As much as you might like to, you aren’t allowed to open a business in Hawaii and start providing goods and services unless you have the required licenses and permits. Here is a summary of the Hawaii business licenses and permits an owner must obtain, along with the procedures for securing them.

Small business licenses and permits have some major purposes. One is to ensure that all businesses pay their taxes and abide by the laws of the state and localities where they operate. Another is to safeguard public safety. For example, they ensure that anyone who sells food is storing, preparing, and serving it in a sanitary manner. For another example, they restrict skilled professions such as engineering, medical services, and accounting to those who are properly qualified.

Both licenses and permits are issued by government agencies, but they have different purposes, and, therefore, different requirements. Licenses exist to track businesses for government records and taxation and to ensure that business owners are professionally qualified to operate their businesses. To obtain a license, an owner completes a registration form and in some cases pays a fee.

Permits exist primarily for ensuring public safety. They often require the business to pass an inspection, and the businesses are subject to ongoing monitoring. Businesses such as restaurants and food trucks typically require a health department inspection and an up-to-date permit to operate.

Hawaii business owners may have to obtain federal, state, and local licenses and permits.

Anyone doing business in Hawaii is required to get one or more licenses, permits, and registrations. The Hawaii Department of Taxation frequently refers to all of these credentials as “licenses.” Their website contains a table that shows all the license types, along with who must register, the fee (if any), and whether the license needs to be renewed. These are licenses for such activities as hotel and short-term accommodation rental, motor vehicle transportation rental, and distribution and sale of fuel, alcohol, and tobacco.

In addition, there are a number of permits at the county and city level. Honolulu County, for example, requires zoning permits, which restrict where certain types of businesses can operate. Anyone who sells alcoholic beverages will need a liquor license from the local government. In some parts of the state, a business that deploys an alarm system must obtain an alarm permit from the local police department. Signs may require a permit, and electric signs may require an electrical permit as well. If you run a business from your home, you will need the same permits required from a business in a building, and you may need a Home Occupancy Permit.

A number of business types are regulated by the federal government, and these require a permit from the federal agency that controls them. These include agriculture, alcohol, aviation, firearms and explosives, fish and wildlife, maritime transportation, mining, nuclear power, radio and TV broadcasting, and transportation. If you are in any of these businesses, you will have to apply to the appropriate agency. Each agency has its own procedures for application along with its own fees, and you will have to contact the agency for details.

There may be more licenses and permits required for your business than you would like. Fortunately, there are procedures for finding all of them.

The Hawaii Department of Taxation lists all the licenses, permits, and registrations required for tax purposes. These credentials include:

In addition, there are permits required at the county and city level for such things as zoning, food preparation and service, alcohol sales, home business operation, and even alarm and signage permits. Every municipality has a local licensing or permit authority you can call to get a list of permits you need. You may also find these on the website with the name www.(county/city name).gov.

There are also federal business licenses and permits required for lines of business that are regulated by federal agencies. The Small Business Administration maintains an Apply for Licenses and Permits page that lists these and includes a link to the federal agency where you can get more information and apply. These business activities include:

If you are in any of these businesses, go via the link to the relevant agency for more information.

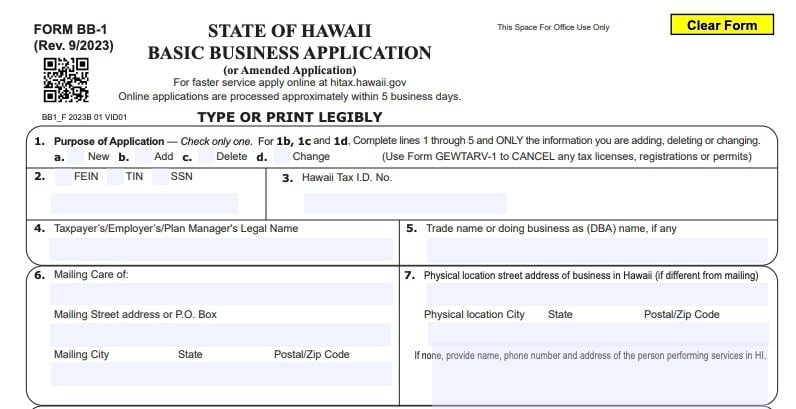

Although you may need several licenses from the Hawaii Department of Taxation, you can apply for all of them at the same time via the same form. This is form BB-1, the Basic Business Application. You can also apply online at Hawaii Tax Online. You will have to create an account with a user ID and password before you can navigate to the form, fill it out, and submit it.

Whether you submit the paper or the online form, below is the information you will need to provide. The questions will guide you on which licenses you are required to obtain. You will need to add up the fees and submit payment with your application.

For county and city permits, the procedure is less straightforward. As each municipality has its own rules, you will have to apply via whatever process the licensing and permit authority uses. You may have to call the local authority if the process is not clear.

For each federal license or permit that you need, you’ll have to go to the relevant agency using the link provided on the Apply for Licenses and Permits web page. You’ll have to use the specific procedure that each agency uses, applying for the license and paying the required fee.

If you submit your BB-1 online, you can expect to receive your tax ID in five to seven days.

If you mail the paper form or drop it off at any district tax office, you will receive you ID in four to six weeks.

Most Department of Taxation licenses have a one-time fee and do not require renewal. However, liquor, tobacco, and retail fuel licenses must be renewed annually. They do not renew on the license anniversary. Instead, there are specific calendar dates when each is up for renewal.

For county and city permits, renewal rules are set by the municipality. Renewal rules for federal licenses and permits are set by each agency.

Navigating the world of federal, state, local licenses and permits can be a challenge for new business owners. However, all the information you need is available online or by phone. You just need to methodically identify the required licensing and work through the necessary steps for each credential.

The consequences for operating a business without proper licensing can be severe. Your business could be temporarily or permanently shut down. You might face cease and desist orders and even criminal charges. Conducting business without required licensing is a crime.

No matter what the form of your business, you will still have to apply for the GET license and any other licenses and permits that your line of business requires.

That depends on the license. Many licenses are available for one-time registration and fee payment, while others must be renewed annually.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands