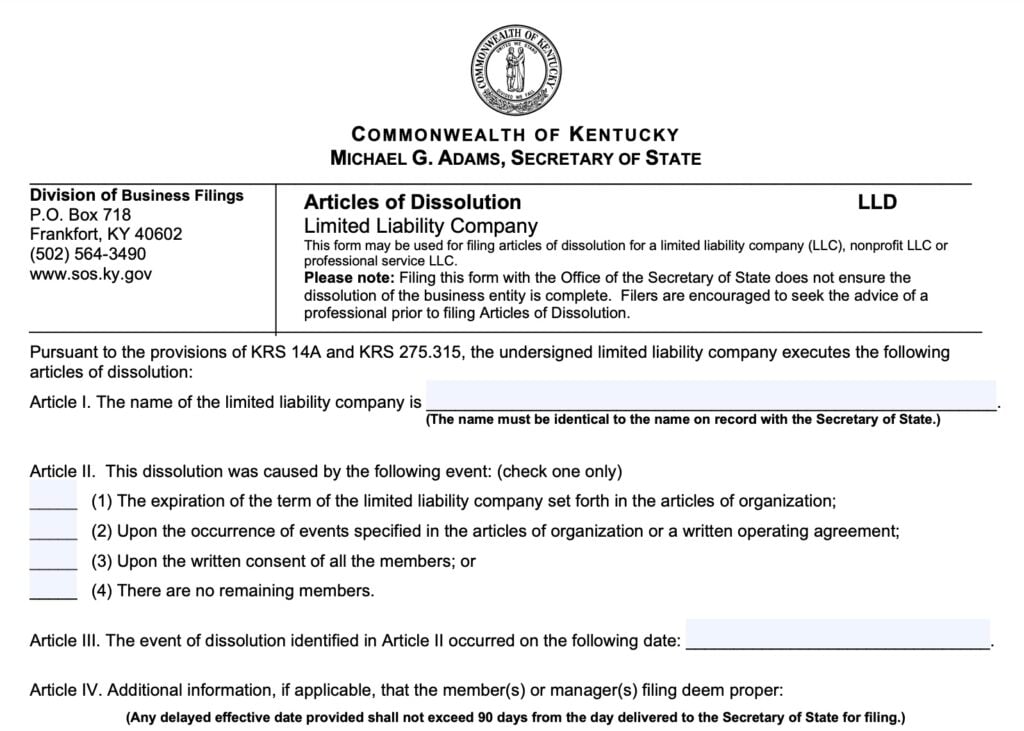

Choose the link for articles of dissolution, which will open a pdf document with highlighted areas to fill out. This is the first part of that form:

Once you’ve filled in all the required areas, it’s time to print the form and mail it. There’s a set of instructions in the same pdf that provides you with the address for mailing and also gives you guidance on how to fill out the form correctly.

Once you file articles of dissolution it’s a very straightforward process to close your business with the state. That’s because most of the work that goes into shutting down and dissolving your LLC will be done before the articles are actually filed. It’s not necessarily easy to say goodbye to a business you’ve put your heart and soul into, but you can also focus on the idea that it’s a new beginning for you.

Taking everything you learned through the creation and operation of your limited liability company is a great way to use that knowledge on something new. Experiences aren’t wasted if you take them with you and apply the knowledge you’ve gained to new ventures.

There are several reasons why you might decide to dissolve your LLC, but some are more common than others. Internal disagreements between the members, rising costs or competition, merging with another business, cash flow or accounting issues, and moving to another state are all big reasons for you to choose LLC dissolution.

The filing fee for articles of dissolution is $40.

You can’t dissolve your Kentucky LLC online, but you can get the right forms on the Secretary of State’s website. Then, you’ll be required to mail these to the address listed in the form’s instructions.

After the articles of dissolution are filed it generally takes one to three days for a Certificate of Dissolution.

f you don’t officially dissolve your Kentucky LLC you may end up with liabilities such as taxes, annual fees, and other expenses. You could also be in violation for not filing annual reports or other required documentation.

You could end up with double taxation if your LLC is registered in more than one state. Some states have tax credit agreements, but not all of them do. If you’re moving your LLC to a new state it’s better to dissolve it in the state that you’re leaving, in most cases.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands