Whether you are a non-U.S. citizen or a non-resident, you can still start a business in the U.S.

The limited liability company structure is a popular choice because it’s relatively easy to set up, has low running costs, and simple tax structure. Plus, most steps for creating an LLC are the same regardless of where you live.

Naturally, there are some extra-legal requirements and paperwork you must complete before forming an LLC as a non-U.S. citizen. But once you comply, you can start your business and take advantage of this world-leading marketplace.

Since its beginning, America has been known as the land of opportunity where anyone with an entrepreneurial spirit can find opportunity and freedom to make their fortune.

And it’s as true today for us modern day digital nomads as it was for the first settlers, but luckily now, staking your claim is much easier and less dangerous!

Here’s why:

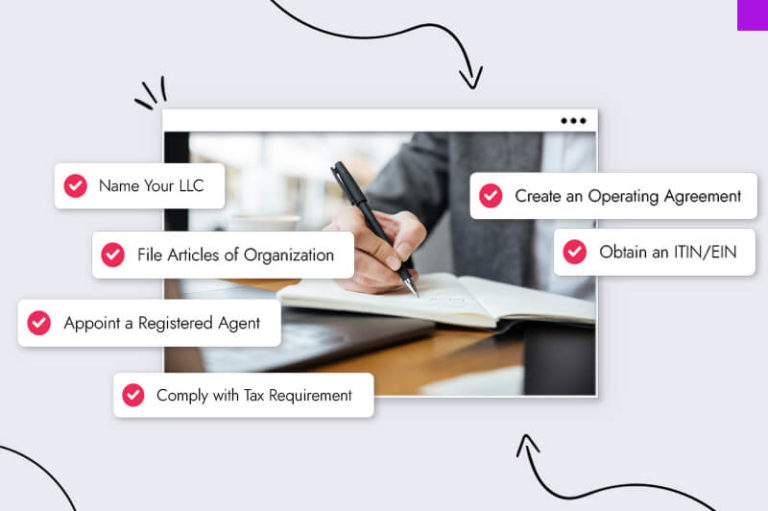

Now let’s look at how to start an LLC as a non-citizen.

Each of the 50 states has its own rules and requirements for starting an LLC.

Delaware and Wyoming offer preferable conditions to non-U.S. citizens and foreign nationals (especially e-commerce entrepreneurs like Amazon vendors and drop-shipping), making them a popular choice!

But before you consider Delaware or Wyoming as your business state, here’s how to file a non-citizen LLC.

The IRS uses an Employer Identification Number (EIN) to identify your LLC for tax purposes, similar to a Social Security Number (SSN) for U.S. citizens.

You need an EIN to file your LLC tax returns, open a business bank account, or apply for a merchant account like PayPal or Stripe.

As a foreign LLC owner, you can apply for an EIN by completing Form SS-4 and send it by mail or fax to the IRS.

The IRS will also need a U.S. or non-resident return mailing address.

Before registering your LLC, you must choose a business name that complies with your state’s rules, and while these vary, most states require:

Most states have an online entity name check tool you can use to see if your name’s available. And you can search the United States Patent and Trademark Office (USPTO) online database for trademarks.

Once chosen, you can reserve your business name while filing your articles of organization by applying for a “Reservation of a Business Name” via your state’s department website.

An operating agreement is an internal document that describes an LLC’s operating terms and defines the responsibilities and rights of its members.

While not all U.S. states require you to have an operating agreement, creating one is recommended for 2 important reasons:

1. You’ll need one to open a U.S. business bank account if your LLC has more than one member.

2. In cases of disagreements, LLC members can refer to the operating agreement for resolution.

You must designate a registered agent with a postal address in your chosen state to receive official documents such as government notifications, a service of process (notice of lawsuits), and tax forms on your business’s behalf.

LLC members can act as registered agents, but for non-residents, a registered agent service solves the problem.

Professional registered agents cost between $199 to $300 per year, and you’ll find them online. An alternative to employing a registered agent service is to designate your U.S. accountant or attorney.

To form your LLC, you must file articles of organization (also known as a certificate of organization or formation) with the appropriate government agency. In most states, that’s the Secretary of State’s office.

Articles of organization are legal documents you’ll use to establish your LLC at the state level; it contains the following business information:

Some states require further information, so contacting yours is advisable before registering.

Depending on your business type and location, you might need specific business licenses and permits to operate in your state.

Business licenses are specific to your business activity and show you comply with industry standards. In comparison, permits allow you to provide or sell particular services or products within your state.

There are 4 different levels of business licenses:

Unsure what license or permit your new LLC might need? No worries, you can find out more here. Or on the Small Business Association (SBA) website, which provides a list of license and permit regulations with the relevant government agency contact details.

The law doesn’t require you to open a business bank account, but it’s advisable for several reasons.

The good news is as an LLC owner, you can open a U.S. business bank account, but naturally, there are some prerequisites:

A separate business bank account can also ensure your LLC is compliant come tax time; let’s look at how next.

LLC members must pay taxes on profits earned even when living abroad. To do so, you’ll need to prepare an annual report for your state, employ a U.S. registered accountant and file the correct tax returns with the IRS and your state of business.

Depending on your business, you might be liable for state taxes, sales taxes, tax nexus, and federal taxes. Plus, you must pay quarterly profit estimations (preliminary tax) and amend any shortfalls in your end-of-year tax return.

LLC non-citizen IRS tax forms include:

To file Form 1120 and Form 5472, your LLC will need an EIN.

To maintain a U.S. LLC in good standing, you must also file an annual report with your state and keep your registered agent. It’s also a good idea to review any tax treaties between the U.S. and your country of residence to ensure you remain compliant.

Next, gaining permission to live in the land of opportunity can be complicated, but it’s not impossible!

You’ll need a visa or green card to work in the United States, and both are difficult to get.

However, a popular choice for foreign citizens is the E-2 visa, which you can apply for when starting an LLC as a non-resident.

The E-2 visa

The E-2 visa enables you, your spouse, and your children to live in the U.S. while your LLC is operational.

You get an E-2 visa by investing substantial capital into a U.S. business/enterprise, such as an LLC, and creating employment. And while there’s no set investment amount, most experts recommend $100,000 or more.

Once you get the visa, it remains valid for the duration of your LLC and you can renew it indefinitely.

The green card

You can become a permanent resident and gain authorization to live and work in the U.S. by applying for a green card.

You get a green card in the following ways:

Green cards are notoriously difficult and time-consuming to get. We advise you to speak with a U.S. business attorney before applying.

You can register your LLC in any state, but as mentioned, some are better than others. Such states have lower tax rates and maintenance fees, and 9 don’t charge income tax, 2 of which are Delaware and Wyoming.

Delaware is a popular choice because you don’t pay income tax on any out-of-state business. This makes it an obvious choice for foreign LLC owners.

It’s also a business-friendly location that suits entrepreneurs’ planning to expand by gaining venture capital from U.S. investors.

Other reasons to start an LLC in Delaware are:

Wyoming is the go-to state for many non-resident LLC owners. Especially e-commerce business owners and those who wish to keep a low profile because LLC members or managers don’t have to list their names for public record.

It also has the best LLC asset protection and privacy laws in America.

Other reasons to start a Wyoming LLC are:

So, if you want to keep a low profile and avoid state income tax while doing business in the USA, Wyoming fits the bill.

In 1931, author James Truslow Adams coined the term “American dream,” describing it as: “That dream of a land in which life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement.”

Fortunately, it no longer matters who or where you are because now anyone can start an LLC as a non-US citizen and live the American dream.

About time too!

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands