For many entrepreneurs, self-employment is a way of pursuing their passion; for others, it provides an alternative way to build equity and financial resilience in a world of financial flux.

But every aspiring business owner needs a niche in an up-and-coming trend unique to this time.

So, if this is the year you plan on becoming an entrepreneur, you`ll need a list of inspirational self-employment ideas tailored for 2025.

We choose our business ideas because of their low startup costs, current demand, and high-profit possibilities. For some, you can begin with little or no experience; for others, you’ll need certification.

So, if you dream of being the boss, read on; your future awaits!

List of ideas:

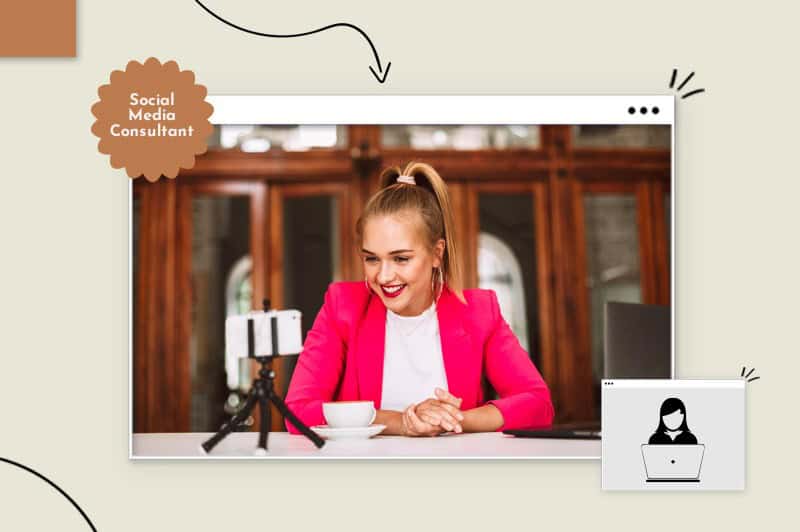

First on our list of business ideas is a service every serious brand needs: social management consultancy.

Social media consultants work with clients to improve and optimize their social media presence using target audience marketing techniques and strategic practices.

As expectations grow for brands to have a consistent social media presence, so does the demand for social media consultants. This growth makes social media consultancy a future-proof business idea, one you could eventually turn into a digital marketing agency!

Wages start at $15 per hour and rise to $250 depending on your experience, which includes technical skills, social media management, website development, digital product development, and SEO knowledge.

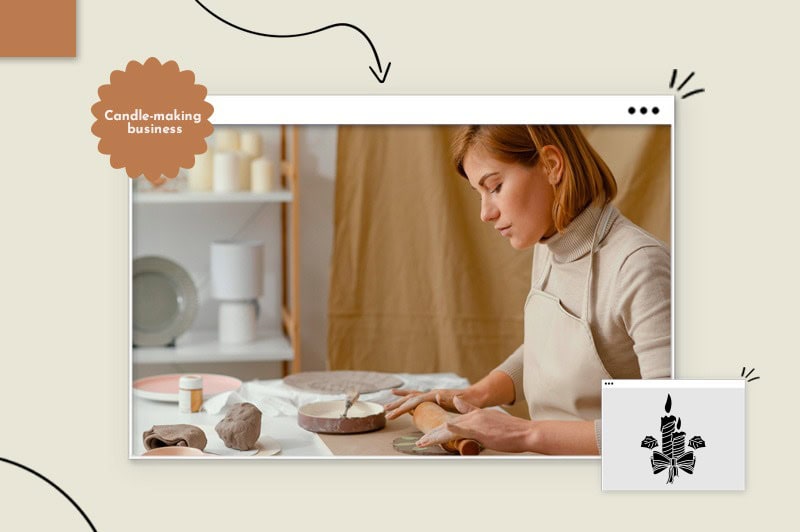

Number 2, on our top self-employment ideas for 2025, ticks several boxes, including low entry costs, high demand/profits, and no previous experience requirements.

And it’s a niche trending in the right direction!

The National Candle Association reports that the U.S. candle industry is worth $3.2 billion annually, and they forecast it to rise to over $5 billion by 2026, with an average profit margin of 200 to 300% per candle.

You can start a home-based candle business as a sole proprietor for as little as $1,000. Then, grow your business relative to demand using your profits and protect your assets by forming an LLC.

The good news is you can learn to make candles on YouTube and using online classes.

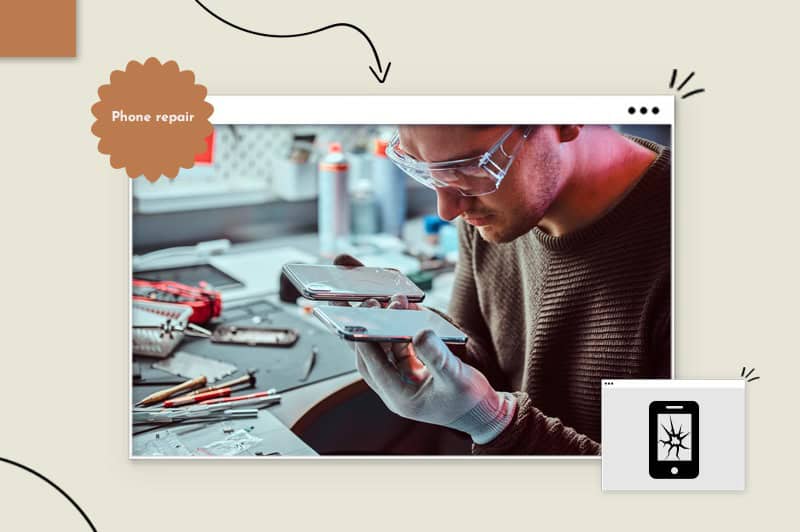

What do 97% of Americans have in common?

Yup, cell phones, with 310 million smartphones currently in circulation. And with 66% of people breaking their cell phones annually (over 204 million needing repairs), this business idea is always in demand!

The phone repair business idea makes our list of top businesses to start in 2025 because the market size of the U.S. cell phone repair industry was $3.8 billion in 2023. And it suits entrepreneurs with no previous experience, and you can reduce your startup costs by starting a pickup and drop-off service.

To become a cell phone technician, you’ll need some technical abilities and computer competencies, which you can get by taking a cellphone technician course.

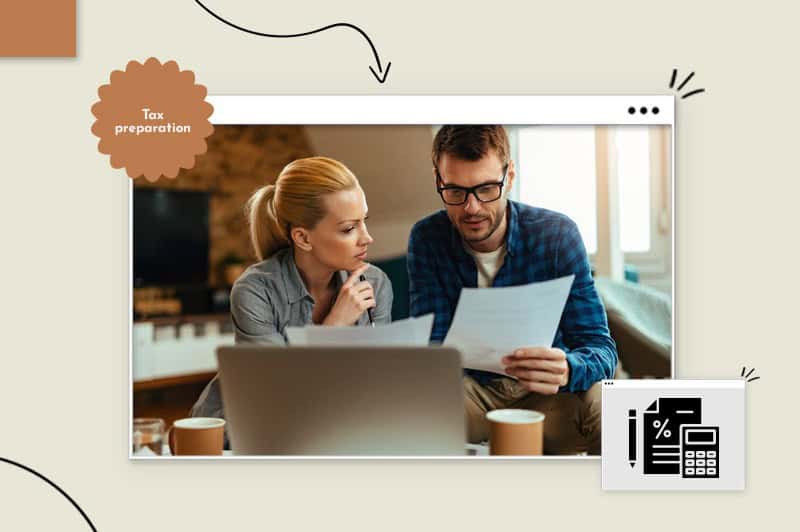

As the saying goes, “Only 2 things are certain in life: death and taxes.” And as most business owners need to file quarterly and annual tax returns, this is one business idea every entrepreneur needs.

Tax preparers complete client tax forms for submission to the IRS, ensuring they comply with federal, state, and local tax laws.

To start a tax preparer business, you’ll need a high school diploma, pass a suitability check, get a professional certification, which you apply for on the IRS website, and a tax preparation license in your state.

Food lovers with previous experience can start a catering business and serve numerous events, like weddings, parties, and business.

Catering businesses work in 2 ways:

Catering startups can expect to earn around $30,000 per year, whereas established businesses often generate profits of over $80,000.

To start your catering business, you’ll need several licenses and permits, such as a food safety certification or a food service permit.

Review the U.S. FDA department’s list of regulations and codes for food service regulations in various states.

Contact the Small Business Administration (SBA) for guidance on catering rules in your state.

Catering makes our list of Top self-employment ideas for 2025 because you can start your catering business from home, hire a commercial kitchen space when needed, and scale your catering business by opening a food truck, cafe, or restaurant as you grow.

Entrepreneurs who want to start a home business can turn their property into a profitable source of income.

As an Airbnb host, you can rent various properties, like an unused room, convert a garage/shed into a mini-apartment, an entire house, or an old airplane. And anywhere, from a bustling city center to a quaint country village.

And it’s a property’s uniqueness that appeals to the Airbnb audience, so all you need is some imagination.

Airbnb reports that the average host’s income is $924 per month. However, some super hosts with multiple properties can earn over $10,000!

To start your Airbnb business, create an Airbnb account, abide by your area’s STR (short-term rentals) regulations, identify your target audience, implement a pricing strategy, provide your listing information, and upload quality pictures.

Starting a cleaning business is an excellent option for a first-time entrepreneur because startup costs are low, and besides some commercial cleaning niches, you don’t need special training.

To start your cleaning business (depending on your state), you’ll need specific licenses, such as a service contractor license, a local business license and permit, and a cleaning business license.

And various niches are available, from residential home cleaning to outdoor work like window or gutter cleaning, power washing, roof cleaning, or soft washing; let’s look closer at that last one more before moving on to our next Top self-employment idea for 2025:

Soft wash is like pressure washing but uses chemicals and low-pressure washing to clean areas like roofs, shingles, windows, and other delicate materials.

Any location with properties built using shingle roofs and walls with a high moisture level, causing moss, algae, and lichen to form, needs this service. And it’s profitable, with a median income of $100,000 per year!

You don’t need any previous experience to start and can buy a 2nd hand truck and soft wash equipment.

Aerial photographers take photos and videos using drones. And the sky’s the limit, with private and commercial clients needing this service, including real estate, farming, construction, advertising companies, sports events, films, weddings, and more.

Reports show that drone pilots earn from $75 to $250 per hour, and with an average investment of $7K with no previous experience requirements, aerial photography flies high on our list of the Top self-employment ideas for 2025.

To start your aerial photography business, buy a quality drone, register it, and get drone insurance.

You’ll also need a Certificated Remote Pilot license and, depending on your location, a general business license. And check your state and federal regulations governing drone usage.

Regarding Top self-employment ideas for 2025, Print-on-demand is an excellent option for entrepreneurs wanting to start a business from home with low investment and high-profit possibilities.

The POD business model enables you to generate an income with minimal investment because you only pay for what you sell, removing the need for up-front inventory and management costs.

Here’s how it works:

Industry experts report an expected 26.1% annual growth rate until 2030, with an estimated monthly income of $4,639 in 2025.

Okay, those are our Top self-employment ideas for 2025, but to start a business, you often need helpful resources, which you’ll find below.

Many government organizations, marketing platforms, and customer relationship management platforms (CRMs) provide support, resources, and online tools to help entrepreneurs grow their businesses.

Most websites contain actionable information you can use (with just a few clicks) to help start your business today.

The Small Business Administration (SBA) helps American entrepreneurs start and grow their businesses by providing informational resources and SBA-backed funding opportunities.

Check out SBA’s Business Guide, which covers crucial aspects of running your business, and discover possible financial opportunities from the SBA sources for funding your business guide.

Small Business Development Centers (SBDC) offer low-cost training and free consulting to America’s small business owners and aspiring entrepreneurs, regardless of their stage of development or location.

With almost 1,000 local district offices, the resources you need are only a short step away.

Possibly the world’s leading cloud-based customer relationship management (CRM) tool, HubSpot offers dozens of free and paid courses, including the HubSpot Academy, which has ongoing team education for department managers, supervisors, and employees, which, upon completion, provides badges you can display on your website.

The IRS Small Business and Self-Employed Tax Center answers every business tax question and provides free resources for SMBs (with assets under $10 million) and taxpayers filing Form 1040 or 1040-SR.

Ideas are great, but executing those ideas is everything.

Eventually, every aspiring entrepreneur must jump from their comfort zone, like leaving a $ 50,000-a-year salary, learning a new skill, or working weekends!

Sure, it’s difficult moving from that state of comfort but seeing your baby come to life, that thing that was your idea out in the world, and making a profit is worth everything.

As Mark Twain said, “The secret of getting ahead is getting started.”

Just remember to validate your idea using a business plan before investing.

Choose a viable business idea, select the proper structure for your startup, register for a business license (this can be state, local, or both), get an EIN, set up your business banking, register for state and federal taxes, create your financial record-keeping system, and get business insurance.

The answer depends on your chosen business structure.

Entrepreneurs using a pass-through taxation business structure, like a single-member LLC or sole proprietorship, use the IRS form Schedule C to report their income and expenses by subtracting their business expenses from their income to get a self-employment net profit, which they report on their personal income tax return.

As of Jan 2025, the self-employed average hourly pay rate in the USA is $15.54.

How much is self-employment tax in the USA?

The IRS’s self-employment tax rate is 15.3%, which comprises 2 parts: 2.9% for Medicare and 12.4% for social security.

Those are our Top self-employment ideas for 2025; we hope one or 2 have given you food for thought and go on to inspire you to take the next step on your entrepreneurial journey.

Finally, once you settle on a business idea, learn how to start a business to ensure it’s viable and suits your business goals and lifestyle.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.

Products

Resources

©2025 Copyright Tailor Brands