Nonprofits are a great way to make a difference in the lives of others and give back to the community. Whether it’s an organization such as the Humane Society or the Salvation Army, most people recognize the impact these organizations make and value their contributions.

However, before you start your own nonprofit, it’s essential to understand what it is and how it differs from other for-profit organizations. For example, starting a nonprofit is often different from how you would start a small business. This article will outline the steps to set up a nonprofit successfully.

Before starting a nonprofit, you’ll need to figure out what you want it to accomplish and what kind of impact you want it to have.

The first thing to do when starting a nonprofit is to conduct a needs analysis. This will help establish what the community and your target audience need and determine whether there’s a market for your product or service.

Additionally, you’ll need to find out if other organizations are already providing the type of services you want to offer. If so, you’ll need to determine why your organization can do better and how it will succeed where others have failed.

To help with this, consider the following questions:

By asking yourself these questions, you’ll be able to identify a need and develop a plan of action for success.

Conducting a competitor analysis is crucial to understanding how your nonprofit stacks up against the competition, which will include for-profit businesses that offer similar products or services.

You should be able to identify what makes your nonprofit different, and why people should choose your organization over the others. Moreover, you’ll be able to set yourself apart in the future by developing a specific plan that will help you reach your goals.

Consider key strategies to get ahead of your competition online and offline, such as:

Once you’ve gathered such information and started developing your strategy, you’ll know what needs to be done to help your nonprofit succeed.

When building a nonprofit organization, finding the right support system is essential. Consider working with donors who are passionate about your cause. Not only will this allow you to secure funds early on, but it will also provide you with insight into how to raise awareness.

If you’re unsure of how to find support, consider asking yourself the following questions:

Next, develop a strategy for how to successfully pitch your idea to investors and secure funding. Consider the following tips when developing your presentation:

Once you’ve successfully secured the funds that are needed, you’ll be able to focus all your energy on building an exceptional nonprofit organization.

If you’re unsure about the nonprofit route, there are alternatives to help you operate in a nonprofit capacity.

Instead, you could opt for:

Although you may not be able to establish a nonprofit organization, there are lots of options available to assist you in achieving your objectives.

Once you’ve done your research and established a basic understanding of how to build a nonprofit organization, it’s time to start building your foundation.

Your mission statement and business plan should be the backbone of your nonprofit’s foundation.

Your mission statement should be clear and concise. It should also be able to provide basic information about your cause, identify who you’re serving, what services you’ll offer, and what sets you apart.

For example, the mission statement of the American Red Cross is to “prevent and alleviate human suffering in the face of emergencies by immobilizing the power of volunteers and the generosity of donors.” Their mission statement tells you why and what they do.

Your business plan will outline how your nonprofit will achieve its goals. In addition, it should include details about how your nonprofit will accomplish its vision and any necessary steps.

Before writing your mission statement and business plan, make sure to:

Once you’ve put together a compelling mission statement and business plan, make sure you share them with everyone involved. By doing so, you’ll be able to answer any questions or concerns they may have.

After you’ve written your mission statement and business plan, it’s essential to determine your business entity.

Business entities are the many forms of legal structures businesses may use to safeguard their assets — the kind of business entity you pick impacts everything from day-to-day operations to taxes and personal liability.

Common types of business entities include:

However, nonprofits cannot be all of these structures. They may only be either a corporation or an LLC. Though forming a nonprofit limited liability company can be complex as there are various types of LLC structures.

Even so, an LLC is a more flexible structure. It offers corporation-like benefits without all the filing, insurance, and other organizational fees associated with incorporating.

This means you have personal liability protection from business debts and obligations while having greater flexibility on how you organize your management.

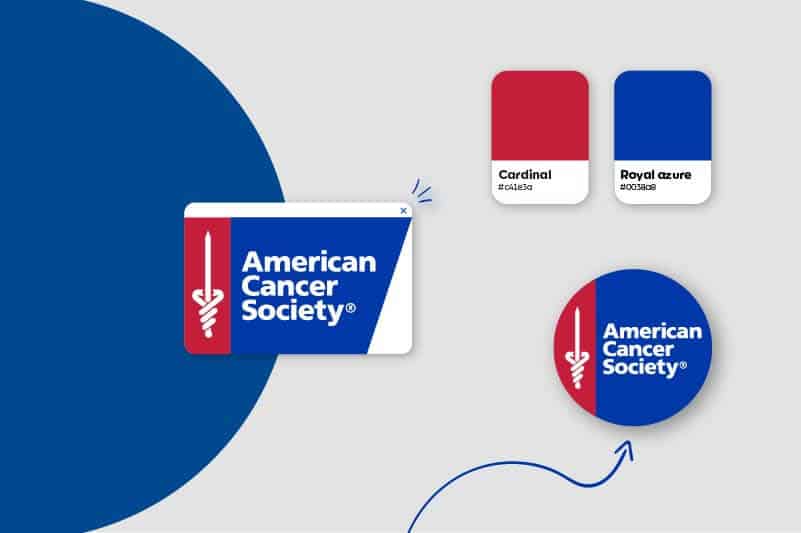

Creating a brand and logo is one of the most important steps in establishing your nonprofit. Your nonprofit logo design should be compelling and identifiable to attract donors and potential clients.

Moreover, developing a cohesive image will have a greater impact on your brand awareness efforts and credibility and encourage others to get involved and support your cause.

If you’re just starting, it can be challenging to develop a design that embodies the entirety of your organization’s mission statement. Therefore, consider having multiple versions of your logo with the help of a logo design tool or graphic designer to simplify the process and give you more options.

Establishing a nonprofit corporation is similar to starting a regular corporation, except that nonprofits must complete additional procedures with the IRS and their state tax department. The main difference between incorporating and having an LLC is the tax-exempt status, which may be necessary depending what your nonprofit does.

The most common incorporation status for nonprofits is a 501(c)(3) organization. If your nonprofit is a 501(c)(3), you’ll still be required to file additional forms with your state unless they automatically grant tax-exempt status.

State regulations for nonprofits vary from state to state. Each has its own set of corporate laws, franchise taxes, and reporting requirements that you should familiarize yourself with.

To open bank accounts or apply for financial assistance, you’ll need to obtain an Employer Identification Number (EIN) from the IRS. Since you’re not allowed to earn profits, your tax forms will be significantly simpler.

There are some forms that a nonprofit should consider when starting:

Since most donors are more likely to contribute money if they can claim a tax deduction, many nonprofits seek 501(c)(3) status. Nonprofits that do not register properly risk losing their tax-exempt status and potential donors.

Although your nonprofit is operational, it must stay current on filing the necessary forms and completing any pending tasks.

The state where you establish your organization may require you to register with their government agencies.

Most states require nonprofit corporations to update their basic contact information, names of responsible parties, and registered agent regularly. If a nonprofit has staff, it must file initial and ongoing employment paperwork with the state Department of Labor.

Additionally, most states also demand charitable organizations that seek donations to register with the state and report on their fundraising operations.

In most states, nonprofit corporations formed or registered to do business in the state are required to submit a bi-annual or annual report with the government. The filing is sent to the appropriate state agency. If a corporation does not file, it may risk losing its “good standing” in the state.

Building a nonprofit organization is a complex process that, when done right, it is worth the time and effort.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands