Licenses and permits are a fact of life for small businesses, and Iowa, like every other state, requires you to have them before you start selling goods or providing services. So if you’re starting a business in Iowa, read this post to learn about the business licenses and permits that you need in the state, along with some procedures for obtaining them.

There are reasons that small business licenses and permits are required. One is to ensure that businesses abide by Iowa law and pay their Iowa taxes. An equally important reason is to protect public safety. For example, they ensure that operations such as restaurants and health care providers maintain safe premises. Also, they validate that professional services such as accounting, plumbing, and electrical work are being performed by qualified professionals.

Both licenses and permits are issued by federal, state, and local governments. However, there are key differences in their purposes and in the procedures for securing them. Licenses allow businesses to collect tax and also ensure that business owners that provide professional services are qualified. You obtain them by registering, paying a fee, and in some cases taking an exam or otherwise proving your qualifications.

Permits are more oriented toward public safety. They generally require an initial inspection as well as ongoing inspections. For example, a food truck or restaurant is subject to health department inspection to secure and retain its license.

Iowa does not have a general business license. However, the Iowa Department of Revenue does require a general tax ID as well as a separate ID for other tax types, including auto rental, hotel rental, construction, hazardous materials, employee withholding, water service excise, and fuel.

There are also business licenses and permits required for a wide range of professional services, including everything from chiropractic to dentistry to mortuary science. Other business types that may need licenses and permits are restaurants, child care, pest control, and passenger transport. If a business can have an impact on public safety or requires professional competence, you can expect Iowa to require a license.

Cities and counties may also have their own licensing requirements. There might be zoning permits, signage permits, outdoor seating permits, and various permits relating to building codes. These can be different for every municipality where you conduct business.

Some types of businesses are governed by the federal agencies, and these require a permit from the agency that regulates them. These include agriculture, alcohol, aviation, firearms and explosives, fish and wildlife, maritime transportation, mining, nuclear power, radio and TV broadcasting, and transportation. Small business owners in any of these fields must apply to the appropriate agency for a permit or license. Each agency has its own procedures and its own fees.

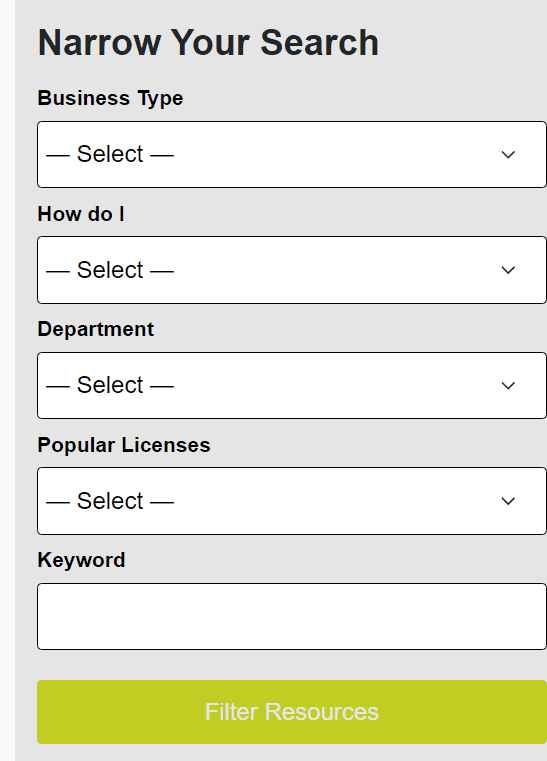

Iowa maintains a number of resources to help small businesses figure out which licenses and permits they must obtain. For example, there is a Business License Navigator that you can use to search for information about licensing using this search screen:

In the Business Type drop-down list, you can select Food Truck/Restaurant, Child Care Center Services, Professional Certification (CPA, Real Estate, etc.), Growth/Expansion, Vending Machines, or Construction/Contractor.

The How Do I list has options relating to starting a business. The Department list shows all Iowa departments that issue licenses and permits. The Popular Licenses drop-down lists common ones such as food service, nursing, and passenger transport.

You will need a tax permit for these tax types:

Another Licenses & Permits page allows you to search for businesses by license type, and it lists all the business and professional licenses issued by the state.

You can also contact the state for questions on licenses and other Iowa issues via phone, email, text, or chatbot, or simply by entering your question.

In addition to Iowa state licenses and permits, there are those issued at the county, city, and town level. These might include zoning permits, signage permits, and outdoor seating permits, among others. You will have to contact each local municipality where you plan to do business. Check with the local licensing/permit authority, call city/town hall, or look at the entity’s website to learn what is required.

If you are in a business that is regulated by a federal agency, you will have to check with that agency to learn what the requirements are. The Small Business Administration maintains an Apply for Licenses and Permits page that lists the affected business types. For each, it provides the name of the agency and a link where you can get more information and apply. These business activities include:

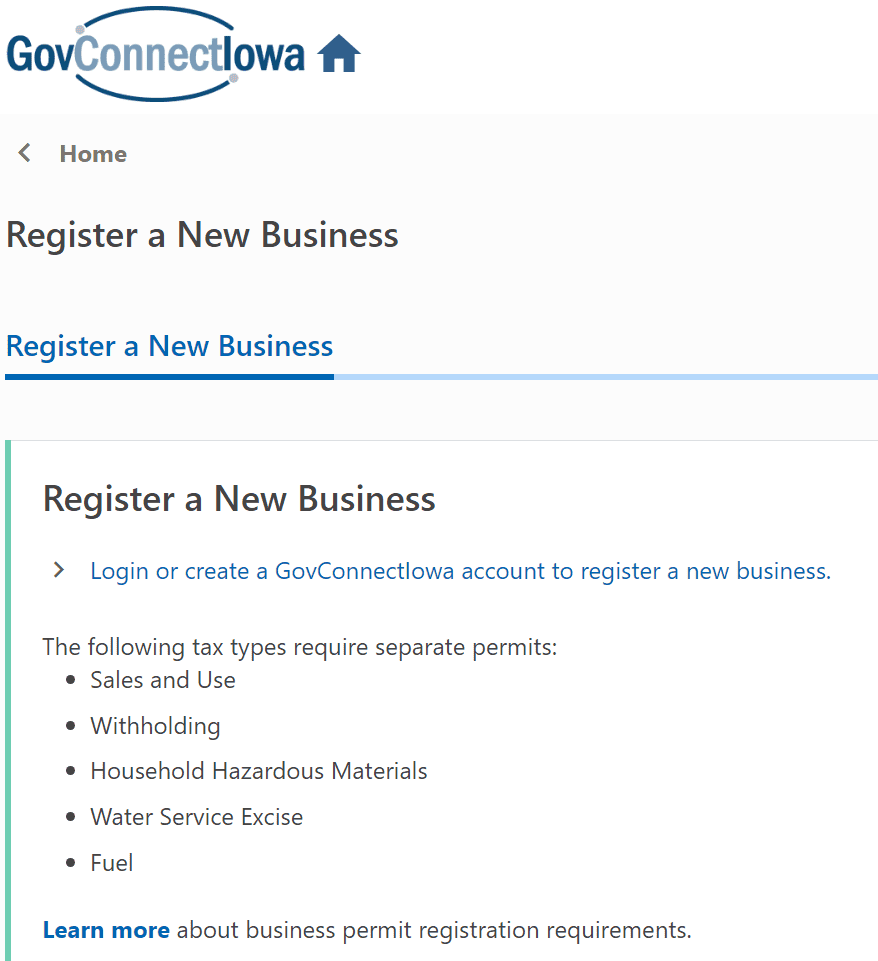

The first step is to register your business with the Iowa Department of Revenue by applying for the sales and use tax permits that you need. This, along with most other state-related business activities, can be done at the GovConnectIowa we page. You will have to create an account with a user ID and a password before you can actually navigate to the screen and fill out and submit the form.

Alternatively, you may complete Iowa Business Tax Permit Registration form 78-005 and mail or fax it to the Department of Revenue.

To secure other state licenses, you will have to submit an application to the department or agency that regulates your industry. Many of the applications are handled by the Iowa Department of Inspections, Appeals and Licensing (DIAL).

The application process for local licenses depends on the location. A large community such as Des Moines may have a web page with links for submitting applications. For smaller local authorities, it could require a call to the town hall or permitting agency to learn what the process is.

For each federal license or permit that you need, you’ll have to go to the relevant agency using the link provided on the Apply for Licenses and Permits web page. You’ll have to use the specific procedure that each agency uses, applying for the license and paying the required fee. For example, if you are in the broadcasting business, you’ll need to go to the FCC Consumer Information on Obtaining Licenses page where there are links for all the types of communications the FCC licenses.

As soon as you have completed the tax ID application process, you may begin collecting taxes. Your copy of the application serves as proof of registration until you receive a letter with your account number. The letter takes about six weeks. You can see the letter electronically at GovConnectIowa under View Letters.

Some but not all Iowa state and local licenses must be renewed annually. Holders of state licenses will receive a 70-day renewal notice. With local licenses, you should find out what the renewal requirements are when you apply initially. Some localities require that renewal applications be submitted 30 or 60 days in advance.

Securing all the required licenses and permits is one of the challenges an Iowa small business faces, but it’s not an insurmountable one. The information you need is available on government websites or by phone. If you proceed methodically and make use of all the resources listed here, you can start doing business with confidence that you have everything the federal, state, and local authorities require of you.

The consequences can be severe, because conducting business without proper licensing is a crime. Your business could be shut down either temporarily or permanently. You as an individual could be prosecuted under criminal charges.

You don’t need to register your sole proprietorship with the state, but you still must obtain any licenses and permits required by your line of business. Also, most cities and counties require a local business license.

It depends on the license. Many licenses are available for one-time registration and fee payment, while others must be renewed annually. Iowa will notify you when renewals are coming due.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands