Home » LLC Formation » Articles of Organization for LLCs

Articles of organization are mandatory for entrepreneurs wishing to use an LLC entity as their business structure.

This legal document provides your Secretary of State with the information they need to determine whether to approve your new business. And, to ensure you comply with state laws and regulations. Laws and regulations governing LLCs protect consumers and business members. Every state has them and all LLCs must comply.

Each U.S. state has requirements for filing LLC articles of organization, but the essential steps are similar throughout the U.S. We’ll look at those so you can complete and submit your LLC’s articles of organization and get your business started.

The articles of organization are a legal document you must complete and register with your chosen state when you form an LLC. It includes your business name, purpose and structure, principal business address, registered agent’s name, and doing business as (DBA) if using one.

The articles of organization come in different names in various states, including a certificate of formation and certification of organization. Articles of incorporation sound similar but those are for a corporation, while articles of organization are for an LLC.

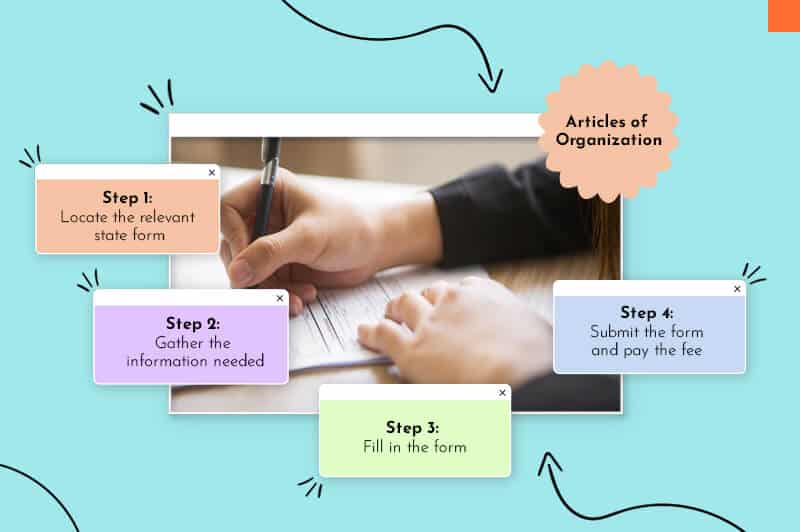

To file articles of organization, you must get the correct form, collect the right information, fill it in, submit it, and pay the fee. Let’s look at how you do all of those next:

Most secretary of state’s websites outline the requirements for filing your articles of organization. You can also locate the specific information for each state on our state’s hub page. The information to look for includes:

Note: Most business owners register their LLCs in the state where they live and work, but it’s not a legal requirement. You can choose another state with lower set-up fees and favorable tax treatments.

Before you can file, you have to gather the correct information. Here’s a list of what you’ll need in most states:

You can find the exact information you’ll need to submit with your articles of organization application form on your secretary of state website.

Your next step is to complete the LLC articles of organization form. Take your time and review your secretary of state’s website as mistakes can result in your application being denied. And, ensure all members always sign your LLC’s articles of organization before submitting.

Note: Some states provide a fill-in-the-blank form to save you from writing out your article of organization from scratch.

Once you complete the article of organization form, you can submit it. Depending on your state, you can file your paperwork and pay the fee electronically or by mail with a signed check.

Most states charge a fee to file your articles of organization. Costs vary from state to state and can range from under $50 to over $500. For entrepreneurs in a hurry, most states provide an option to expedite your application for an additional fee.

After you file your LLC article of organization application, consider completing the following legal steps so your business runs smoothly:

You don’t need an operating agreement to start an LLC. Still, creating one is advisable to avoid disagreements on how you’ll run your business. An operating agreement outlines the members’ percentage ownership, wage/management structure, and members’ roles and responsibilities.

Opening a business bank account serves several essential purposes, such as establishing business credit, enhancing professionalism, and separating your finances. That’s crucial as it makes bookkeeping easier come tax time and can help you avoid issues regarding your company’s limited liability.

Depending on your business type, you might need a business license or several permits to operate your LLC. Business licenses ensure your LLC complies with local, county, and state laws, and permits allow you to provide specific services and products.

You can learn more about licenses/permits and how to apply on the SBA website or read my business licenses and permits post where I tell you all about them.

All business types have specific tax implications. The good news is the LLC structure simplifies the process. LLCs are pass-through entities which means the business doesn’t pay taxes on its income, thus avoiding double taxation. Instead, members pay tax on their share of LLC’s profits when filing their tax returns.

The LLC structure makes tax easier for new business owners. But keeping up-to-date bookkeeping records and employing a certified tax accountant to ensure you fulfill all IRS obligations is advisable.

State: | Filing Fee: |

200$ | |

250$ | |

150$ | |

50$ | |

100$ *The state of CA is waiving the filing fee until June 2023 | |

50$ | |

120$ | |

90$ | |

$99 | |

125$ | |

100$ | |

50$ | |

100$ | |

150$ | |

90$ | |

50$ | |

165$ | |

40$ | |

75$ | |

175$ | |

100$ | |

500$ | |

50$ | |

135$ | |

50$ | |

105$ | |

70$ | |

100$ | |

75$ | |

100$ | |

125$ | |

50$ | |

200$ | |

125$ | |

135$ | |

99$ | |

100$ | |

100$ | |

125$ | |

150$ | |

110$ | |

150$ | |

300-3,000$ + 50$ a Member | |

300$ | |

70$ | |

125$ | |

100$ | |

200$ | |

100$ | |

130$ | |

100$ |

You now know that every start-up LLC must file articles of organization with the state where they’ll register and run their LLC. And while the process can appear daunting at first, if you follow the steps in this post and on your secretary of state’s website, you shouldn’t have any problems. But to ensure you don’t, here are the most common questions entrepreneurs ask before filing an LLC article of organization:

Articles of organization is a document describing the business basics of your LLC.

It includes information like your business name, all members’ names and addresses, and, if using one, your registered agents’ contact details.

Yes, all U.S. states require you to file articles of organization with the secretary of state’s office when creating an LLC.

As you may have guessed by now, the procedure to amend articles of organization varies from state to state.

However, here are the most common steps:

Again, states vary on what to include so review your secretary of state’s website before filing your application.

That said, most states require you to include:

Articles of organization (also referred to as a certificate of formation or an organization) is an external government document you file with your chosen state when registering an LLC. An operating agreement is a document that describes your LLC’s structure, financial and functional decisions, and each member’s duties, responsibilities, and powers.

Few states mandate an operating agreement, but it’s recommended you create one (even if you’re a single-member LLC) to keep control in cases of internal disputes and litigation. Because if you don’t have one, your state could implement standard state regulations in its absence.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness.

Products

Resources

©2025 Copyright Tailor Brands