Home » How to Start a Small Business » Start a Business In Nebraska

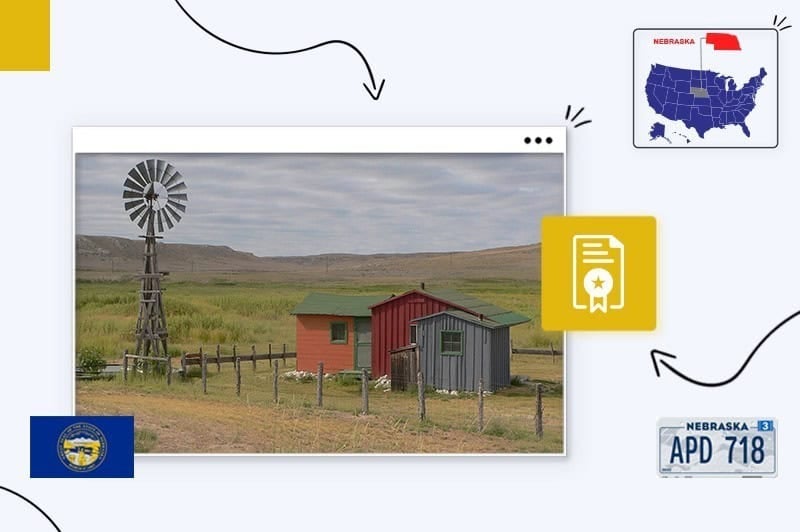

We know Nebraska for its high quality of life, expansive farmlands, vast prairies, and endless skies.

But Nebraska’s business-friendly environment makes it ripe for entrepreneurs.

For instance, the Cornhusker state’s small business tax incentives and government grants, low business costs (8% below the national average), attractive real estate prices (18% below the national average), affordable utility costs (13% below the national average), and a bustling job market all combine to make Nebraska a great place to start a business.

And despite its sparse population (smaller than Houston), Nebraska offers aspiring business owners (like you) the opportunity to enter a competitive niche and pursue their entrepreneurial dreams.

But to start a business in Nebraska, you must take specific steps, like complying with the state license and permit regulations, federal and local tax laws, insurance requirements, and payroll rules.

Starting a new business can seem daunting, especially if this is your first time, our guide is here to help you navigate the in and outs of the process without losing your cool.

Let’s walk those steps together and kick-start your new Nebraska business.

The steps:

Fine-tune your business idea

Create a business plan

Choose a business name

Choose a business structure

Set up Banking, Credit Cards, & Accounting

Get Funding for your Nebraska business

Get Insured

Obtain Permits & Licenses

Find your team

Market & Grow Your Business

Open the doors!

Your first step in starting a business in Nebraska is choosing a viable business idea that’s affordable, profitable, scalable, and suitable for your needs.

You prove the first 3 using strategies that calculate your startup and running costs, projected profits, market size, and the percentage of customers you hope will become clients.

But it’s the last one that’s crucial (you) because when you start a business in Nebraska, it becomes an integral part of your life, so it must suit how you want to live.

Also, consider your skills, experience, financial capabilities, natural abilities, interests, and personal goals when validating your idea because those are the ingredients that make a successful business.

Okay, let’s look at how you validate your business idea.

Validating your idea helps confirm it provides a need or solves a problem for a significant enough audience willing to pay your asking price.

All pretty important, right?

And it does it by answering questions like:

You’re probably asking, where do I find that information?

The answer is in your business plan, which we’ll look at next.

But what if you need a business idea?

No worries, here are some that suit Nebraska.

Okay, now for your business plan:

A business plan has 3 purposes: to validate your idea, outline how you’ll achieve it, and convince others to invest.

Plans come in 2 forms: Traditional and one-page, and which you use depends on your needs and goals.

Both include 3 crucial sections:

MR gathers, analyzes, and interprets information about your chosen business idea to learn about its market trends, your prospect’s buying habits, and your competitor strategies to ensure your niche is viable.

Market research uses specific strategies to gather this info; you only need to learn how to read and apply it, and then you can create your marketing plan.

Your MP contains how, when, and where you’ll promote what you sell to your target audience, and you create your marketing plan using the results from your market research.

The depth of your M.P. depends on the market you’re entering but often includes your advertising strategies (online or traditional), promotional platforms (website or Facebook, etc.), and time-sensitive objectives (when and or how long you’ll run specific promotions).

Now, let’s talk about money.

The F.P. section of your business plan ensures your idea is financially viable by calculating your startup and running costs (fixed and variable). It also contains your expense budget, cash flow projections, balance sheets, and revenue forecasts if you need external funding.

The correct location is essential for your business success for several reasons, especially if you rely on a high-footfall of passing traffic like the retail or food industries.

Other aspects to consider when choosing a location are your target market, visibility, customer access, necessary resources, costs like utilities and rent, and zoning requirements.

Nebraska zoning laws regulate which businesses operate in specific locations and can include high-streets to home-based businesses.

Zoning laws also exist to preserve our green spaces, control pollution, and enhance town developments.

Laws and regulations vary throughout Nebraska at city and town levels, so contact your local planning or zoning department for further information.

Choosing an online-only business depends on your niche, like providing a consultancy service via your website or selling products on a platform like Amazon or Etsy. However, most brick-and-mortar businesses also need an online presence to promote their brand and enable prospects to find them.

To create a successful online presence, you might require:

Choosing a catchy and unforgettable name is crucial for any small business owner (on or off-line) as it conveys your brand’s purpose and attracts your target audience.

Your business name should suit your niche and brand personality, be available as a domain, and connect with your client’s emotions.

Luckily, strategies exist to craft a business name that nails all these aspects.

Once you have a name, check trademark availability on the United States Patent and Trademark Office (USPTO) website to claim ownership throughout the U.S.

Your last step when choosing a business name is ensuring it complies with Nebraska’s naming requirements.

Every U.S. state has specific business naming requirements; in Alabama, these include:

For further information, see how to start an LLC in Nebraska and ensure you comply with Nebraska’s naming requirements.

You can reserve your chosen business name for 12 months (costs $15) by filing an Application for Reservation of Name with the Nebraska SOS.

Non-legal entities like sole proprietorships, general partnerships, and legal entities like LLCs can register a Doing Business As (DBA) to trade using a brand name different from their own or registered business name by filing a Trade Name Application with the Nebraska Secretary of State (SOS).

Business structures (the entity you run your brand under) come in 2 forms, informal and formal:

Every business structure has pros and cons that affect your legal responsibilities and tax obligations. The correct structure for your startup is the one that aligns with your business needs and goals.

Let’s explore which suits you:

All the mentioned business entities use the pass-through tax structure, directing profits and losses to owners or shareholders, who report them on their tax returns (avoiding double taxation at a corporate level).

S corporations enjoy an extra tax advantage where shareholders can receive tax-free dividend payments and their taxable wages.

An LLC may offer additional tax advantages, read more about this in our guide.

Regardless of your business type, a dedicated business account and credit card can help streamline your bookkeeping by tracking your income and expenses.

But there are other reasons your business might need them, especially if you form an LLC.

Maintaining separation between business and personal finances is crucial for legal entities like LLCs and S corporations to uphold the corporate veil and keep liability protection.

But all business structures can benefit from a separate bank account as it simplifies their bookkeeping and projects a professional appearance to clients and vendors.

You’ll need an Employer Identification Number (EIN) to open a business account in Nebraska.

When you start a business in Nebraska, a business credit card can help you in several ways:

Credit cards help separate your personal and business finances.

Convey a professional image.

Provide a credit line when you need it most.

Increase your business credit rating, which can reduce the cost of a business loan.

With accounting, size doesn’t matter because every business needs a system that tracks its income and expenses to ensure tax compliance, including payroll, local, state, and federal.

While you might need an accountant to file those taxes for your business, you can use accounting software that integrates with your new business and credit card accounts for your daily bookkeeping tasks.

Most of us need funding to start a business in Nebraska, and many options are available.

But before you borrow, calculate your business running costs and profit margins to ensure you can afford the repayment terms because a lack of cash flow puts 82% of startups out of business.

Your Nebraska funding options include:

New and existing Nebraska business owners can access many state grants and funding incentives to help relocate, start, and grow their brands.

Grants are non-repayable cash amounts states and cities give to businesses that meet specific requirements. Incentives are often tax deductions to encourage growth after you open your business.

Nebraska Grant and Incentive providers include:

The Small Business Administration (SBA) supports small business owners throughout the USA by supporting every part of their entrepreneurial journey, including SBA-backed loans with lower interest rates and longer repayment times than other lenders.

Business insurance protects your company and private assets, shielding against unforeseen disasters like personal injury lawsuits or natural catastrophes.

Common types of business insurance include:

Workers’ compensation is mandatory for Nebraska employers with employees part or full-time, ensuring coverage for expenses related to employees’ work-related injuries.

When you start a business in Nebraska, you might need federal, state, and local government permits and licenses to operate in your jurisdiction.

The permits and licenses you need depend on your niche, marketplace requirements, and locality.

Below are links to the federal, state, and local license and permit departments to determine which ones you need for your business:

All U.S. states have regulations businesses must follow; in Nebraska, those include:

Pro tip:

To register for sales tax and withholding tax, use Form 20, Nebraska Tax Application.

Every innovative idea needs a team of skilled individuals to make it a business.

Even if you’re a solo entrepreneur, finding people who can help you is imperative when starting a business in Nebraska.

But depending on how you hire, you could incur Nebraska’s hiring and payroll regulations.

Let’s look at both next:

Your employees are the face and heart of your business; some provide your service or customer care, while others run your online marketing strategy or tend to your quarterly tax returns.

So, you need a diverse team who can provide the skills you require to make your business tick.

The easiest way to find your team without hiring multiple employees is to outsource professionals (like freelance content creators), hire a local tax accountant on retainer, or employ contractors on a project basis.

All 3 options have several advantages; you avoid the cost of hiring employees, benefit from their experience, and use them on a need-only basis.

If you employ full or part-time in-house workers, adhere to the following correct hiring procedures:

Some of these are below:

The Cornhusker state payroll regulations ensure employers treat employees fairly and follow state and federal rules.

Once you’ve got your team, use payroll software to track their work hours, issue paychecks, and streamline your Nebraska state and federal tax returns.

When you hire full/part-time employees or independent contractors, you must set up your payroll system to withhold payroll taxes, file your state and federal tax returns, and pay them.

To do so, you’ll need:

Contractors provide skills many small business owners need but don’t have. And as they’re self-employed, you avoid the costs of employing staff!

However, you must classify contractors correctly and verify their valid Nebraska contractor license.

We build memorable businesses around a brand that encompasses what it stands for and engages its audience’s emotions, using specific marketing techniques to gain their trust.

To achieve that, you need a brand identity that captures their imagination.

Fortunately, several low-cost marketing strategies are available for new business owners on tight budgets. All they need is some innovative thinking, time, and patience.

Your established competitors already have your target audience’s trust and attention. To claim your slice of the market pie, you need sales strategies that engage your prospect’s interest and motivate them to try your brand instead.

One such strategy is special offers:

The quickest way to promote your brand and gain your target audience’s trust is to collaborate with an established business that serves the same audience while providing a complementary service or product.

For example, a wedding planner could partner with a well-known wedding photographer, as both serve the same clients while offering different services (and gaining trust through association), increasing their chances of landing clients.

Word-of-mouth marketing (WOMM) is the most potent form of marketing because it involves real people (your customers) recommending your brand to others who trust their opinions.

To encourage WOMM, you must invest in your customers’ satisfaction by putting them first and ensuring your service or product fulfills their needs.

Reviews can make or break your business, which applies to brick-and-mortar brands as much as e-commerce.

Check these stats out:

So, whether you sell on Amazon or run a coffee shop, ask your customers to review you at every opportunity and make it easy for them to do it.

Everything your target audience sees or hears about your brand is content marketing, and its purpose is to convince them to buy from you, so it must send the right message.

Here’s how to create content that speaks your prospect’s language.

And that’s how to start a business in Nebraska; now it’s time to open your doors and make your first sales.

An excellent way to ensure people know you’re open and engage their interest is to throw a launch event.

And any type or size of business can do it.

For example, a new local butcher could throw a free community BBQ or a clothing boutique could host a fashion catwalk with complimentary prosecco and canopies.

Here’s how you can ensure its success:

Throwing a grand opening event is a great way to make a positive first impression with your community and target audience.

Launch event 7-step plan:

Purpose: Design your event around what you want to achieve, whether creating community awareness, meeting possible brand collaborators, or just having fun.

Venue: Use a venue that suits your event aim and your brand’s style to create a comfortable atmosphere.

Promotion: Advertise your launch event everywhere your target guests can see it, including other related businesses, local media, and online.

Activities: Make your event fun and exciting using interactive activities that engage people’s imagination so they remember the event (and your brand).

Branding: Use various branded materials to familiarize guests with your business.

Opportunities: Use your launch event to learn more about your prospects and community and for them to learn about you.

Moments: Capture your event with photography and video and promote it across your marketing platforms to increase brand awareness.

Your launch event is also an excellent opportunity to make your first sales and collect your future communities’ email addresses by offering special promotions.

Zero, as Nebraska doesn’t implement a state business license. But you might need one locally, and as every county differs in license and permit fees, you must contact your town clerk’s office for further information.

The answer depends on your niche and where you’ll run your business. However, most new businesses must register with the Nebraska Department of Revenue (DOR) and need specific licenses/permits to operate.

It costs $100 to file for a trade name (DBA or “doing business as“) in Nebraska. And if you’re forming a separate entity (like an LLC), name registration is part of the total registration fee.

It costs $100 to register your LLC Articles of Organization online with the Nebraska Secretary of State office.

And that’s how to start a business in Nebraska.

Sure, it may seem like a lot of work, but anything worth achieving is, right?

The key is taking your first step and building momentum as your business grows because optimizing a modest start is easier than trying to begin perfectly.

If needed, start small and get into the mix; odds are, you’ll learn loads and realize you don’t need to have everything figured out to start a successful business in Nebraska.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness.

Products

Resources

©2025 Copyright Tailor Brands