At the heart of America, Ohio presents an excellent business opportunity.

With its vibrant history in industries like manufacturing and farming, the Buckeye State boasts a growing gross domestic product (GDP) and an abundance of natural resources.

Ohio’s business-friendly climate features one of the lowest tax rates among all fifty states, including zero corporation tax.

The state offers a low cost of living, ranking high in “America’s cheapest states to live in”, with many amenities priced below the national average.

From the lively city of Cincinnati to the scenic landscapes of Hocking Hills State Park, there are plenty of opportunities for entrepreneurs in Ohio.

When you start your own business you need a vision, and faith in your way. But you also need knowledge, and one of the best ways to get started is by relying on the hard earned experience of other entrepreneurs.

Here are a few tried and tested business creation tips to help you kickstart your business journey.

Read on to learn more about starting a business in Ohio:

- Fine-Tune Your Business Idea

- Create a Business Plan

- Choose a Business Name

- Choose a Business Structure

- Set up Banking, Credit Cards, & Accounting

- Get Funding for Your Florida Business

- Get Insured

- Obtain Permits & Licenses

- Find Your Team

- Market & Grow Your Business

- Open the Doors!

Step# 1. Fine-tune your business idea

Great business ideas don’t grow on trees, specialty cider, artisan olive oil, and gourmet coffee aside.

Specific considerations go into choosing a great business idea.

For instance, your idea needs a wanting audience, beatable competition, sustainability, and accessibility.

But what if you’re stuck on developing a business idea?

No worries, here’s how to find and fine-tune your business idea.

How to develop a business idea:

Follow these 4 steps and uncover some business ideas worth validating.

- Choose a product or service: Businesses come in two forms: products (manufacture or sales) and services (on and offline). And your business journey begins by picking one or the other.

- Identify and improve a problem: Find an existing product or service with a problem, fix it, and bring a unique selling point (USP) to your niche.

- Play to your strengths: Combining your experience and skills is a powerful way to create a business idea. For example, if you can’t sleep because of light pollution and you’re a seamstress with allergies to man-made fibers, develop a hemp sleeping mask.

- Serve your community: Many businesses fail because of a lack of demand; ensure yours thrives by identifying a demographic that needs a product or service you can provide.

With that in mind, let’s look at Ohio.

Popular Ohio business ideas:

A proven way to choose a business idea is to serve your region’s local interests, preferences, or specialties.

Ohio’s largest industries by employment are trade, transportation, utilities, health care, education, government, and manufacturing. Those alone offer endless offshoot business ideas serving their needs.

Other popular Buckeye businesses that suit local interests and preferences include:

- Coffee Shop

- Craft Brewery

- Food Truck

- Boutique Clothing Store

- Fitness Studio

- Pet Services

- Art Gallery

- Home Improvement Services

- Specialty Food Store

- Vintage/Consignment Store

- Bed and Breakfast

- Personal Training

- Home Bakery

- Mobile App Development

The last step is crucial for fine-tuning your business idea.

Validate your business idea:

You validate your business idea by answering four essential questions:

- Do people want what you’re selling? Research Google trends to see how many people per month search for your idea.

- Will they pay for it? Test your product or service with Facebook Ads.

- How much will they pay? Talk to your target audience on various platforms and check out your competitors to see what people pay.

- Can your idea be profitable? Build a product prototype to determine what it will cost and if you can make a profit.

Step# 2. Create a business plan

Business plans come in two forms: one-page and traditional.

You’ll need a traditional plan for funding as it details your financial plan. A one-page business plan is your guide throughout and after the startup business stage.

The three most important parts of your business plan are:

Market research

Market research refines your business idea by analyzing consumer behavior and economic trends. Giving you a deep understanding of your target audience, you can avoid risks and make informed decisions when your business is still in its conceptual stages.

Financial plan

A financial plan outlines how you’ll achieve your financial objectives. It includes details about your revenue, expenditures, and cash flow.

And it summarizes your current financial position and outlines your long-term business goals.

Marketing Plan

Your marketing plan details how you’ll connect with your future customers and promote your product or service. It includes things like the advertising methods you’ll use and the best time to use them.

Choose a location

Your business location must be where your target audience is, it’s especially true if your niche relies on foot traffic, such as food and retail. For instance, let’s say you want to open a vegan restaurant. Downtown Franklinton in Columbus, known for its vegan lovers, would be ideal. A retail store, on the other hand, tucked away in a remote location with zero visibility might struggle to attract customers and make a profit. When choosing a business location, ensure it meets the following requirements:

- Your location must suit your business’s style

- Suit your ideal client’s style

- Be in an area known for your niche

- Have suitable road and public transport access

- Convenient for deliveries

- Have adequate power supplies, water, and sewage

- Suit your budget

- Comply with local zoning laws

Ohio zoning laws and regulations:

Zoning laws are rules and regulations determining which businesses can trade where, and you must apply for them before you set up shop.

Zoning laws vary from city to city, so visit your local county clerk’s office or check out Ohio.gov for further information.

Decide if you’re an online-only business

Opening an online-only business is one way to avoid zoning laws and save on rent. You don’t have to be an e-commerce entrepreneur to do it.

Most product and service businesses can start online.

For example, imagine you’ve chosen a product business idea; you could sell it using Amazon, eBay, Etsy, or a website, depending on your niche. And you could run a service business idea (like a tradesman) from home and advertise and sell it online.

Many brick-and-mortar businesses start this way to reduce financial risk, allowing owners to grow their businesses sustainably.

For an online business, you’ll need:

- A website: Your website is your digital shopfront and where you’ll promote your brand, use reviews to create trust, collect users’ emails, and sell your product or service.

- Social media presence: Social media is no longer optional for small businesses as it’s how you reach and engage with your customers and grow your brand.

- Supply and distribution plan: Product sellers need reliable suppliers and delivery; a supply and distribution plan ensures you never run out of stock or let your buyers down.

- Comply with online tax laws: Tax laws vary from business to business, but if you sell online to Ohio residents, you must collect and remit Ohio sales tax at 5.75%.

- Adhere to Ohio-specific online business regulations: Retailers must get a vendor’s license (to remit sales tax) and register with the Ohio Secretary of State.

Step# 3. Choose a business name

A business name is your most important asset because it creates a brand identity that defines your business, engages your audience, and separates you from your competitors.

And the more successful your brand, the more valuable your business name equity becomes.

Three ingredients make a great business name:

- Branding: And1, a tiny sneakers business, took on Nike in the mid-90s and almost won because their branding resonated with their target audience, street-level basketball lovers. The lesson is, create your branding for your audience, and magic might happen!

- Memorability: Your brand’s equity relies on its audience awareness, which comes from memorability, and you create that by choosing a name that’s distinctive, easy to pronounce, and emotionally appealing.

- Domain name: Your domain name controls your online identity and is essential for building consumer confidence in your brand; that’s why it must be your business name.

Ingredients aside, you must follow certain rules:

Ohio naming requirements:

When choosing your business name, you must follow state naming laws.

- Business name availability: Your chosen name must be unique to any other registered Ohio state entity name.

- Legal designations: Business entities must use specific words or acronyms identifiers, such as Limited Liability Company (LLC) or Corporation (Corp).

How to register a business name in Ohio:

- Conduct a business name search on the Ohio Secretary of State’s website to check your name’s availability.

- LLCs and LPs register their business name when filing their Articles of Organization.

- Corporations register their business name when filing their Articles of Incorporation.

- All business types can reserve a name by completing form 534B.

Using a DBA in Ohio:

Sole proprietorships, partnerships, and business entities can register a fictitious name (Doing Business As), in Ohio that allows them to operate using a catchy brand name more suited to their niche.

You can file a DBA online via the Secretary of State’s website or by mail.

Mailing address:

Ohio Secretary of State

PO Box 670

Columbus, OH 43216

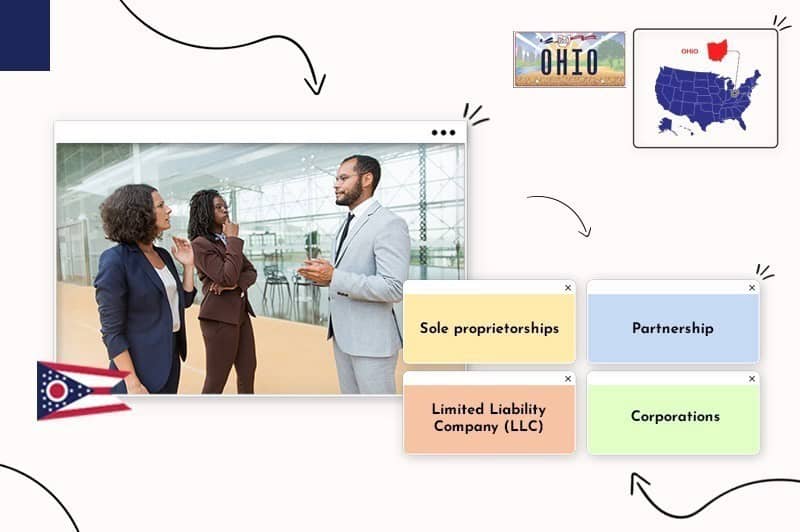

Step# 4. Choose a business structure

A business structure is the legal framework your brand operates under and determines the ownership, liability, and taxation of your company.

Choosing the right business structure is crucial as it affects the licenses you’ll need, how you’ll run your business, and your legal and financial implications.

The common types of business structure

Sole Proprietorship:

Sole proprietorships are a pass-through business structure where a single individual manages all aspects of the business, keeping full control over operations and reaping all profits. However, the sole owner assumes complete responsibility and liability.

General Partnership:

A general partnership is similar to a sole proprietorship but with multiple individuals owning a business, sharing responsibilities, and splitting profits. Each partner contributes to the business’s operations, assuming shared risks and liabilities.

Limited Liability Companies (LLCs):

LLCs offer a flexible business structure that blends the simplicity of a sole proprietorship or partnership and the protection of a corporation. LLC owners, referred to as members, benefit from limited liability that shields them from debts and obligations.

Starting an llc is one of the preferred options for independent business owners, as they may offer many tax and legal benefits.

S Corporations:

An S corporation offers limited liability protection, facilitates pass-through taxation, and allows shareholders to sell stocks, making it an attractive option for entrepreneurs raising capital.

Tax advantages of each option

- Sole Proprietorship: Owners report profits and losses on their tax return, eliminating separate business tax filings. And sole proprietors can deduct certain business expenses from their income, reducing their tax bill.

- Partnerships: General and limited partnerships also use pass-through taxation and avoid double taxation. Partnerships allocate profits and losses among partners relative to agreed-upon percentages.

- Limited Liability Companies (LLCs): By default, LLCs are pass-through entities, so they avoid double taxation. Members also report their income on their tax returns, which they can reduce by deducting allowable startup and running costs.

- S Corporations: S corporations employ pass-through taxation by passing federal income taxes on corporate profits. Income flows to shareholders, who report them on their tax returns. S corporations also allow shareholders to receive tax-free dividend payments, which can lower self-employment taxes.

Step# 5. Set up banking, credit cards, & accounting

My stepfather was a self-employed accountant for 58 years, and he told me the key to business success was balance.

Balance in accounting terms means your book’s balance at the end of each tax quarter; in other words, what you earned and spent adds up to what remains in your account. You need it to maintain a steady cash flow and pay the correct taxes.

And you achieve it by using business banking, credit cards, and accounting.

Business bank account

Maintaining a separate business account is crucial for tracking your income and expenses, regardless of your chosen business structure.

A separate bank account ensures LLCs, LPs, or corporations avoid breaking the corporate veil and maintain liability protection.

And non-legal entities like sole proprietorships can use a business account to project a professional image to clients and suppliers.

To open a business bank account in Ohio, you’ll need an EIN.

Business credit card

I used a $1000 credit card to start my first online business because I couldn’t get a bank loan.

Ten years later, I still use it even though I don’t need it because it provides a useful credit line. As I pay it off on time, it improves my business credit history.

Another reason to use one is that vendors prefer doing business with you when using a business credit card.

Business accounting

Accountants are costly, but most business owners need one to file their income and payroll taxes.

You can do everything else using accounting software and handy apps that integrate with your business and credit card accounts. You can even use them to send invoices, track employees’ working hours, and send reminders to late-paying clients.

Step# 6. Get funding for your Ohio business

Starting a business requires funding, but there are important steps to take before securing the money to cover costs.

Begin by calculating your business expenses to help you choose the right funding option for your business. And be mindful of your spending and stay organized by creating a detailed financial plan.

Business funding comes in several forms:

- Bootstrapping: A self-funding approach using your savings and current income to provide capital to start and run your business, while reinvesting your profits to support its growth along the way.

- Friends and Family: Loans from friends and family are a great way to finance your startup; however, when mixing business with personal relationships, ensure you have a written agreement.

- Small Business Loans: You can apply for loans from banks and other lending institutions. Although you must repay the loan with interest, it lets you get capital when needed.

- Small Business Grants: Small business grants offer funding you don’t repay. Grants are usually at a local level awarded after completing an application process with a grantor.

- Angel Investors and VCs: VCs invest in larger companies for an ownership stake and influence in operational decisions. Angel investors support smaller firms and hold ownership shares without direct involvement in daily operations.

- Crowdfunding: You join a crowdfunding platform, post your business idea and how much you need, and if people like it, they invest. This is often used by small startups as an alternative to traditional bank loans.

Ohio grants and state incentives:

Small business owners can apply for business incentives in Ohio, such as tax credits and grants.

Here are some resources to explore:

- Ohio Department of Development State Incentives: Provides a range of grants, loans, bonds, and tax credits to assist small businesses in Ohio.

- Ohio Chamber of Commerce: Find a list of small business Ohio state grant and loan programs.

- US Grants-Ohio small business grants: Tells you about all available grants and how to apply.

- Entrepreneurs Center: Supports small business startups in achieving their dreams in the Dayton region.

Step# 7. Get insured

Insurance is essential for every business, but the coverage you need depends on your business niche and Ohio state insurance regulations.

Let’s first look at the common insurance options:

- General liability insurance: Protects against lawsuits and damages caused to a client’s property and injuries incurred on your business property.

- Professional liability insurance: Covers claims related to negligence, errors, unfinished work, personal injury, and copyright infringement.

- Property insurance: Covers your commercial property, assets, inventory, equipment, and building, safeguarding them against losses and damages resulting from fire, theft, vandalism, or natural disasters.

- Business interruption insurance: Provides coverage for lost income and ongoing expenses when your business operations are disrupted because of illness or natural disasters.

- Commercial auto insurance: Protects against liability claims, vehicle damage or loss, and personal injury for drivers.

Ohio state-specific insurance regulations:

Ohio requires employers with one or more employees to have workers’ compensation insurance from the state, not a private insurance company.

- Workers’ compensation insurance covers medical expenses and lost wages for employees who experience workplace injuries.

Exceptions include sole proprietorships, partnerships, or LLCs designated as sole proprietorships or partnerships.

For further information on Ohio’s insurance requirements, visit the Ohio Department of Insurance.

Step# 8. Obtain permits & licenses

To do business in Ohio, all companies must register with the Ohio Secretary of State, which provides a business license.

Depending on your business’s niche, you might need additional licenses or permits at a federal or local municipality level.

- Federal licenses: Specific industries need a federal license, such as aviation, commercial fishing, manufacture of firearms, or selling tobacco or alcohol.

- Professional occupational license (POL): Certain occupations like cosmetologists, barbers, security guards, teachers, contractors, teachers, doctors, nurses, and lawyers require a POL.

- Local municipality licenses: Your county or city might require a general business license to operate within their location.

- Vendor or sales tax permit: Brands selling tangible products need a seller’s license to collect and remit Ohio sales tax.

- Local permits: To provide certain services or trade in specific areas, you might be required to have a health and safety or building permit

Your municipality can help you with local licenses and permits, and the Ohio Business Gateway provides a list of licenses you might need.

You can also read more about business licenses required in Ohio.

Ohio-specific regulations:

Like all US states, Ohio has specific regulations for different business types.

For example, Ohio does not require legal entities to file an annual report or pay inventory or state income tax, making it an attractive place to start a business.

However, all businesses must register with the Ohio Department of Taxation.

Step# 9. Find your team

Traditionally, small business owners hired full-time employees to help run their operations, which still applies to service businesses like the trade and food industries.

But in our modern business environment, you can now outsource many duties, such as bookkeeping, web design, and advertising. This allows you to avoid payroll taxes and enables you to reinvest in your business.

However, you still need to find the right team and comply with certain regulations:

People are the backbone of the business

Anyone who’s run a business knows the importance of finding the right people for their team. After all, our employees run our daily operations and liaise with our customers, making them the backbone of our business.

But support goes further than in-house employees, such as gaining advice from an experienced accountant and learning from other business owners who can help you navigate your journey from a startup to a successful brand.

Comply with Ohio Payroll regulations

Hiring employees brings responsibilities such as payroll regulations and specific filing duties; here are some most business owners must follow:

- An employer must report new employees to the Ohio New Hire Reporting Center.

- You must pay your employees at least twice a month.

- For overtime work, you must pay 1.5 times your employee’s wage for working over 40 hours a week.

- Register an Unemployment Compensation Tax Account with the Ohio Department of Job & Family Services.

You can learn more about your responsibilities as an employer by contacting the Ohio Bureau of Workers’ Compensation.

Hire contractors

One way to avoid Ohio’s payroll regulations is by hiring contractors on a part-time basis, like an accountant, lawyer, or online marketing specialist.

Contractors are self-employed people who run their businesses and pay their own taxes and health insurance.

When hiring contractors, you must clearly distinguish their status as contractors to avoid Ohio employee liabilities.

Step# 10. Market & grow your business

Every business needs a marketing strategy to reach, engage, and convert its target audience into customers.

The good news is, many of these strategies are free and help turn one-time buyers into lifelong lovers of your brand.

Invite customers to opt-in to a mailing list or newsletter

Opt-in emails are a form of inbound email marketing where people choose to receive messages from your brand. You’ve probably seen them on a website with a pop-up box asking for your email address before you leave.

Well, they work, but to convince people to give their contact details, you must provide an enticing offer or value, such as a free ebook or a special offer.

Consider making special offers to attract your first customers. Special discounts are a great way to attract new customers and build brand loyalty.

Some you can use are:

- Free samples

- Buy one, get one free

- Cashback promotions

- Flash sales and discounts

- Free shipping and returns

- Coupons and vouchers

- Loyalty programs

Look for local businesses or brands to collaborate with

Brand collaboration is when two or more businesses join forces to develop a product or service that appeals to the same customer base, increasing sales or engagement rates for each brand.

Another benefit of local business collaboration is reaching a wider audience and recommendations from a business whose customers already use and trust it.

Invest in word of mouth (happy customers attract each other)

Word-of-mouth marketing (WOMM) happens when customers share their enthusiasm for your product or service through everyday conversations on and offline.

It’s unpaid advertising, driven by positive customer experiences, often exceeding their initial expectations.

Pay attention to online reviews; ask happy customers to review you

Reviews are crucial for establishing a positive reputation and fostering trust with your target audience. Always ask your customers to leave a review and make it easy across all of your marketing platforms.

Analyzing what people say in their reviews helps you see what you’re doing right or wrong. It provides genuine feedback from real people, which enables you to align your business to meet their needs.

Create unique, helpful content to showcase your activity

Creating valuable content is an effective way to increase audience engagement, enhance brand visibility, and boost sales.

The strategy works by addressing the questions and concerns of your audience. Doing so shows you care about your customers and go the extra mile to help them resolve their pain points.

Conclusion

Now you understand how to start a business in Ohio.

Follow the steps and gain legal advice regarding taxes and insurance, especially if hiring employees.

And most importantly, validate your business idea to ensure there’s a demand and you can afford the startup costs.

FAQ

Registering an LLC in Ohio costs $99. And there’s an annual $500 Ohio franchise tax most business entities must pay.

Businesses must register with the Ohio Secretary of State to operate within Ohio.

Filing Articles of Incorporation in Ohio costs $99. If you opt to expedite the filing process, you can pay an additional fee of $150.

Forming an LLC in Ohio takes on average 3-7 business days. Ohio LLC owners can submit their articles of organization online, in person, or by mail. The Ohio Secretary of State provides three expedited service options, each incurring an additional fee.

The processing time for a DBA registration with the Ohio Secretary of State is 3-7 business days.