Home » How to Start a Small Business » Start a Business in Washington State

Want to start a business in Washington state?

You’re not alone!

The Evergreen State has a thriving business environment because of its entrepreneurial ecosystem, booming economy, and low taxes.

Washington ranks 7th in CNBC’s “Best states to start a business,” and 657,529 small businesses and many of the world’s leading brands (Microsoft, Starbucks, Boeing, and Nordstrom) already call it home.

But Washington is also a great place to live, with its world-class health care, excellent quality of life, and stunning natural beauty, ideal for families and young entrepreneurs alike.

Add the many small business government incentives and state programs to help you start your business in Washington, and the Evergreen State is a prime location.

All you need to know now is how to start a business in Washington. Such as which structure to choose, licenses and permits to get, insurance to use, and including those from outside the State, where and how to apply.

All of which you’ll find here.

We know from experience that starting your very own business is a big task, and you may have emotional reservations since when you dream big, the fears can get big too.

But don’t worry… We’ve got your back! We created this guide to help you take some of the mental load off, and to focus on the things that matter most.

Here are the steps to follow when starting a Washington State Business:

Fine-tune your business idea

Create a business plan

Choose a business name

Choose a business structure

Set up Banking, Credit Cards, & Accounting

Get Funding for your Washington business

Get Insured

Obtain Permits & Licenses

Find your team

Market & Grow Your Business

Open the doors!

But you need a viable business idea before you do any of that!

You should consider 2 things when choosing your business idea.

The first are your skills, passions, interests, and long-term goals because running a business is a lifestyle commitment, and the more your choice suits you, the better your chances of success.

The 2nd is your business idea’s validity because you need an idea that’s accessible, profitable, and sustainable.

You answer the 1st; research answers the 2nd.

But what if you still need a business idea?

No worries, here are some that often do well in Washington.

The Evergreen State is the number one producer of organic fruits and vegetables in the U.S. and has the freshest and most diverse seafood in the country, so if you’re considering those as your business idea, you could be on a winner!

If not, here are others to get your creative juices flowing:

Next, we’ll examine how validating your idea proves it’s worth your investment!

Validating your idea confirms people need it and will pay your asking price. It also means your idea is accessible, sustainable, and scalable to expand throughout Washington and beyond!

Entrepreneurs starting a local Washington business should choose an idea that suits their community’s interests and needs. You do this by researching your locality to see what services and products people buy, then offering something better.

Aspiring online entrepreneurs can do the same by using online strategies that prove a particular demographic of society wants what they sell, like researching online search volumes for specific services and products using Google Analytics and Google Trends.

However, local and online validation answers the same questions:

And you answer those in your business plan!

You’ve probably heard the adage, “If you fail to plan, you’re planning to fail.”-Benjamin Franklin.

You use a business plan to ensure your new venture is viable, to enable potential investors to determine if it’s investible, and to guide you through the startup stages and beyond.

Need help writing a business plan? Not a problem, use our free template and read our How to Write a One-page Business Plan post.

But before you do, every business plan needs 3 crucial sections:

You research your chosen business ideas marketplace for 3 reasons:

You then take this information to develop your unique value proposition and create your marketing plan.

Pro tip:

Once you know your market, use tools like the Washington State Data Book to learn about your target audience’s demographics (age, gender, location, employment, and income).

Every marketplace has buyers who need and want that specific product or service. Marketing is how you reach, engage, and sell to them.

Your market research tells you which strategies work for your niche. For example, it could be paid online advertising, organic SEO content, or traditional like local advertising on billboards or shop signage.

You then use them in your marketing plan to maximize your chances of making a sale at the minimum cost.

Your financial plan calculates your startup and running costs to ensure you can afford to enter your chosen niche, charge accordingly, and maintain a positive cash flow.

For entrepreneurs needing funding, a financial plan (with projections) also helps convince potential lenders or investors that your business idea is viable.

A thorough financial plan has 5 budgets:

Once you know your business idea is viable, it’s time to choose your location.

My business location is a home office (and sometimes a local cafe), and many online sellers do the same to reduce costs.

However, entrepreneurs starting a physical business in Washington need a location that suits their target audience’s shopping habits.

For example, future retail or restaurant owners need high footfall (passing trade), convenient access, parking, and a location where their target audience expects to find them.

Recent research by Zippia says the following 10 places in Washington are ideal for starting your new business:

The key to choosing the perfect location for your business is knowing where your clients shop for your product or service, and it’s part of your market research.

But all Washington locations (including home-based businesses) have one thing in common: they must comply with Washington zoning laws.

Zoning laws exist to save our green spaces, reduce pollution, ensure people don’t open inappropriate businesses in the wrong locations, and maintain health and safety standards.

The easiest way to start your physical business in Washington is to choose an area or property already zoned for your business needs.

This step is easy because if you’re going to sell online, then you’re an online business!

But mom-and-pop stores should also create an online presence to ensure their target audience can find them, read their reviews, and book appointments or services.

E-commerce and physical business owners need the following to ensure that happens:

Next, your business needs an engaging and memorable name:

Besides global brands, can you think of any local or online business names?

Why do you remember them?

Sure, you might use them regularly, but odds are those names attract you because they connect with your emotions, resonate with your needs, and are memorable because of being witty or unique.

That’s the power of a great business name!

As yours will be your audience’s first impression of your business, you must choose one that represents your brand, what you’re selling, and what suits your ideal clients.

Coming up with the right business name is challenging; fortunately, strategies exist to help you choose the perfect name for your business.

Once you have some ideas in mind, you must ensure they conform to Washington State requirements:

Okay, let’s finish this section with a D.B.A.:

A DBA (doing business as) allows you to run your business using a different name from your legal entity or your name in a sole proprietorship or general partnership. Washington calls a DBA a trade name, and you apply for one with the Department of Revenue for $5.

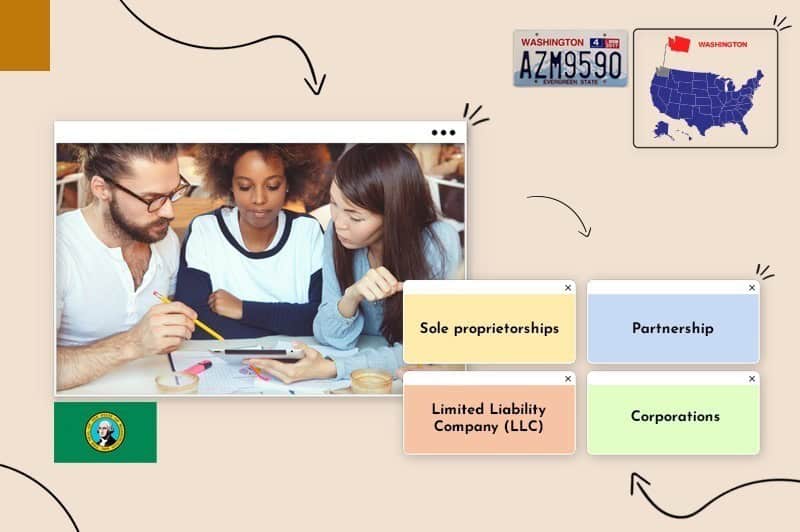

A business structure is the entity under which you run your business, and they come in 2 types: formal and informal.

Formal business structures include limited liability companies, limited liability partnerships, and corporations; informal are sole proprietorships and general partnerships.

Your choice depends on your need for liability protection, raising capital, if you plan on selling your business (or a percentage), and whether you’ll have employees.

With those in mind, here are your options:

Let’s look at the pros and cons of the business entities in Washington to help identify the one that suits your business idea.

You are a sole proprietor if you start a business alone without registering a formal entity with the Washington Secretary of State. Sole proprietors handle their business’s daily and financial operations and pay any due taxes on their tax returns. But this simplicity means sole proprietors are liable for any debts or litigation against their business and may have difficulty getting business loans.

Similar to a sole proprietorship, but with 2 or more individuals who start a business in Washington without registering. Partners pay taxes on profits earned via personal tax returns and handle all debts and litigation cases.

Limited liability protects business owners from their business’s debts or litigation. You form an LLP by registering with the Washington Secretary of State. The structure suits professionals like lawyers and accountants who want to start a business while keeping separate liability from one another.

LLCs are a midway point between a corporation and a sole proprietorship (or general partnership if there’s more than one owner).

Owners (called members) get a corporation’s liability protection while availing of a sole proprietor’s simple pass-through tax structure and management flexibility.

You form an LLC by filing articles of organization with the Washington Secretary of State and paying the $180 filing fee.

An S corporation entity is the most popular with SMBs (small to medium business owners) because it uses the pass-through tax structure, which avoids double taxation at the corporation level. Corporation owners are shareholders who can sell stocks and shares to raise capital.

Formal entity owners must designate a registered agent to receive legal or official documents, like a service of process or government notices for their business.

A registered agent must have a physical Washington address and be open during business hours.

You (or another business owner) can be your registered agent or employ a registered agent service provider.

Setting up a separate business bank account and using a business credit card helps track your startup’s income and expenses, which can simplify your bookkeeping duties and minimize your accountancy costs.

But those aren’t the only benefits!

Here’s how dedicated business banking can help you run your business in Washington.

Legal business entity owners (like limited liability companies) must separate their business and personal finances to avoid breaking the corporate veil and maintain their liability protection.

The corporate veil shields your assets from your business (when you start an LLC or S corporation), but you can lose it in litigation if you mix your finances.

General Partnerships and Sole Proprietorships don’t have liability protection. Still, dedicated business accounts can help owners ease their bookkeeping needs and increase their brand’s credibility with clients and vendors.

Business credit cards have several advantages for formal and informal business entity owners.

For instance:

When you start a business in Washington, you’ll need to wear many hats, one being accountancy, to ensure you pay your bills and maintain a positive cash flow.

However, some accountancy duties, like annual and payroll taxes, require a certified accountant to ensure you stay compliant with federal and Washington state tax laws.

The problem is that accountants are expensive!

Fortunately, you can reduce accountancy fees by using accountancy software that integrates with your designated business bank and credit card accounts to manage your bookkeeping tasks, send invoices, track working hours, and monitor payments.

Okay, let’s talk about money.

Before your new business can earn money, you’ll need financing to help with your startup and running costs, here are a few options:

Other funding options include:

Washington offers business incentives (tax credits and grants) to startups in specific industries and businesses wanting to move to the Evergreen State.

Washington grant, incentive, and loan providers include:

When you start a business in Washington, your insurance needs depend on your business type, niche, and whether you’ll have employees.

Some insurance coverage is mandatory, while others are optional. Let’s look at the most common types of business insurance next:

Mandatory business insurance policies depend on your industry and whether you’ll have employees. Contact the Insurance Commissioner of Washington State for further information.

Most new businesses need licenses or permits at the federal, state, and local levels; some also need professional licenses.

Entrepreneurs running businesses in multiple Washington locations need licenses for each county/city they do business in.

For information on which local, state, and federal business licenses your startup needs, check the links below:

The Washington State Department of Licensing has two helpful pages with information:

When you start a business in Washington, you might be liable for federal, state, and local level taxes:

Pro-tip:

Read the tax classifications for common business activities or contact the Washington Department of Revenue at https://dor.wa.gov/contact-us for further information

All U.S. states have regulations businesses must follow; in Washington, those include:

Okay, that’s how to start a business in Washington! The last 3 steps describe how to launch and run your new venture:

Hiring employees is a big step for most new business owners, one you must consider carefully to ensure your wage obligations don’t outweigh your income. As a first step you may prefer to work solo, but as your business grows, so will the need for extra help.

The good news is you’ve plenty of hiring options when you start a business in Washington State.

Employees are essential to most businesses; even solo business owners need the right team to care for their bookkeeping and tax filing needs. Service and brick-and-mortar business owners might also need employees for labor, customer service, and stock control.

Fortunately, (besides labor employees), you can source professionals like freelance marketers, bookkeeping experts, and lawyers or accountants on a need-only basis, maximizing your output while minimizing costs.

Your team can also include other business owners who advise and local employees who bring crucial local knowledge to your new venture.

Even friends and family can help, when you make your first steps as a business owner. A helping hand, good advice, or just a heart to heart talk with someone you trust can go a long way.

You don’t need to have ‘Employees’ to rely on the people around you.

But if and when your business does grow enough to hire full time employees, here are a few tips.

Washington State has payroll regulations you must follow if you hire employees; they include:

When you hire employees or contractors in Washington, you’ll need a payroll system to withhold federal income and Social Security and Medicare taxes.

Professional contractors provide temporary services many small businesses need to run effectively, but unlike full-time employees, you’re not liable for their taxes or insurance obligations, which reduces your hiring costs.

How to hire Washington contractors:

For further information, read this guide on how to contractors in Washington state.

All that’s left now is to tell people you’re open for business!

Here’s where you take your business plan’s marketing research to create a marketing plan that engages your target audience and turns them into loyal customers.

But first, you must create your brand’s logo, color schemes, fonts, and message to stand out from your competitors.

Check out our Logo Maker and other marketing tools to help you create a unique look for your business. Once you have those in place, try some of the following marketing strategies, many of which are free!

The best way to build a loyal community is to collect people’s email addresses using an opt-in box on your website.

To convince people to provide their email, entice them by offering something in return, like a discounted service/product or a helpful “How to ebook” that solves some problems they experience in your niche.

You can make your first sales by attracting customers using special offers like opening day discounts, buy one get one free, and seasonal flash sales.

These limited-time deals help convince your prospects to try your brand; if they like it, they could become repeat customers!

Local business entrepreneurs can increase their target audience by collaborating with other established brands in their area.

All you do is find potential partners with a similar clientele and create marketing initiatives that promote each other’s products or services.

The key is collaborating with a business that isn’t a direct competitor but whose customers need your company’s services.

Word-of-mouth marketing is when you recommend a brand to another person. It’s proven to be the most powerful (and free) form of advertising because we believe what our friends, family, and colleagues recommend far more than a sales pitch!

To encourage WOMM, provide excellent service, and always put your customers’ needs first.

Reviews can make or break your business because everyone reads them before choosing which brand to buy from, service to hire, restaurant to eat in, or place to stay.

How to get reviews:

Content is a great way to engage your target audience’s interest and get them talking about your brand.

Your content includes your brand’s visuals (like your logo and slogan), videos on TikTok, images on Instagram, and any posts you publish on your website or relevant platforms like Reddit.

To create engaging content your target audience wants, look at your competitors’ strategies, then steal their ideas and make them your own.

Okay, now to open your business doors:

When starting a business in Washington, let people know you’re open by throwing a launch event.

A launch event can be a small party in your local shop or a grand event with hundreds of guests.

Either way, your goal is to create a buzz that grabs your target audience’s interest.

How to throw a successful launch event:

Take advantage of your launch event to collect your guest’s email addresses and promote special offers that entice them to buy your products/services.

And that, my friends, is how to start a business in Washington. But if you have some unanswered questions, I’ll finish with the most commonly asked FAQs.

It depends on your chosen business entity, niche, and business needs; for example, you’ll need a registered agent if you start an LLC and might have extra expenses, like licenses, permits, and business insurance.

Yes, Washington has a mandatory state business license for businesses with a gross income of over $12,000 annually.

It costs $180 to file your Articles of Organization with the Washington Secretary of State.

On average, forming an LLC in Washington takes 10 working days. Corporations can take up to 2 months.

Yes, and you don’t need to worry about zoning laws if your home business has only 4 daily customers (by appointment only) during regular working hours.

You can register your out-of-state business by filing a foreign qualification with the Washington Secretary of State.

Yes, any business owner (over 18 with a physical address in Washington state) can act as their registered agent.

And that’s how to start a business in Washington.

All you need to do now is follow the steps in this post, take advantage of the available Washington State small business incentives and grants, register your business, get the right insurance, and begin marketing your new business idea.

Once you do those, you could have a thriving Washington business; the rest (as they say) is history.

Good luck.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness.

Products

Resources

©2025 Copyright Tailor Brands