Starting a limited liability company (LLC) in Illinois requires preparation of various documents. You must file some documents with the state, while other documents are for your own use within the new company. The articles of organization are the key legal document in the process of creating an LLC. By filing this document with the Illinois Secretary of State, you officially create a new LLC as a formal business entity. The following is a guide to this document and the process for filing it, as well as a few recommended steps that you may take afterward.

The articles of organization provide the Secretary of State’s office with the information it needs to create your new business. It is the most important document in the LLC formation process. Without it, you cannot create a business entity.

Every state requires articles of organization to create an LLC, although the exact name of the document may vary based on the state. The information provided in the articles of organization enables the state to confirm that you have met all of the legal requirements to set up a business entity.

When you file your articles of organization, you must pay a $150 fee to the Illinois Secretary of State. If you have already formed an LLC in another state, you may register it to do business in Illinois by filing an Application for Admission to Transact Business, which also requires payment of a $150 fee. If your LLC has the ability to create a series of affiliated LLCs, the filing fee for either document is $400.

You may pay an additional $100 with either filing for expedited service. This fee shortens the processing time to one business day.

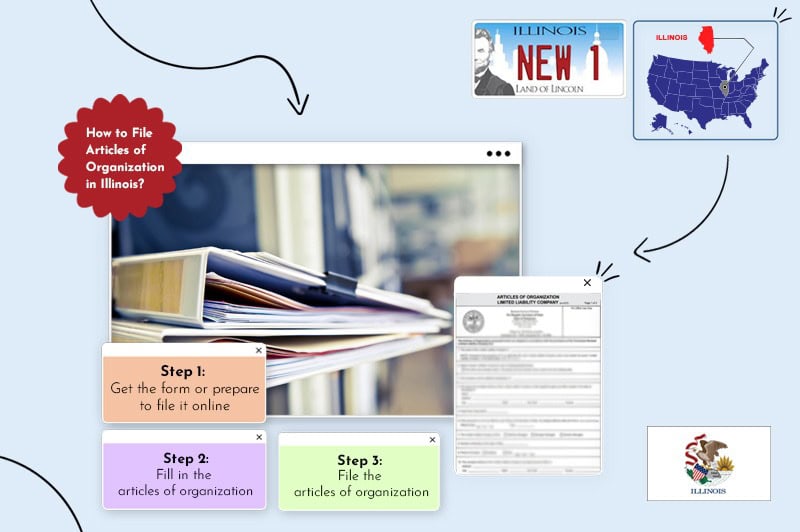

The following steps can help you prepare to file Articles of Organization to start an LLC in Illinois.

You can file Articles of Organization online in most cases, or you can file a paper form by mail. You may be required to file by mail in some situations. To prepare for filing, you can do one of the following:

Next, you should gather the information that you will need for the Articles of Organization.

Your LLC’s name must be distinct from all other business entities registered with the Secretary of State. You may search for LLC names at the Secretary of State’s website to see if the name you want is available.

Illinois law requires that LLC names only consist of letters in the English alphabet, Arabic or Roman numerals, and a limited set of symbols. It requires LLC names to include one of the following terms, separate from any other word:

If you want to name your business “John’s General Store,” acceptable names to put on the Articles of Organization include the following:

The LLC’s name may not contain any of the following terms:

Additional restrictions include the following:

Every business entity organized in Illinois must have a registered agent and a registered office. Your registered agent is an individual or business that you have designated to receive service of process and official correspondence on the LLC’s behalf. The registered office must be a street address, not a P.O. Box.

You may serve as the registered agent for your LLC. You may also use a registered agent service like Tailor Brands. Since the name of the registered agent and the registered office address are in the public record, using a registered agent service can protect your privacy. Anyone who wants to sue your company will send the lawsuit paperwork to the service’s address, not your address.

You must designate a registered agent and office in the articles of organization. If you have already retained a registered agent service, you may list them. You can change the registered agent or registered office at any time after the Secretary of State approves your LLC.

Once you have all of the necessary information, you have several options for filing the articles of organization. The filing fee is $150 no matter which filing method you use, unless you must pay $400 for a series LLC. The $100 expedited service fee guarantees that the Secretary of State will process your application within 24 hours, not counting weekends and holidays.

You can file articles of organization online, in most cases, at the Secretary of State’s website. The Secretary of State accepts all major credit cards for payment of applicable fees.

You must file your articles of organization by mail in two situations:

To file by mail, send an original signed Form LLC-5.5 and one copy to the Secretary of State at the following address:

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62756

You may pay the filing fee by certified check, cashier’s check, or money order. You may call the Secretary of State’s office with any questions at 217-524-8008, Monday through Friday from 8:00 a.m. to 4:30 p.m. Central time.

If you are in or near Springfield, you can file in person at the above address between 8:00 a.m. and 4:30 p.m. Monday through Friday. Bring an original signed Form LLC-5.5, a copy, and payment of the fee by one of the methods mentioned above.

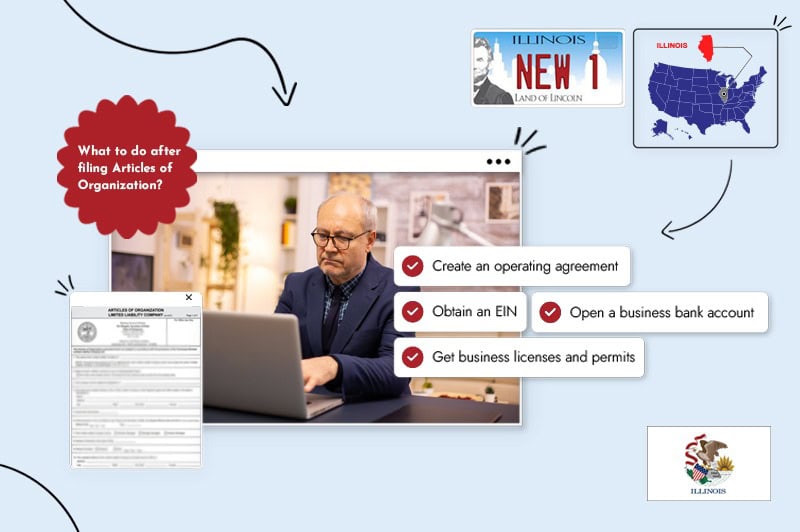

Once the Secretary of State has approved your articles of organization, your LLC officially exists. The next steps for LLC formation in Illinois are usually as follows:

You can obtain an employer identification number (EIN) from the IRS. This number serves some of the same functions as a Social Security number. For example, you will need an EIN to open a bank account or apply for a loan in the LLC’s name. Applying for an EIN will not cost you anything. You can get a quick reply if you apply online.

The operating agreement establishes procedures for making decisions related to operating and managing the LLC. It also determines how the company will apportion profits and losses among the members. Even if you are the only member of your LLC, you should strongly consider having an operating agreement. It can help guide you in a wide range of situations that you might not expect.

One of the main benefits of having an LLC is the protection from liability. You, as an individual, will most likely won’t be held liable for the LLC’s debts, and the business is protected from your personal liabilities. In order to maintain this liability protection, you should keep your assets separate from the LLC’s assets. One of the simplest ways to begin doing this is by setting up a new bank account in the LLC’s name. Any income received by the business should go directly into this account.

You might need various permits or licenses from the local, state, or federal government to engage in the type of business you want to do. For example, if your LLC will operate a retail store, you will probably need permits from one or more city or county agencies authorizing it to operate a business that is open to the public. If you plan on running a bar, you will need a liquor license. You can contact your local government to get more information on what you need.

When forming an LLC, articles of organization are the most important document you need to get started. The document is not particularly complicated, but you must make sure it complies with state law, so the Secretary of State does not reject it or request revisions. Help is available in this and other parts of the LLC formation process.

You can update your Articles of Organization by filing Articles of Amendment with the Secretary of State. You may be able to file online if you are changing the LLC’s name. For any other change, you must file Form LLC-5.25 by mail or in person. The filing fee is $50.

Ownership of your LLC could change if you bring on new members, if existing members depart, or if you sell the entire business. You can file Articles of Amendment to indicate the addition or departure of members. Your next Annual Report may also reflect ownership changes. If you are selling the business outright, you might need to file a Form CBS-1 indicating the transfer of assets.

The Secretary of State charges a $5 fee to file a Statement of Termination, which dissolves an LLC that is otherwise in good standing.

You may search for business names on the Illinois Secretary of State’s website.

An LLC that has been organized in another state can do business in Illinois if it files an Application for Admission to Transact Business and receives approval from the Secretary of State.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands