Forming a limited liability company (LLC) in Illinois provides many benefits. For example, operating through an LLC protects you, as a business owner, from personal liability for business debts. The benefits of an LLC also come with responsibilities. Every Illinois LLC must file an annual report and pay a filing fee. Many states require this kind of report. Illinois is very strict about it. Failure to file a report by the deadline every year can result in significant penalties for your business. Read on to learn more about the annual report requirements in Illinois.

Every LLC registered in Illinois must file an annual report. This includes LLCs formed under Illinois law and LLCs from other states that have registered with the Illinois Secretary of State. The Illinois Legislature reduced most of the Secretary of State’s filing fees several years ago from $250 to its current price of $75.

The annual report consists of technical information about the business entity, such as its current legal status, the names of its owners, and its primary business address. The report indicates whether any information has changed since the previous year. It also identifies the individuals or businesses that are responsible for managing the business.

You will need the following information in order to prepare an annual report for your LLC:

The due dates and filing requirements for your LLC’s annual reports are very important. Missing a deadline could have serious consequences.

The deadline to file an LLC annual report in Illinois is before the first day of the anniversary month of the LLC’s formation or registration. For example, if you filed articles of organization for your LLC on July 15, your annual report would be due on June 30 the following year and each year after that.

You may file an LLC annual report up to 45 days before the due date. The Illinois Secretary of State will not assess a penalty until the 60th day after the due date.

In most cases, you can file your annual report at the online portal. The filing fee is $75, payable by credit card (Visa, MasterCard, Discover, or American Express).

The Secretary of State will void your filing if your credit card company declines the payment. You are responsible for making sure the filing went through.

You may also file annual reports by mail. You must file by mail if:

To file by mail, you can send an original signed Form LLC-50.1 and one copy to the following address:

Secretary of State

Department of Business Services

Limited Liability Division

501 S. Second St., R. 351

Springfield, IL 62756

You may reach the Secretary of State’s office at 217-524-8008, Monday through Friday from 8:00 a.m. to 4:30 p.m. Central time.

You will need the information listed earlier in this article. Form LLC-50.1 specifically asks for the following:

Rather than filing annual reports yourself, you may use a compliance service. This is among the services that Tailor Brands offers to LLCs. A compliance service can monitor all of your company’s annual compliance requirements. It can provide you with reminders of due dates, obtain all of the necessary information, and handle the filing for you.

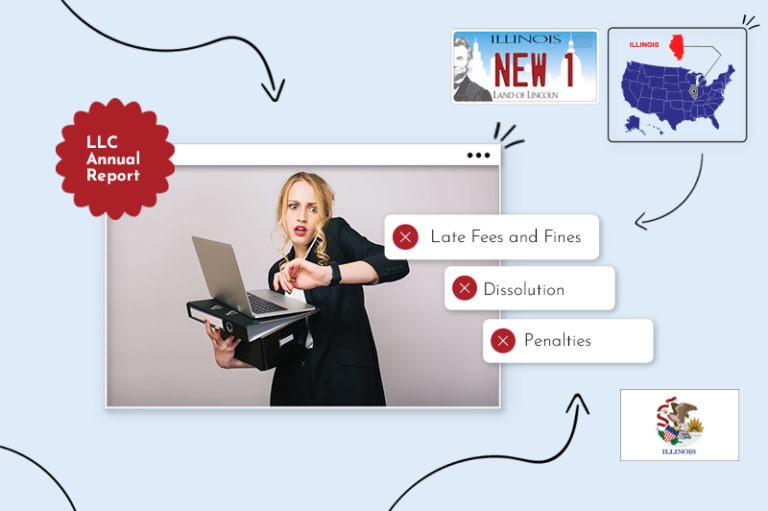

Failing to file an annual report as required by Illinois law can have serious repercussions for the LLC. Section 50-15 of the Illinois Limited Liability Company Act identifies the penalties for failure to file.

Once an annual report has been overdue for 60 days, the Secretary of State will assess a fine of $100. An additional $100 fine will be added after one year, followed by another $100 each year until the LLC meets its filing obligations.

In addition to monetary fines, an LLC that is not in compliance with Illinois annual report filing requirements cannot file any other documents with the Secretary of State. It cannot amend its Articles of Organization, for example, nor can it change its registered agent or registered office. The Secretary of State will not accept any new filings as long as the LLC is out of compliance.

Some states may revoke a business entity’s authorization to do business if it remains out of compliance for too long. This does not dissolve the entity, but it deprives it of the ability to engage in any business activities within the state.

Illinois does not go quite this far, although the effect is similar. Instead, the Secretary of State will show that a non-compliant LLC is not in good standing with the state. A lack of good standing deprives an LLC of many rights and privileges, and could potentially deprive the LLC’s members of liability protection.

Illinois LLCs are obligated to file annual reports, beginning within a year of the date they are formed or registered in the state. An LLC that fails to meet this obligation faces not only monetary fines, but also the possible loss of business privileges. Tailor Brands offers compliance services to LLCs and their owners so that they can focus on running their businesses.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands