Some businesses, like corporations and limited liability companies, need an Employer Identification Number to file taxes. For others, an EIN is optional.

But sometimes, small business owners and freelancers (AKA, sole proprietors) cross the IRS line and need an EIN to operate. Even if your sole proprietorship doesn’t legally require an EIN, having one has numerous advantages.

So, does your sole proprietorship need an EIN? Let’s find out!

An EIN (or a business tax ID) is an Internal Revenue Service (IRS) assigned 9-digit number given to business entities to identify them when they file their taxes. Business owners who need an EIN use it instead of their Social Security Number (SSN).

Sole proprietors who don’t file excise tax returns have a Keogh retirement, or Solo 401 (k) pension plan, or employees don’t need an EIN.

Instead, they’d use their Social Security Number for their taxpayer identification number and file Form 1040 Schedule C to report their income and expenses.

However, there are certain circumstances when you need a sole proprietorship EIN, such as:

You can check out the IRS questionnaire for further information to see if you need a sole proprietorship EIN. But chances are unless you fall within the IRS’s “certain circumstances” you won’t. However, there are several benefits to getting one.

Many sole proprietors choose to get an EIN to be ready for whatever the future holds. For example, you might need to scale your business and take on employees. Having an EIN enables you to act quickly.

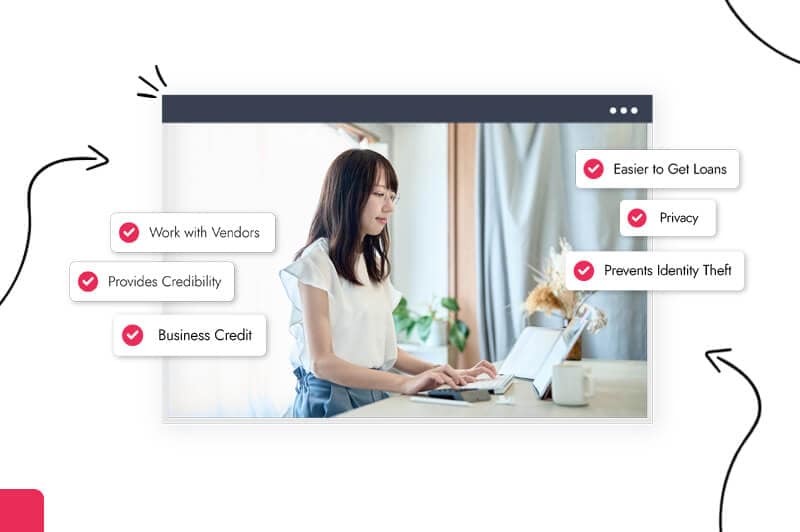

There are several other reasons you should get an EIN for your sole proprietorship, the first being professionalism.

An EIN conveys professionalism, establishing your sole proprietorship as a credible business, not just a side gig.

For instance, sole proprietor freelancers and independent contractors must provide clients with an SSN or an EIN to receive a 1099 tax form. Many clients are more comfortable doing business with sole proprietors with an EIN because they know they’re legit.

In addition, having a sole proprietorship EIN shows clients you’re an independent contractor, not an employee, making you more attractive to businesses looking to hire.

Opening a business bank account helps avoid commingling funds by separating business and personal finances. Identifying and tracking business transactions from personal ones simplifies your accounting and bookkeeping.

Both help you avoid incorrect or late filing fees, making your life easier and reducing stress.

While an EIN isn’t mandatory sometimes, you might find that most banks require one to open a business account.

Business credit is often the lifeblood of many small businesses, and an EIN is crucial to establishing it.

A business credit report is a commercial summary that evaluates your sole proprietorship’s history of credit accounts, payments to vendors, and other bill payments.

Each time you use your EIN to apply for credit, your account appears on your business credit report. When you’re in good financial standing, your business credit gets a boost, increasing your chances of getting a lower-interest loan and better prices from suppliers.

You can get a business loan without an EIN if you are a legal business. But there’s a catch as most lenders require you to have a business bank account with a credit history, so you’ll often need an EIN.

Using your Social Security Number for your business increases the chances of identity theft and fraudulent tax returns. An EIN reduces that chance by separating your personal and business finances and keeping your SSN private.

Small businesses often rely on suppliers, vendors, and other partners to succeed, but they’re picky with who they’ll do business.

Vendors and wholesale distributors often run an EIN check before doing business with a small business/retailer. Having an EIN and a credit report shows them you pay your bills and are trustworthy.

Many sole proprietors are lone wolves, but you could need employees to help grow your business as you become more successful. Having an EIN today ensures you’re ready to take on extra help and file the proper payroll taxes tomorrow.

An EIN helps simplify bookkeeping and accounting but can also help you with tax reductions and avoid late payment penalties.

Many sole proprietors work from home and claim tax deductions on a percentage of their home office space and utilities. However, tax deductions often lead to audits; having an EIN and a business bank account helps ensure you’re ready if the IRS comes knocking.

And any business that requires an EIN on tax day but doesn’t have one risks their tax return being rejected and incurring late filing fees.

Those are the benefits of having an EIN; now let’s look at how you can get one for your business.

You can get your EIN online using the IRS website or by calling the IRS at 800-829-4933 from 7:00 a.m. to 10:00 p.m. local time. You can also complete Form SS-4 and mail/fax it to the IRS at:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

By Fax: (855) 6416935

Alternatively, you can apply using our EIN application service, which removes the hassle of navigating the IRS website or filling out government forms.

I hope I’ve answered all your questions regarding sole proprietorship and EINs.

Remember that having an EIN for your sole proprietorship gives you the freedom to scale and establish your business. It’s simple to get and you’ll save time down the line when your hands are full.

So, why wait?

Loose ends and unanswered questions aren’t good for business. So, let’s finish up by answering the most frequently asked EIN questions and explaining the difference between those confusing government acronyms!

Yes, even though an EIN and a Tax Identity Number are both 9-digit numbers issued by the IRS for taxes, there’s a difference.

A TIN is an umbrella acronym that covers the following IRS and Social Security Administration (SSA) tax identification numbers as per the IRS website:

The difference is an EIN identifies a business entity like an LLC or corporation when filing taxes only at a federal level. In comparison, a TIN can identify individuals and business entities at the state and federal levels.

When you need a tax ID for federal reasons (i.e., hiring employees or filing taxes), you’ll need an EIN, whereas you use a state tax ID number to pay state taxes. And sole proprietors often use their state tax ID number instead of their SSN to help protect against identity theft.

No, they are the same. FEIN stands for “Federal Employer Identification Number,” and the only difference is when people drop the F when using the acronym.

However, there’s one exception!

There’s a difference when using the acronym EIN to refer to a state tax ID number. Some states issue EINs for state tax forms, which serve the same purpose as a FEIN but at the state level.

No, because you can use your SSN to file your taxes as a sole proprietor. However, remember to check the IRS questionnaire to ensure you don’t fall within certain circumstances because if you do, then yes, you’ll need an EIN. Besides, haven’t I convinced you that getting a sole proprietorship EIN for your business is an excellent idea?

Sole proprietors can only have one EIN. To get another, a sole proprietor must change their business name/type with their local municipality.

It’s easy to look up your EIN; you can:

In case you’re still unsure, here are several reasons you should use an EIN for your sole proprietorship:

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands