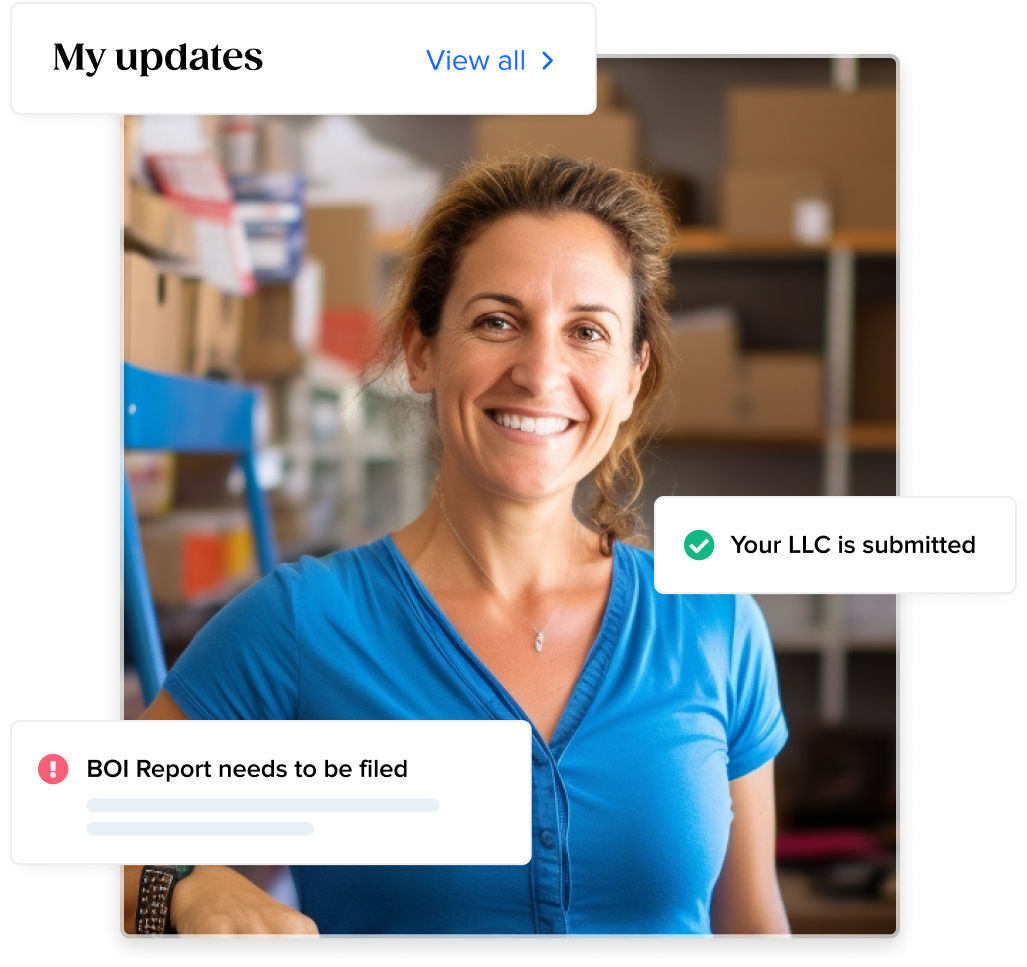

Our BOI report filing service will help you comply with the Corporate Transparency Act and report your beneficial ownership information

Our BOI report filing service will help you comply with the Corporate Transparency Act and report your beneficial ownership information

As recommended by our affiliate partners*

*our affiliate partners may receive financial compensation for their support.

Business owners are required to provide comprehensive information about their beneficial ownership starting January 1, 2024.

This is a new requirement by the Corporate Transparency Act (CTA), a federal law designed to prevent the misuse of companies for illicit activities such as money laundering, terrorism financing, tax fraud, and other financial crimes.

It achieves this by mandating certain businesses to file a BOI report in which they disclose their “beneficial owners” to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

The CTA primarily affects small businesses that are formed under the laws of a U.S. state or territory, or foreign businesses registered to do business in the U.S. larger companies, nonprofits, and many other entities are exempt, as they are already subject to similar reporting requirements.

While the Corporate Transparency Act has broad implications, it’s important to note that not all entities are required to comply with its reporting requirements. The Act provides a list of exempt entities, which typically already provide information to a regulatory authority.

These include, but are not limited to:

The CTA defines a beneficial owner as an individual who, directly or indirectly, exercises substantial control over a company or owns or controls at least 25% of the ownership interests of that company.

This definition excludes minor children, nominees, intermediaries, custodians, and employees whose control is derived solely from their employment status.

Small business owners must understand their obligations under the CTA and take the matter of filing the Beneficiary Ownership Information report with extreme caution.

It’s important to understand that in cases where the reporting owners or the business change its address, ownership, or any other information that was previously reported, an additional BOI submission then must be filed according to the federal deadline of 30 days.

FinCEN, the agency responsible for collecting and analyzing information about financial transactions to combat domestic and international money laundering, terrorist financing, and other financial crimes, plays a pivotal role in the implementation of the CTA.

All the information reported in the BOI will be maintained by FinCen and will be disclosed only upon receipt of a request from a federal agency engaged in national security, intelligence, or law enforcement activity.

FinCEN is committed to safeguarding all information reported under the CTA and has strict protocols in place to prevent unauthorized disclosure.

By understanding and complying with the CTA, your business can stay ahead of the curve and can get back to business as usual, once your BOI report is reviewed and filed.

File your BOI and avoid $500/day in civil fines

Whether you’re already in business or just getting started, our revolutionary

business-building platform connects all the tools needed to build a successful business and provides personalized guidance.

Products

Resources

©2025 Copyright Tailor Brands