It’s important to resist the impulse to walk from a Limited Liability Company / LLC in Wisconsin and grab a new opportunity. Sometimes, business professionals leave an under-performing or unused enterprise behind, assuming it’s no big deal. That assumption can get you in a great deal of trouble. A legally viable LLC may incur fees and penalties or be used by fraudsters to make purchases. At the end of the day, the parties responsible for the company can find themselves in a quagmire of headaches.

That’s why it’s essential to dissolve your LLC in a timely manner. Once the organization has been removed from the State of Wisconsin’s Department of Financial Institutions database, you’ll be able to rest easy and embrace your next career path. A legally complete LLC dissolution requires following a step-by-step process. Any deviation or misstep could leave unwelcome loose ends dangling.

Moving forward cleanly and unencumbered in business allows motivated individuals to freely embrace new challenges and accumulate wealth. By understanding the basics of LLC dissolution in Wisconsin, you will be able to apply your experience, expertise, and laser focus to achieve your goal. To get to that prosperous future, Wisconsin tasks entity owners or an authorized person to complete its filing requirements. You’ll pay a modest one-time fee after following these detailed steps.

From a legal point of view, dissolving your LLC the right way puts creditors, vendors, employees, and others on notice. A thoughtful and legally binding LLC dissolution resolves outstanding debts, distributes assets appropriately, and closes the door behind you. Dissolving your Wisconsin entity can be a complex process. By knowing the different types and how to dissolve an LLC correctly, you can tidy things up relatively quickly.

Entrepreneurs are sometimes taken aback to learn there are multiple ways an LLC can be dissolved. In Wisconsin, you can either perform a voluntary dissolution, or an official could unceremoniously do it for you. These are the three ways an LLC can be closed out.

In an administrative dissolution, the government takes away an LLC’s rights and ability to operate. The reason for this type of involuntary dissolution is often triggered by business entities failing to file annual reports, paying fees, and other requirements. Although this may seem like an easy out if you plan to close the business anyway, it can leave you personally vulnerable to civil liability.

The courts can mandate a judicial dissolution in Wisconsin if an action is brought against the organization. A judge typically orders LLC dissolution based on limited legal grounds. These include the following.

Once the entity is shut down by the courts, owners and members may be required to follow LLC dissolution procedures. In some cases, a judge assigns a professional to supervise debt repayments, asset disbursements, and other items.

If judicial dissolution is the worst-case scenario, then voluntary dissolution represents the best. That’s largely because voluntary dissolution is when the owner or members make an informed decision about their professional and financial futures. However, a positive outcome means investing time, energy, and due diligence.

Dissolving your LLC in Wisconsin proves beneficial in the long run. Taking proactive measures to shutter the business in an ethical fashion buoys your professional reputation. These are the business dissolution steps in Wisconsin.

A voluntary LLC dissolution requires a vote by the entity’s members. The process is usually outlined in the organization’s operating agreement. Typically, a quorum of members must gather to discuss an exit strategy. A vote is held, documented, and recorded. If the closure measure carries, the LLC dissolution process begins at an assigned date.

Entrepreneurs and business professionals gravitate toward LLCs because they provide liability protections and tremendous flexibility. People start single-member LLCs all the time. When an LLC is owned by one person, they can choose to dissolve the LLC without gaining the approval of others. That’s the principal difference between single and multi-member LLC dissolutions.

Although operating agreements often use similar clauses to establish the rules for closing an LLC, some differ significantly. Take the time to reread the operating agreement and pay special attention to the rules regarding LLC dissolution. A well-crafted operating agreement provides details regarding the division of assets, terminating contracts, and paying off debts. Keep in mind that these are strict rules and not mere guidelines.

The “winding up” part of a business dissolution involves notifying key stakeholders and businesses about your intention. Your registered agent, suppliers, consultants, independent contractors, clients, landlord, and others in your orbit need to receive a formal letter that expressly states the operation plans to close. You’ll also need to cancel licenses and permits, close financial accounts, and handle employee issues with compassion.

While the State of Wisconsin doesn’t necessarily have a statute in place that mandates you notify all creditors, it’s prudent to do so. Along with adhering to ethical business practices, notifying creditors and claimants about your LLC’s dissolution creates an open dialogue about debt resolution. If the organization has a revenue shortfall, a solution can be negotiated, processed, and confirmed in writing.

Taking steps to inform and work out creditor issues helps avoid protracted civil litigation. If you simply turn your back on creditors, they are more likely to file a costly lawsuit, arguing the business dissolution was designed to evade paying creditors.

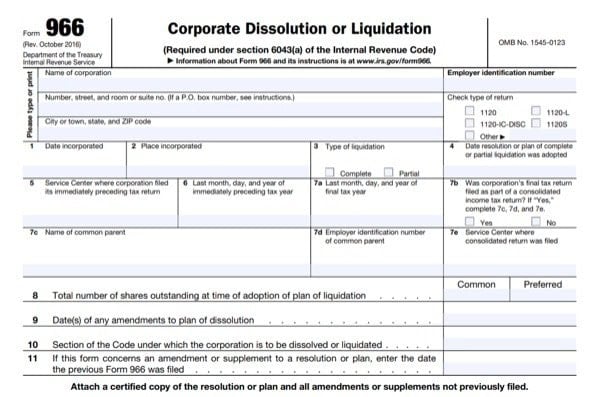

Wisconsin does not insist on obtaining a tax clearance certificate before you can file articles of termination. As you’re winding up tax issues, consider notifying the IRS by completing Form 966. The IRS does not charge a fee, and it helps document the business dissolution process.

Unlike other debts, taxes generally cannot be washed out in a bankruptcy filing. The liability protection afforded by LLCs won’t insulate you from paying taxes. Prioritize tax debt and allocate the necessary resources.

Filing Articles of Dissolution through the State of Wisconsin Department of Financial Institutions calls for paying any and all outstanding fees before application approval. Owners and authorized parties fill out Form 510. Wisconsin provides a digital process with a $20 fee. You need the following information to complete the digital form.

The form can also be downloaded and snail mailed with a check or money order to:

The state charges an additional $25 penalty for delinquent business fees. Not paying outstanding balances may result in the Articles of Dissolution application being denied.

Completing each step in the LLC dissolution process leaves business-minded people free to pursue other endeavors, enjoy retirement, or make quality-of-life changes. You’ll be able to rest easy knowing the taxes have been paid, creditors won’t come looking for money, and scam artists cannot leverage the entity to commit fraud under the business’s name.

Dissolving an LLC in Wisconsin is a process that handles outstanding debt, creditors, taxation, employee issues, contracts, and other matters. By adhering to the procedures outlined in the business’s operating agreement and adhering to state regulations, dissolving your LLC provides insulation from civil litigation and allows you to move forward with other opportunities. If dissolving an entity appears overly cumbersome, consider working with a professional.

Acquiring a certificate of dissolution requires a $20 filing fee and payment of delinquent fees with a $25 penalty. You will need a credit card, debit card, check or money order.

The short answer is: Yes. You can digitally fill out and file Form 510 (Articles of Dissolution) on the Wisconsin Department of Financial Institutions platform. The cost is $20, payable upon completion of the form. Any delinquent fees must be paid in full with a $25 penalty for each overdue year.

The average processing period runs about five business days and costs $20. The Wisconsin Department of Financial Institutions offers expedited processing for an additional $25. Expedited forms are usually processed by the end of the following business day.

If you fail to dissolve your LLC in Wisconsin, you are opening a Pandora’s Box. Wide-reaching problems could emerge, such as creditors filing lawsuits against the entity and you personally. Landlords and contract-holders could continue to bill the organization. There are no pros to not voluntarily working through the dissolution process and properly putting the entity to rest. Also, if you do not take official steps to dissolve your Mississippi LLC and fail to file the required annual reports, the State can and will initiate Administrative Dissolution.

Having multiple LLCs means you will have to file for some type of certificate of termination in each state. Every state has its own LLC dissolution requirements that include unique fees, taxes, and procedures. If you have franchises or individual businesses in multiple states, it may be prudent to reach out for LLC dissolution support.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands