There comes a point in an entrepreneur’s life when it feels like the right time to dissolve a Limited Liability Company / LLC in Nevada and look forward to new opportunities. You may want to dissolve your LLC because it has fulfilled its purpose, you’ve reached retirement age, or other circumstances signal that it’s time to shutter operations. Regardless of why you made the choice to close your LLC, it’s essential to take measured and appropriate steps to complete an exit strategy.

Incomplete business plans tend to omit exit strategies because they either feel like bad omens or indicate a lack of confidence in the organization. Because enthusiastic business professionals prefer to look forward to goal achievement and profitability, few understand how to dissolve your Nevada LLC. Much like the initial planning stage, you’ll need to handle a wide variety of facets, such as finalizing your books, paying state and federal taxes, and filing official documents with the Nevada Secretary of State.

It’s essential to keep in mind that LLC dissolution is a formal and legal process that notifies creditors, landlords, vendors, and other professionals in your orbit. One of the primary reasons to dissolve your LLC involves debt protection. The good news is that by understanding the types of LLC dissolution and the closure steps involved, you can maintain the corporate veil protections afforded by this type of entity.

Closing an LLC in Nevada is not an everyday occurrence. Plenty of entrepreneurs and stakeholders are surprised to learn there are three ways to dissolve an LLC — judicial, administrative, and voluntary. The first two types of LLC dissolution are largely viewed as involuntary, and you would be wise to avoid having the entity canceled or defaulted.

An administrative business dissolution may occur when an entity loses good standing. When this involuntary dissolution happens, the operation no longer has the right to do business freely in Nevada. In some cases, a court-ordered LLC dissolution may be ignored, forcing the Secretary of State to administratively dissolve the entity after 180 days have lapsed. Business professionals who fail to pay annual filing fees can be administratively closed due to default. Restoring the LLC includes covering the missed payment and a penalty.

This type of involuntary LLC dissolution involves a court proceeding. Creditors, negatively impacted parties, or government officials may bring an action against the enterprise. In some cases, owners cannot agree on how to move forward, and a judge could decide the only reasonable solution is to dissolve the LLC. A court-ordered dissolution tasks owners or operators with closing the operation within 180 days. Failing to file articles of dissolution can result in penalties, fees, and the Secretary of State taking administrative action.

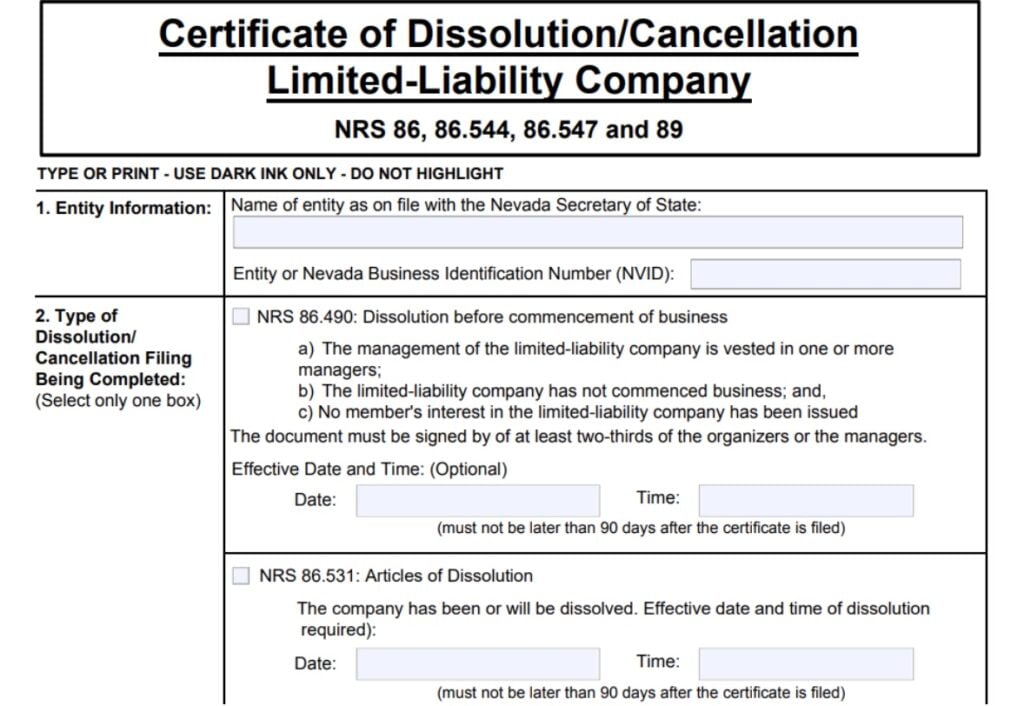

Following the ethical and professional standards expected to shutter a Nevada LLC is by far the path of least resistance. The process tasks owners and key individuals with conducting a thorough review of assets, cash-on-hand, expected revenue, debts, and wide-reaching other issues before filing a Certificate of Dissolution / Cancelation Limited Liability Company document. But before you can put the LLC to bed, there are pre-filing steps that must be completed.

The Nevada Secretary of State has a relatively efficient LLC dissolution process in place on its platform. Once you have tidied up the company’s loose ends, an authorized member, organizer or manager can complete the forms. But before you can apply for a Certificate of Dissolution, the following steps must be completed.

The voluntary dissolution of an LLC calls for stakeholders to take a vote, as set forth in the articles of organization. While individually owned LLCs can skip this step, it’s crucial to have a quorum, record the decision, and make a record of the action.

One of the benefits of creating an LLC is its flexibility. The organization can have a sole owner or numerous participants. Closing a multi member LLC will require assets and cash to be distributed in accordance with the articles of organization after all debts are resolved. Single member LLC owners can simply pass the profit through their individual IRS filing.

In Nevada, an LLC operating agreement can only be adopted by unanimous consent. That does not necessarily mean 100 percent of the owners must agree to close the entity. A smartly crafted document typically includes clauses that outline dissolution procedures. The framework of matters such as dividing assets, real estate valuations, terminating contracts, and debt resolution are key elements to follow. Failing to adhere to the legally binding dissolution rules in your LLC operating agreement will likely trigger a civil lawsuit.

Shuttering an LLC would seem to call for “winding down” operations. Oddly, the term “winding up” is generally used when notifying individuals and other companies about your intent to dissolve your LLC in Nevada. These usually include notifying the registered agent, landlords, contractors, banks, and staff members, among others. A transparent winding up process helps maintain your reputation as a reliable member of the business community.

No scenario exists where avoiding creditors or claimants doesn’t result in controversy, hard feelings, or litigation. An LLC must resolve any debts, leases, taxes, and other financial issues. In Nevada, an LLC may be able to operate past its dissolution for the purpose of paying creditors. It’s important to notify all impacted parties early and negotiate settlements.

All businesses and owners have a responsibility to pay state and federal taxes. Regardless of whether the operation was profitable, broke even, or ran red ink, agencies expect tax bills to get paid. It may be prudent to enlist the support of a tax professional to ensure an accurate IRS filing.

Before filling out the Articles of Dissolution document, you’ll need to gather some information. This includes the entity name, effective date of dissolution, and decide how quickly you want it to go into effect. The standard dissolution process is typically $100 for the initial filing. Additional copies can run upwards of $30 each. A 24-hour expedited filing can cost an extra $25 to $125, a two-hour filing costs $500, and the fee for one-hour processing runs $1,000. Standard and expedited filing can be mailed to the following.

Regular or Expedited Filings:

Expedited Filings Only:

The Secretary of State may require proof that the members voted in conformity with the Nevada LLC’s articles or organization. Include the document and record of the vote to ensure the filing doesn’t run into any bureaucratic snags.

Following the step-by-step procedures to lawfully and ethically dissolve your LLC will pay dividends. It demonstrates you are a responsible business professional who practices transparency. Completing the LLC dissolution process also prevents disgruntled vendors and employees from bringing you to court due to missteps.

There’s no right or wrong answer to why you should dissolve your LLC in Nevada. There are instances in which a key person passes away, and their death triggers its closing. Sometimes, the cost of doing business in one area becomes too high. Many people shut down LLCs due to retirement and quality of life issues. As long as you do it by the numbers, things will fall into place.

The cost of dissolving an LLC in Nevada depends on how quickly you want it put to bed. The fee for a standard LLC dissolution is $100. If you want it done quickly, 24-hour processing adds $25 to $125, 2-hour service is $500, and 1-hour service runs $1,000. You can use a check, money order, credit card, or trust account to pay the fee.

The short answer is: Yes. Use the Nevada Corporation Commission’s business portal, called Silverflume. Log onto the platform and go to Existing Business. Then choose Cancel, Dissolve, or Terminate and follow the prompts. Digital filings are usually processed on the same day. However, there is no guarantee.

Standard snail mail processing can take 7-10 business days. Online filings may be completed on the same day. Expedited LLC dissolution services can be as quick as 1 hour if you are willing to pay the premium.

If you forget to dissolve your Nevada LLC, the Secretary of State will likely send it into default for not paying annual fees. You will be held accountable for back fees, penalties, and opening yourself up to unnecessary civil actions. It’s always a good idea to voluntarily dissolve an LLC.

Also, if you do not take official steps to dissolve your Mississippi LLC and fail to file the required annual reports, the State can and will initiate Administrative Dissolution.

There are no shortcuts in terms of terminating an LLC. You will need to follow the articles of organization outlined in each state’s organization. Gather all the pertinent information, close bank accounts, pay down debts, notify vendors and employees, and file Articles of Dissolution or Articles of Cancelation in compliance with each state’s statutes. It can involve some heavy lifting, and it may be worth considering getting professional support.

Also, if you do not take official steps to dissolve your Mississippi LLC and fail to file the required annual reports, the State can and will initiate Administrative Dissolution.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands