New Jersey residents say the best things about New Jersey are the low crime rates, booming job market, and high quality of life.

And for good reasons.

The Garden State ranks 5th in WalletHub’s happiest states in the country and 4th for best healthcare in the US.

And it suits start-ups, ranking 1st in CNBC’s 2023 most-improved state for business.

In the current financial climate, more and more people are turning to side businesses or full time entrepreneurship to bolster their financial resilience, and this trend is only expected to increase in coming years.

But as with all the US states, you must take specific steps to start a business in New Jersey.

For any aspiring business owner, making the first steps of starting your own business can be daunting. In this article you’ll find a step by step walkthrough of all the key points to keep in mind when starting and growing your dream business.

So, if you are ready, let’s go on and learn how to start a business in New Jersey:

- Fine-Tune Your Business Idea

- Create a Business Plan

- Choose a Business Name

- Choose a Business Structure

- Set up Banking, Credit Cards, & Accounting

- Get Funding for Your Texas Business

- Get Insured

- Obtain Permits & Licenses

- Find Your Team

- Market & Grow Your Business

- Open the Doors!

Step# 1. Fine-tune your business idea

Entrepreneurs dream of owning profitable businesses and gaining control of their life. Allowing us to make brave decisions, follow our intuition, and own our victories and failures.

It’s a liberating experience, even the failures; trust me, I know!

But to achieve this independence and profitability, you must be self-aware, fast, and happy when choosing your business idea.

Why?

Because self-awareness ensures you don’t waste time on a lousy business idea (know your skills, strengths, and interests). Speed grabs your opportunity before someone else. And happiness in your work will motivate you to continue through tough times.

If you already have your business idea, great; if not, here are some ways to find one.

How to develop a business idea in 4 simple steps:

- Use your experience: Use your skills and strengths and choose an idea you can become an authority in.

- Pick a product or service: Most businesses provide either products or services, so that’s where to start. Are you going to sell a product or a service?

- Solve the problem: Next, find a problem with existing products or services you can fix that brings value to your target audience.

- Serve your Niche: Adapt your idea to serve the New Jersey public and your target audience’s needs.

Validate your business idea:

Whether you’re selling food truck Hoagies to bennies down the shore, Moz to local restaurants and delis in Hoboken, or vintage clothing on Bloomfield Ave in Upper Montclair. You’ve gotta ensure folks want what you’re selling!

Validating your business idea is part of your business plan, and the better you do it, the fewer chances you’ll take.

Your goal is to determine:

- The level of demand for your idea in New Jersey.

- Who your target market is?

- Who are your competitors, and if you can compete with them?

- And identify why your idea is better than what’s already available.

Step# 2. Create a business plan

Your business plan synthesizes crucial information from different sources, like:

- Your market analysis.

- Sale plan.

- Management organization.

- Product or service description.

- Competitive analysis.

Infusing them to develop a solution (tell a story) to reach your goals and convince others to buy into your business idea.

For example:

Market research

You use this to find your target market size, identify your competitor’s authority and see if your idea is rising in popularity or deflating like an old helium balloon.

And help you develop a marketing plan outlining strategies to engage, attract, and convert people into loyal brand advocates.

Marketing plan

Your marketing plan contains all the strategies you’ll use to put your brand where your target audience can see it, including implementation timelines and budgets.

Financial plan

Your financial section confirms whether your business idea is financially viable to ensure you can afford the start-up and running costs and, if necessary, convince others to invest.

A financial plan has 5 statements, including analysis:

- Income statement.

- Cash flow projection.

- Balance sheet.

- Shareholders’ equity statement.

- Financial projections.

The 5th is so investors can see what revenue you expect and how quickly you’ll earn it.

Choose a location

The Garden State teems with diversity, from natural wonders, nature reserves, and beautiful beaches to world-famous cities and thriving small towns, so it suits many niches.

Your perfect business location depends on your idea and whether you’ll rely on a passing trade like retail and restaurants, bring your service to your customers or sell online.

Other considerations are price and zoning laws.

New Jersey zoning laws and regulations:

Zoning laws determine which businesses can operate where throughout NC and include regulations for health and safety, fire certificates, building use, signage, and waste removal.

Even home-based businesses like catering and mobile ones like food trucks must comply, and each county and city sets its rules.

Contact your county clerk’s office or the relevant municipal department to learn about zoning laws and regulations.

Decide if you’re an online-only business

Starting an online business is one way to reduce your start-up costs and avoid zoning laws.

Many entrepreneurs start online and progress to a brick-and-mortar store relative to demand, so keep that in mind when deciding.

If starting an online business, you’ll need:

- A website: No matter the size, online businesses need a website, domain, business email address, and logo. And thanks to cool software tools, you can quickly get all 4 with Tailor Brands.

- Social media presence: Connect with your target audience on their preferred platforms to engage their interest and gain their trust.

- Supply and distribution plan: Selling products? Then you’ll need a supply and distribution plan to meet your sales obligations.

Note:

Tax laws vary depending on your type of business, and most states have specific regulations regarding selling online. We’ll look at those a little later, but first:

Step# 3. Choose a business name

Shakespeare wrote the adage, “A rose by any other name would smell as sweet.” This might be true for roses, but not for your business name.

Your business name must convey who you are, what you offer, and why your brand is sweeter than the rest.

An example of how it works.

- Have you heard the slogan “It does exactly what it says on the tin?” It was a UK advertising campaign for the “Ronseal wood stain brand” that had such a powerful connection with its audience it became a colloquialism for an “accurate description of a brand’s qualities.”

It’s simple, right? And that’s why it’s powerful.

And you choose the right name for your business by following similar guidelines:

- Branding: Your business name should suit your product or service; this doesn’t mean it must say what you sell (trademark rules won’t allow that), but it must convey the essence, like PayPal, Airbnb, or Ronseal.

- Memorable: Those previous names are memorable because they’re short (2 – 3 syllables), catchy, and relevant to their service.

- Domain: Ideally, you want your business name as a .com domain to build your online presence; however, sometimes, other TLDs (like .org or .net) work just as well, or you can add a verb, like www.getcottoncandy.com

- Trademark: Get a trademark from the USPTO to stop others from using your business name.

New Jersey naming requirements:

- Separate business entities (LLCs and corporations) must ensure their name is unlike any other filed with the New Jersey Department of Revenue and Enterprise Services (DORE).

- LLCs and corporations must include specific identifiers (like LLC/limited liability company or Corp/Corporation).

- You can check name availability using a business entity name search on the DORE website or using the Name Availability Search tool.

- And reserve a business name (with the New Jersey DORE for 120 days) by filing an Application for Reservation of Name.

Sole proprietorships and general partnerships don’t register a business name with the NJ Secretary of State’s office when forming (they use their names). Still, they can use a catchy brand name by filing a Doing Business As.

Using a DBA in New Jersey:

Known in New Jersey as a fictitious name, a DBA enables all businesses to use a name that suits their branding, is memorable, and is available as a domain by filing a Registration of Alternate Name for a $50 fee.

Step# 4. Choose a business structure

A business structure describes your business setup; you can do it in 2 ways formal and informal.

Formal structures include limited liability companies (LLCs), limited liability partnerships (LLPs), and corporations, which are separate entities from their owners.

Informal structures include sole proprietorships and general partnerships, not separate from their owners.

Here’s how they work:

Common types of business structure

- Sole proprietorship: You don’t register your business, are one entity, own 100%, receive all profits and losses, and are liable for debts and litigation.

- Partnership: Same as a sole proprietorship but with 2 or more partners who receive profits and liability relative to their percentage ownership.

- Limited liability company: Two types exist, single and multi-member. LLC owners (members) register with their state, are separate entities, and have liability protection against the LLC’s debts of litigation.

- S corporation: A more complex structure with shareholders and sellable stocks. The S corp is the most popular corporation with SMBs, as it’s a separate entity that provides liability protection but uses a simple tax structure similar to LLCs and sole proprietorships.

Tax advantages of each option

All use the pass-through tax system, meaning the profits and losses pass to the owners (in LLCs, its members, and S corps shareholders), who report their liability on their tax returns.

The advantage is avoiding corporation tax, which can be as high as 9% in NJ.

An S corp has further advantages, like shareholders receiving tax-free payments known as dividends, and the corporation pays half their self-employment tax liability.

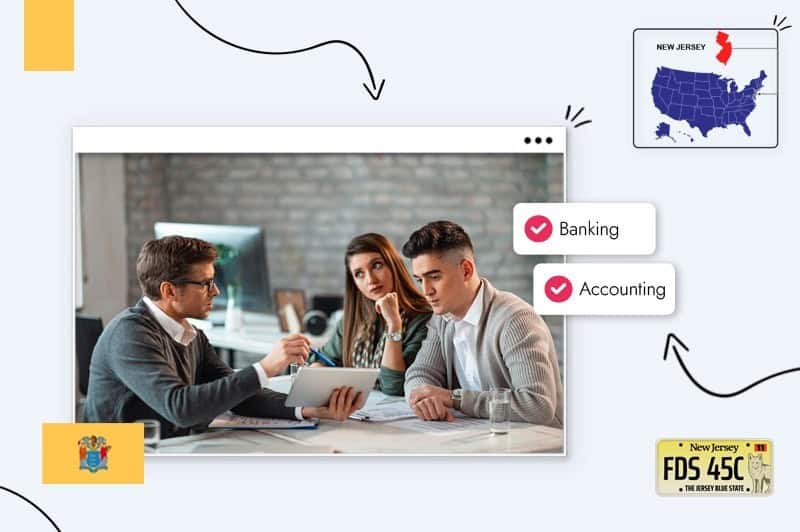

Step# 5. Set up banking, credit cards, & accounting

There’s a checklist of necessities most businesses need to start and run efficiently; banking, credit cards, and accounting are on that list.

And even though informal entities don’t need them, they can benefit from using them.

Business banking

Formal entities (LLCs and corporations) must have a business account to avoid breaking the corporate veil (mixing business and personal income) and keep their liability protection.

A business account also simplifies bookkeeping (you can see your debits and credits), which is crucial for balancing your accounts come tax season.

Business credit card

Credit cards also help simplify bookkeeping and give your business a professional look when dealing with vendors.

Another advantage is a credit card account can help build your business credit score and improve your chances of getting a business loan.

Business accounting

Accounting comes in 2 forms: daily/monthly bookkeeping duties, which you can easily do using accounting software that integrates with your business accounts.

And quarterly/annually, where you file quarterly estimated and end-of-year returns, and for those, you might need the help of an NJ tax accountant, especially for payroll taxes.

Step# 6. Get funding for Your New Jersey business

Your business structure determines what type of funding you can get; for instance, banks rarely lend to start-ups without collateral or stocks, like S Corp.

Even LLCs without a proven credit history can find traditional loans hard to get; fortunately, you have other options:

- Bootstrapping: You self-fund your business and reinvest every dime until it makes a profit and can take a wage, which often involves living off your savings.

- Friends and Family: An interest-free option (usually) where you borrow from friends or family members who believe in your idea.

- Small Business Loans: The traditional funding approach is borrowing from your local bank and repaying over a set period plus interest.

- Crowdfunding: Born from the 2007/8 financial crash, crowdfunding platforms enable budding entrepreneurs to pitch their idea with the hope enough people will invest.

- Small Business Grants: The holy grail of SMB funding, and just as elusive, SMGs are non-repayable funding from local authorities to help stimulate the economy and create jobs.

- VCs and Angel Investors: Don’t confuse Angel with fairy God Mother, as these investors fund a percentage ownership share. VCs invest in larger corporations and take some operational control. In contrast, Angel investors fund SMBs and take a silent partner approach.

New Jersey grants and state incentives:

NJ businesses can apply for state incentives or grants to support their growth.

- New Jersey small business grants: List of 2023 NJ grant opportunities.

- NJM blog: Popular NJ blog provides information on recent grants and deductions to help small businesses grow.

- NJ Treasury: Information on business incentives and tax credits.

- NJ Economic Development Department (NJEDA): Provides low-interest financing through variable or fixed-rate loans, loan participations, and guarantees.

When applying for tax credits or state grants, first get a business registration certificate (BRC) from the New Jersey Division of Revenue.

New Jersey Small Business Administration (SBA):

The SBA New Jersey division assists small businesses in getting funding (business loans) from SBA partners, often with longer repayment terms and lower interest.

Angel investors:

The New Jersey Angel Investors is a directory with over 5000 investors that fund businesses in the Garden State.

Step# 7. Get insured

Insurance helps reduce some risks when starting a business in New Jersey, and some policies are optional while others are not.

The most common forms of business insurance are:

- General liability insurance: Also known as slip and fall insurance, protects against workplace injury claims and client property damage.

- Professional liability insurance: Covers professionals providing advice against claims of errors, omissions, and negligence.

- Business interruption insurance: Assists with income expenses and losses when unable to run your business because of illness, fire, or other disasters.

- Commercial property insurance: Covers costs of damage or theft to equipment and property.

- Umbrella insurance: An extra insurance policy covering expenses beyond your existing business insurance.

New Jersey-specific insurance regulations:

NJ businesses with employees must have 2 types of insurance.

- Workers’ compensation: Employers of part and full-time employees must get worker’s comp to cover medical costs and disability benefits should an employee get injured at work.

- Commercial auto insurance: All work vehicles in NJ must have commercial auto insurance to cover accidents, employee injuries, and 3rd party claims.

Step# 8. Obtain permits & licenses

Permits and licenses work at federal, state, and local levels. Which ones your business needs depend on your niche, location, and if you have employees.

Although NJ doesn’t have a general business license, you might need permits or licenses at the state and local levels.

The permit and license requirements are on NJ’s Licensing & Certification Guide.

And you’ll find a municipality department list on the State’s Municipal and County Governments website.

Federal income tax and New Jersey local tax

Besides New Jersey taxes, you might need to pay federal income and employer taxes, so check the IRS Tax Guide for Small Businesses and Taxpayers Starting a Business to learn more.

New Jersey has the following taxes:

- New Jersey corporation tax: NJ has an adjustable corporate tax rate ranging from 6.5% to 9%.

- NJ income tax: New Jersey has a variable income tax rate ranging from 1.4% to 10.75%, depending on your income.

- Sales tax: Sales and Use tax is 6.625%.

- Franchise tax: NJ imposes a Corporation Business Tax (NJ CBT) on corporations for the privilege of doing business in the Garden State.

New Jersey-specific regulations:

- Sales tax: Product sellers must register to remit sales tax with the North Carolina Department of Revenue (DOR).

- Withholding tax: Employers must register for withholding tax using DORE’s NJ Business Gateway Services.

- Professional and occupational licenses: Certain professions need an occupational license.

- Get an EIN: Future employers must get an Employer Identification Number online or by mail from the IRS.

- After you form your NJ business, you have 60 days to register with the NJ Division of Taxation.

- All businesses must register with the New Jersey Division of Revenue.

For further information, contact the New Jersey Division of Revenue or the Division of Taxation.

Step# 9. Find your team

Hiring the right talent that can do the job you need them to is crucial when finding your team.

Let’s look at your options:

People are the backbone of the business

It’s no secret that employees involved in customer service, product development, or service duties can make or break your business. So, when hiring, follow a strict onboarding process to ensure you employ people that suit your brand.

Here are some New Jersey organizations that can help you:

Once you have your team, it helps to use a payroll service to track working hours, issue paychecks, and simplify your tax returns.

Comply with New Jersey Payroll regulations

New Jersey state has labor laws that regulate minimum wage, overtime, payment dates, earned sick leave, and termination, and employers must follow them.

Before you hire, visit the Department of Labor and Workforce Development for payroll guidance, report new hires to NJ state, and register for employee taxes with the IRS.

Hire contractors

Besides full-time employees, you can outsource an experienced NJ accountant on a retainer or independent contractors on a need-only basis to help you achieve your targets.

When employing contractors, you must categorize them correctly to avoid breaking New Jersey employment and tax laws. In other words, you can’t say an employee is a contractor to avoid employee taxes and insurance.

You can learn more about hiring contractors correctly on the Department of Labor and Workforce Development A-B-C test page.

Step# 10. Market & grow your business

The thought of marketing can be intimidating as you’ve numerous approaches to choose from.

But you must do it because a creative marketing campaign is how you’ll elevate your brand above your competitors.

Successful marketing strategies understand their audiences, have appealing messaging that elicits an emotional response and are where people will see them.

Use these 6 strategies to grow your business:

Invite customers to opt-in to a mailing list or newsletter

Email marketing (mailing lists and newsletter) is as old as the Appellation Mountains and just as impressive, with a $41 return for every $1 invested.

Opt-ins (those pop-up boxes asking for your email address) are persuasive CTAs (call to action) on your website offering value to your viewer, like a free ebook or mini-course.

Once you have a mailing list, you can begin your email marketing campaign to build trust with your readers and form a community eager to engage with your brand.

Consider making special offers to attract your first customers

One way to land your first sales are special offers that provide value to your target audience.

The offers you use depend on your niche and audience needs; here are some examples:

- Free samples or limited offers.

- Bundle deals like buy one, get one free.

- Flash sales with limited-time discounts.

- Coupons and vouchers.

- Loyalty programs.

- Free shipping and returns.

Look for local businesses or brands to collaborate with

People trust brands they’re familiar with, which can be problematic for start-ups.

One way around this is collaborating with other established businesses to attract customers’ attention and establish trust through association.

Brand collaboration also enables both businesses to cross-promote each other’s services/products, reach a wider audience, and increase sales.

Invest in word of mouth (happy customers attract each other)

Word-of-mouth marketing (WOMM) is a personal recommendation strategy.

Here`s how it works:

Person A recommends your brand to Person B, and as they trust one another, the recommendation gives your brand credibility, and you get a new customer. Not only is it free marketing, but it’s also the most powerful, as results show 92% of consumers trust WOMM.

Investing in WOMM means making your customers so happy they`re compelled to tell others how great you are; here’s how you do it:

- Offer a quality product that solves a problem.

- Provide impeccable customer service.

- Ensure a seamless purchase experience.

- Encourage user-generated content (UGC).

- Create a referral program.

- Ask for reviews and ratings (then share them).

Pay attention to online reviews; ask satisfied customers to review you

With 90% of people reading reviews before buying a product, and 85% of consumers trusting online reviews as word-of-mouth recommendations, Asking for reviews is an essential part of your marketing plan.

Here are some ways to ask for reviews:

- Send a post-purchase email offering a one-off discount on their next purchase if they leave a review.

- Reach out with a simple follow-up email asking how they enjoyed your product.

- Make it easy to leave reviews on your website.

Create unique, helpful content to showcase your activity

There’s a divide separating your brand and your audience (trust). Content (videos, podcasts, blogs, and imagery) bridges that divide.

The key is to provide interesting and valuable content that people consume and want to share.

And you do that by starting conversations:

- Tell stories about real people: Authentic stories resonate on a deeper level because we relate to them, either interview someone or write case studies using a captivating storytelling format.

- Ask provocative questions: Get people thinking and talking by asking questions and encouraging viewers to reply with their experiences.

- Be a disruptive influence: Use your experience or a fresh perspective on a subject to go against the tide and get people talking.

- Become the go-to resource: Showcase your activity and become your niche’s guru by providing insights and guides for your target audience.

The more you can get people talking, the quicker they’ll share your content, and that’s how you’ll build your online community.

Step# 11. Open the doors!

Your last step to start a business in New Jersey is opening your doors, letting your target audience know about it, and managing your dream NJ business.

Launch events are great for creating brand awareness and even landing your first clients.

Plan a successful launch event

A launch event is how you create a buzz about your new business, let your local audience know you’re open, and make essential connections with prospective clients and other potential business collaborators.

How to throw a successful launch event:

- Set a date and time: Choose a date that allows you to organize and a time that works for your guests

- Select your format: Launch events can be in-person or virtual, whichever suits your target audience.

- Pick a suitable venue: Choose a location that fits your brand and decor that mirrors its personality.

- Create a memorable experience: Make your event memorable by having product giveaways, exciting speakers, live entertainment, and interactive activities.

- Use social media to spread the word: Get people talking about your event online by posting content that engages their interest and builds anticipation.

- Partner with local influencers and other brands: Now’s a perfect time to create your first brand collaborations; contact local influencers and organizations to help promote your launch event to a broader audience.

- Get people’s contact information: Use your event to collect people’s details and begin your email marketing campaign.

- Follow up with an email: Send thank you emails to attendees and continue building your brand community by offering post-launch discounts to land your first sale.

Land your first sale

Your first sale could happen in your launch event, organically online, or it might take some time until you establish your brand.

The trick is not to worry about it and focus on the solutions you provide to your audience.

Conclusion

And that’s how to start a business in New Jersey.

Follow the NJ rules for hiring, permit/license regulations, choose the right location, and brand your business.

And above all, remember.

“The proof you can do hard things is one of the most powerful gifts you can give yourself.” -Entrepreneur Nat Eliason.

So, stick with it, and your Joisey start-up could soon be making gravy.

FAQ

Depends on the type of business. For example, formal entities (like LLCs) must file Articles of Organization with the NC state. In contrast, informal entities might only need specific permits.

The filing fee to register an LLC is $125.

Choose your business name, appoint a registered agent, and register Articles of Organization and certificates of formation with the New Jersey online business formation service.

The Garden State doesn’t have a mandatory business license. Still, depending on your niche, you might need federal or local licenses and permits.