It’s never easy when you decide to end a business that you’ve worked hard building. However, if you do decide that it’s time to throw in the towel and move on to other ventures, it’s important to follow the appropriate process for dissolving your Michigan LLC.

In this article on how to dissolve an LLC in Michigan, we’ll go over the step-by-step process you can follow to legally terminate your company with the Michigan Secretary of State. Follow this guide, and you’ll be able to dissolve your LLC with minimal issues and hassle.

Before we get started covering the process of how to dissolve an LLC in Michigan, let’s first take a look at what LLC dissolution is and the different types of dissolution that can take place:

Dissolving an LLC means that you are formally ending the company’s existence in the eyes of the law. By doing this, you release the company (and yourself) from obligations such as tax and reporting obligations.

There are three main types of LLC dissolution. While voluntary dissolution is the focus of this guide, it’s important to understand the other types of dissolution an LLC can undergo as well:

Administrative dissolution occurs when an LLC’s dissolution is ordered by the state—typically for reasons such as not filing required reports or failing to pay required fees. This type of LLC dissolution can often be reversed if the company addresses the reasons behind the dissolution.

Judicial dissolution is a type of LLC dissolution that is ordered by the court. This can occur due to things such as the company engaging in illegal activities, deadlock among its members, or an ability to continue achieving its stated purpose.

This is the most common type of LLC dissolution, and it occurs when an LLC’s members voluntarily agree to dissolve the company. Explaining how to voluntarily dissolve a Michigan LLC will be the focus of the rest of this guide.

If you’ve decided that you no longer wish to operate your Michigan LLC, it’s essential to legally dissolve the company rather than just calling it quits. Following the correct process for dissolving a Michigan LLC will ensure that all of the company’s legal obligations are eliminated as well.

To dissolve your LLC in Michigan, here are the five steps you will need to follow:

If you are the sole owner of your company, the decision to voluntarily dissolve it lies solely with you. However, if your LLC has two or more members, then you will need to hold a formal vote on whether to dissolve the company.

Single vs multi-member LLC dissolution

Single-member LLCs can dissolved at the sole discretion of said member. Multi-member LLCs, on the other hand, must hold a vote on whether to dissolve the company. The rules for this vote, including the majority required to pass, should be outlined in your LLC’s operating agreement.

Speaking of your company’s operating agreement, this document (along with state laws) will be your primary guide throughout the dissolution process. Along with outlining how a dissolution vote should proceed for multi-member LLCs, your operating agreement will also cover things like how the company’s assets are to be distributed, how contracts should be canceled, and how creditors should be notified.

If your LLC’s operating agreement does not specify a process for voting to dissolve the company, the Michigan Limited Liability Company Act (MLLCA) provides default rules. Under these rules, dissolution generally requires the consent of members holding a majority of the interests in the company, unless the articles of organization or operating agreement state otherwise.

In some cases, Michigan law may require unanimous consent from all members to dissolve the LLC. This is more common in small LLCs where each member has equal voting rights or in cases where the LLC’s formation documents require unanimous approval for major decisions.

Once the decision to dissolve the company has been made, winding up all business affairs is the next step in the dissolution process. Be sure to attend to matter such as:

Before you can legally dissolve your Michigan LLC, you must first settle any remaining debts that the company owes. Start by notifying all creditors and claimants of the company’s dissolution, and pay off any remaining balances owed to them.

Once all debts ( such as credit card debt, loans, or leases) have been settled, you can the distribute the company’s remaining assets. For instructions on how assets should be distributed, refer to your company’s operating agreement.

The last matter you have to attend to before you can dissolve your Michigan LLC is to file final federal and state tax returns. If your company owes any taxes, these must be paid as well.

After filing the final tax return and settling any outstanding tax liabilities, you will need to obtain a tax clearance certificate from the Michigan Department of Treasury. This certificate confirms that all state taxes have been paid and that there are no remaining tax obligations.

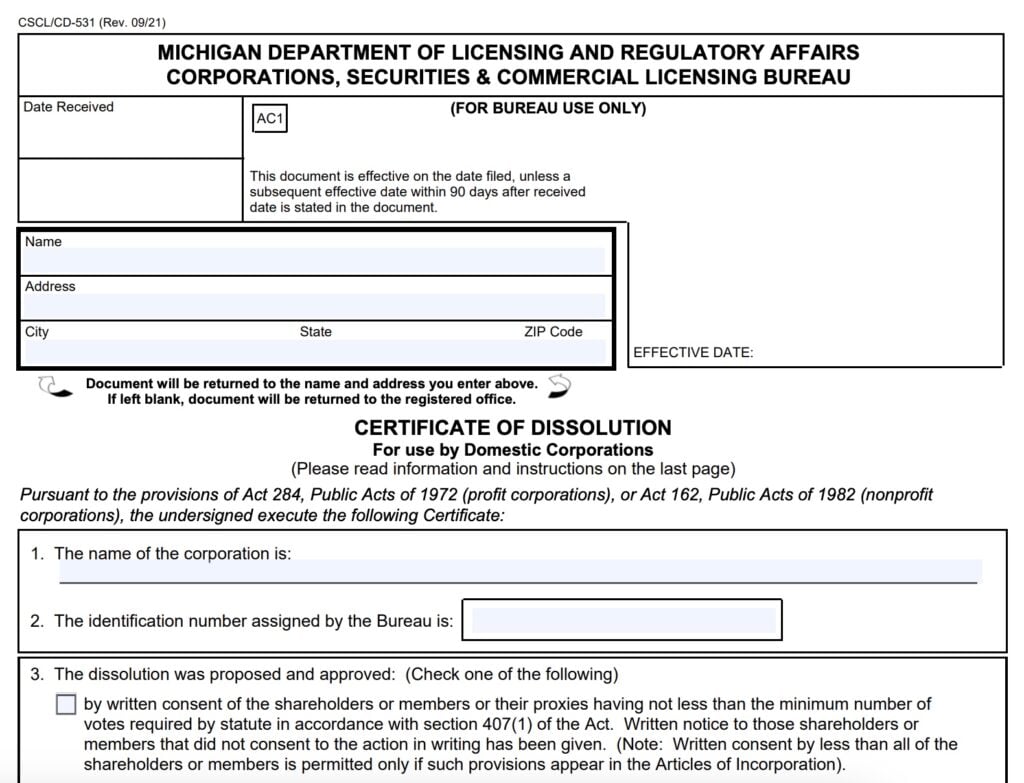

Once you have completed all the steps we’ve covered so far, you can formally dissolve your Michigan LLC by filing a Certificate of Dissolution with the Michigan Department of Licensing and Regulatory Affairs (LARA). This form is available on the LARA website, and here is what it looks like:

To avoid any mistakes that could lead to delays, be sure to carefully review the form and fill out all required sections. Once you’ve done this, the Certificate of Dissolution can be filed either online or by mail.

To file online, you can visit the Michigan LARA Corporations Online Filing System. Log in if you already have an account or create a new one if you don’t, then select “Dissolve a Business.” from the dashboard menu. Next, search for your LLC by name or entity ID, and select the option to file the “Certificate of Dissolution.” Complete the form and submit the required $10 filing fee.

To file by mail, download and complete the Certificate of Dissolution form from the LARA website. Include a check or money order for the $10 filing fee, and mail the form to:

Michigan Department of Licensing and Regulatory Affairs

Corporations, Securities, and Commercial Licensing Bureau

P.O. Box 30054

Lansing, MI 48909

You will receive a confirmation letter once your filing has been processed. Note that mailed filings may take longer to process than those submitted online.

If you’ve made the difficult decision to dissolve your Michigan LLC, it’s important to make sure you complete this final process correctly. By following the steps in this guide, you can formally dissolve your company and prevent any issues from arising due to the LLC you formed still legally existing despite no longer being in operation.

If you no longer wish to continue operating your company, it’s essential to formally dissolve it. Dissolving your Michigan LLC will mean that it ceases to exist in the eyes of the state, freeing you up from any ongoing obligations such as filing taxes and annual reports.

The only cost associated with dissolving an LLC in Michigan is the $10 filing fee you are required to pay when filing Certificate of Dissolution with the Michigan Department of Licensing and Regulatory Affairs (LARA).

The Certificate of Dissolution required to dissolve a Michigan LLC can be filed online.

Once you’ve filed the Certificate of Dissolution, processing times will vary depending on both your filing methods and the volume of filings that LARA is dealing with at the time. Generally speaking, mailed filings have a processing time of a few weeks, while online filings are typically processed in a few business days.

Failing to properly dissolve your Michigan LLC means that it will remain an active company as far as the state is concerned. The result is that you will still be required to meet all legal obligations and reporting requirements even if you are no longer actively operating the business.

If your Michigan LLC is registered to conduct business in other states as well, then you will need to dissolve the company in each state individually. Be sure to keep in mind that different states will have their own unique procedures, forms, and filing fees required for dissolving an LLC.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands